There are 3 main factors that will lead to an increase in the cryptocurrency market cap by the end of this year. Will the bitcoin price (and overall cryptocurrency market) increase by 10x this year? Probably not. But it is very possible for it to increase 3-5x or more.

The biggest reason I think the market will grow is because of the recent opening of an SEC regulated, institutional grade, digital asset custodial service by Coinbase. Coinbase is the largest digital asset exchange in North America, with $10 billion+ in assets already under management. Institutional grade custodial services for digital assets had never reached Wall Street standards, until now. This was a gigantic barrier to entry for big institutions; there weren’t any regulated services available to store large amounts of digital assets without unnecessary technical and financial risk (that these institutions did not want to take). This has now changed, and this barrier to entry was obliterated by the debut of this long needed service.

Before I continue with my second point, here are a few recent announcements in the crypto market: Andreessen Horowitz just announced a $300 million crypto dedicated fund, Goldman Sachs recently announced they are opening a bitcoin trading operation, IBM agreed to a $740 million deal with the Australian government to incorporate blockchain and artificial intelligence into their Defense and Home Affairs Departments over the next 5 years, the amount of cryptocurrency based hedge funds doubled from 110 as of Oct 18, 2017 to 226 just 4 months later, and we are seeing more and more cryptocurrency futures and ETF offerings in North America, Europe, and Asia every quarter.

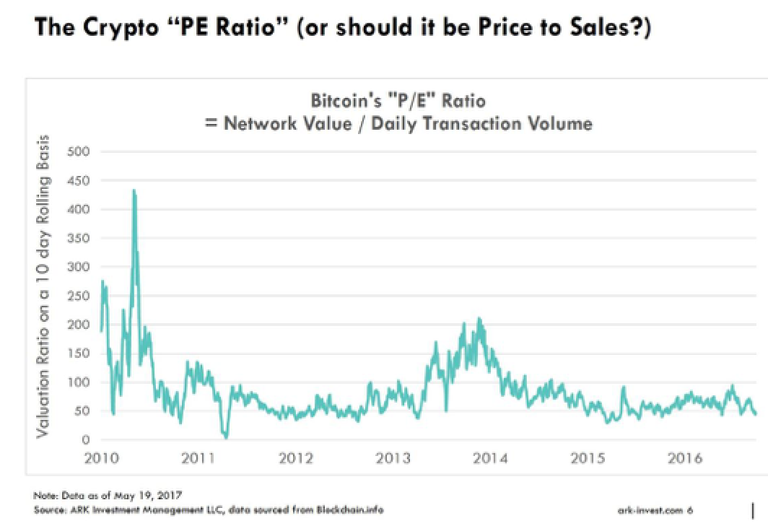

A second and equally important factor for determining value is the estimated earnings multiple of the cryptocurrency market. The tech sector is notoriously high in their earning multiples, sometimes eclipsing over 100x in their P/E ratios (GoDaddy’s was 171.68, and Square, the payment processing app, had a P/E ratio of 1052.75 as of Feb 14, 2018). Bitcoin has no underlying assets to determine its value, so it does not have a traditional P/E ratio, but it is possible to value the network based on the number of outstanding bitcoins, multiplied by the daily price ( to determine the value of the network), divided by the daily transaction volume (liquidity in the network). This gives us a modified P/E ratio, a “bitcoin P/E ratio” that shows us the value of the network versus available liquidity.

As of today, we see the current “bitcoin P/E ratio” at 29.41 [($6429 per bitcoin * 17,143,612 outstanding bitcoins) / $3,748,190,000 in daily trading]. Historically, we’ve seen this “bitcoin P/E ratio” at around 50, going up to almost 450 at times, with this ratio dropping at the end of bear and bull cycles. When people take profits at the top of bull markets or take money out of a bear market, the liquidity increases compared to the value per coin, and we see a lower “bitcoin P/E ratio”. At the peak of the most recent bitcoin bull market (Dec 17, 2017), the ‘bitcoin P/E ratio’ was 22.65, a ratio lower than we’ve seen in years, which should have been a signal to traders that people were taking profits and cashing out.

We’ve seen a 70% decrease in the cryptocurrency market cap since January, and as market psychology goes, more investors tend to take more money out of the market the lower it gets (although a non emotional investor tries to buy low, not sell low). I do not think we will return to a “bitcoin P/E ratio” of 450, or even 200 (and if we do, I will prepare to sell), but I think we will get closer to historical averages once the market scare hysteria diminishes, and major financial institutions begin to enter the market at a scale unseen before. With the current cryptocurrency market cap valued at $254 billion, and the addition of institutional grade custodial services, an introduction of $10-$20 billion dollars could easily result in a $20,000+ value per bitcoin, and a total market cap of over $1 trillion by the end of the year.

A tertiary considering factor when speculating on the value of the cryptocurrency market is the price to “mine” (or validate) a single bitcoin transaction (similarly to mining price speculation for precious metal valuations). As less and less bitcoins are available as rewards for validators (the # of rewards per validation decrease over time), the mining process requires more energy and resources to validate a single transaction. Historically, the value of bitcoin has been approximately 2.5x the mining cost, reaching over 3.5x in the December 2017 peak. By the end of the year, the cost to mine a single bitcoin will be, on average, between $8,000-9,000 (compared to around $5000-$6000 at the end of 2017, but prices vary by country and electricity costs), which, according to this valuation, would put the price of a single bitcoin between $20,000-$22,000, compared to $6430 now.

In China, we can see that online and mobile payments are already starting to eclipse the Yuan, as well as credit & debit cards, with Chinese mobile payments totaling over $9 trillion total in 2016 (compared to only $116 billion in mobile payments spent in the USA). These types of payments will continue to grow (especially in the USA as more consumers adopt mobile payments), with cheaper, faster, and decentralized options becoming more accessible to the everyday consumer. In my opinion, the current prices of the cryptocurrency market do not reflect the value this market provides now, and in the immediate and upcoming future.

For the first time in history, value no longer has to be controlled & regulated by a single governing body, but can be secured and regulated by the active community as a whole. Imagine if the decisions made by Facebook weren’t controlled by Mark Zuckerberg, but rather, democratically by every active member of the community. Everyone would have the ability to vote and decide on how the network runs. This can be applied to almost any network based application, whether it be financial transactions, social media, supply chain logistics, ride sharing, securities or real estate markets, and many, many more. This is the type of groundbreaking technology that blockchain enables.

With cryptocurrency, the Fed can’t arbitrarily increase interest rates, no more cryptocurrency can be “discovered” (like gold, oil, or diamonds), so the market can’t artificially inflate with a supply increase, and the entire programming code behind these projects are public for anyone and everyone to verify (compared to a bank like Wells Fargo who created millions of fake accounts to inflate their value). Cryptocurrency is the by far the most democratic way we have ever seen to store and transfer value. Personally, I still think we are in the first or second inning, and we will start to see the first large scale, real world, uses for blockchain and distributed ledger technology this year and in the next upcoming years. The introduction of usable industrial and consumer blockchain based products into the market, coupled with the introduction of institutional investors, points to very positive signs for blockchain and distributed ledger technology in the near future.

As of 1 year ago, bitcoin prices were $2500 each and had $780 million in daily trading volume. Today, we see $6450 per bitcoin, $3.75 billion in daily trading volume, and more daily transactions now than ever before. These projects are not slowing down, but are just starting to come into fruition on a major scale.

I am not a financial advisor, and this is not financial advice.

References:

•https://www.cnbc.com/2018/07/05/fundstrats-tom-lee-cuts-his-year-end-bitcoin-forecast-to-20000.html