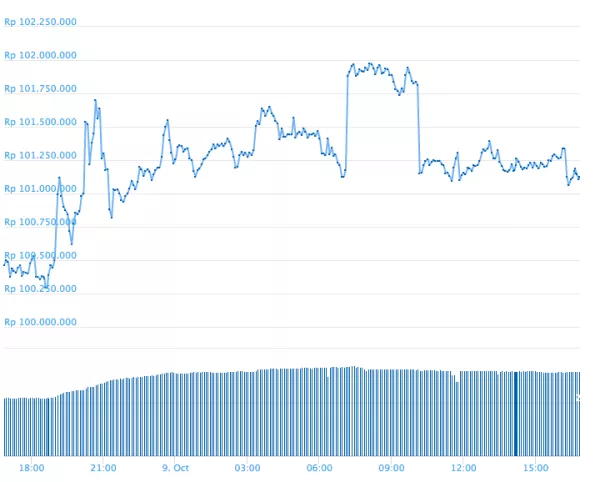

The Bitcoin / USD exchange rate on Monday has risen from $ 100,498,000 to $ 102,618,000 at the support level sentiment.

Bitcoin has a stable week, up and down in a certain range with a tendency to face upwards. Many believe the digital currency has found its base and massive investments from David Swensen, a leading investor, which was made recently into two crypto funds that have legitimized the speculation. That could be the reason Bitcoin rejects bears. Yesterday's price almost formed Doji on the uptrend, confirming the wavering selling sentiment in the Bitcoin market.

BTC / USD Technical Analysis

From a technical point of view, the daily chart can be interpreted slightly bullish.

The daily chart shows Bitcoin has risen sharply since June 28 lows but with extreme bearish pressure on the descending trendline above, it's still too early to like this long-term uptrend. Especially because of the bull trap signal that applies. Until now Bitcoin is once again trying to break above the rising upward trendline. Weak action in Relative Strong Index (RSI), which is a momentum indicator, makes it more likely for Bitcoin to form higher highs after closing the current candle. Stochastic Oscillator somewhat tells the same story as RSI.

As it stands, Bitcoin is in a bullish bias, but in reality, we might head to another bull trap. There are still conditions that can cancel the trap if, 1) Bitcoin breaks above the higher highs of September 5, and 2) Bitcoin does not close the price below $ 100,346,000