Note: this post is not investment advice and is for educational purposes only. Caveat emptor!

Crypto/heritage cross breed budgetary instruments—particularly, those that blend digital currencies with inheritance monetary items—are the most recent pattern at the convergence of blockchain and Wall Street. Controlled adaptations of these half breed items are rapidly coming to advertise, including stablecoins and bitcoin-upheld ETFs, fates, swaps and depositary receipts. There's much energy encompassing this pattern—in light of current circumstances, in one case—however everybody ought to be cautioned that there are likewise obscure and possibly huge dangers to "crossing the streams" between the settlement frameworks of heritage and crypto.

Confuses are inescapable. Mischances will occur. Nobody ought to be astounded when they do.

All things considered, interest for these half breeds is probably going to be huge.

In Part 1 of this two-section arrangement, I'll spread out the contrasts between the heritage and crypto settlement frameworks and clarify why the classification of "crypto folded over inheritance" crossovers includes less operational dangers than the class of "heritage folded over crypto" half and halves. In Part 2, I'll clarify what these settlement framework contrasts mean for proprietors of half and half items.

Definitions

"Crypto folded over heritage" half and halves incorporate stablecoins and tokenized gold bars. In this classification of half and halves, the proprietor purchases a cryptoasset intended to track the inheritance resource's cost by holding the genuine heritage resource in a ring-fenced account. At the end of the day, inheritance resources, (for example, dollars, securities, products or land) collateralize the cryptoasset. These cross breeds are issued, exchanged and settled on a blockchain, however the fundamental resources (e.g., money, gold) that back this classification of mixture are issued, exchanged and settled in the heritage monetary framework.

"Inheritance folded over crypto" mixtures incorporate bitcoin-settled ETFs, fates, swaps, depositary receipts and some other subsidiary upheld by any cryptoasset. In this classification of cross breeds, the proprietor purchases a conventional money related instrument intended to track the cryptoasset's cost by holding the genuine cryptoasset in a ring-fenced account. As such, cryptoassets collateralize the customary money related instrument. These crossovers are issued, exchanged and settled in the heritage framework, however the basic cryptoassets (e.g., bitcoin, ether) that back this classification of half and half are issued, exchanged and settled on a blockchain.

An Important Distinction

Neither security tokens nor money settled bitcoin subsidiaries (e.g., ETFs or prospects) are crypto/inheritance half and halves as characterized here. Why? Since they settle altogether inside their very own settlement framework (crypto and inheritance, separately) and don't cross streams with the other framework.

I draw a basic refinement between security tokens and tokenized securities. A security token is local to a blockchain—it's issued, exchanged and settled on a blockchain, and is certifiably not a crossover. A tokenized security is a half and half that fits into the "crypto folded over inheritance" class—it's a cryptoasset upheld by an offer of Apple stock, for instance, for which the cryptoasset settles on a blockchain however the Apple share settles in the heritage settlement framework.

Money settled crypto subordinates settle completely in real money inside the inheritance framework, and never contact the fundamental cryptoasset. Thus, they don't present the dangers of intersection streams between settlement frameworks. They unquestionably include value hazard, yet they don't involve the exogenous settlement chances that their "physical" settled brethren do.

How the Legacy and Crypto Settlement Systems Differ

For what reason do these qualifications make a difference? Since the crypto and inheritance settlement frameworks vary at essential, key dimensions. As far as I can tell, few Wall Street experts even comprehend the spaghetti maze of the heritage settlement framework—most complete their long vocations while never expecting to cooperate broadly with it since the way of life energizes profound specialization and it's hard to move out of limited swim paths. At the point when issues emerge t,here's dependably another person in the "back office" who will deal with it. It wasn't until the point that I was compelled to dive profoundly into the settlement framework, while organizing benefits exchanges from partnerships to insurance agencies, that I needed to learn it—on the grounds that each exchange included huge and one of a kind settlement multifaceted nature both for the advantages and liabilities. We needed to arrange and practice the strategies down to the moment, truly, on the grounds that the expenses of any little settlement disappointment would have been major. That encounter influenced me to understand that the cryptoasset settlement framework (on a blockchain) is far better than the heritage settlement framework. Here's the reason.

Cryptoassets are advanced carrier instruments that are intended to settle shared, on a gross premise, in close ongoing and in "physical" shape (i.e., in the genuine cryptoasset). At the point when cryptoassets exchange, the purchaser and vender all the while trade an incentive for esteem ("net" settlement).

Paradoxically, the heritage monetary framework utilizes a deferred net-repayment framework including layers of middle people. The catchphrases are deferred, net and delegates.

Deferrals are intentional in the heritage framework—normally estimated in days—and they empower budgetary delegates to settle with one another on a net premise. Mesh is a training that supports the go-betweens to the detriment of clients, since mesh limits the liquidity and capital go-betweens need to hold. Mesh implies purchaser and vender don't at the same time trade an incentive for incentive in each exchange—rather, their middle people don't settle and just aggregate agitated charges and credits for a characterized time, and after that settle by trading just the distinction at the selected time. Mesh is the reason the securities business mixes together "road name" securities in omnibus records instead of isolates them for every individual client. For instance, agents just trade the net of every one of their clients' purchase and offer requests for Apple shares every day. They don't send each Apple share forward and backward to one another. Rather they settle up on a net premise—generally once per day secondary selling stations close.

The blend of mesh, postponements and layers of mediators—the act of permitting agitated exchanges—mean (1) counterparty hazard and (2) wrong proprietorship records are just unavoidable truths that apply to everyone in the inheritance budgetary framework. Counterparty chance is the hazard your agent will default in the wake of taking your cash however before conveying you the Apple shares, in the above precedent. Uncertain proprietorship records empower circumstances, for example, Dole Food to emerge (where Wall Street's bookkeeping frameworks made 33% more substantial cases to Dole Food shares than there were Dole Food offers) and intermediary casting a ballot errors are inescapable (an unmistakable Delaware lawyer pronounced that it's unrealistic to confirm the genuine victor of an intermediary challenge nearer than 55-45%). The inheritance settlement framework, in my experience, is the reason the money related framework is precarious and uncalled for to ordinary financial specialists.

In the crypto framework, conversely, counterparty chance doesn't characteristically exist—since it's a shared framework that at the same time conveys the advantage and the installment to purchaser and vender, separately. It's inalienably a conveyance versus-installment framework. As a settlement framework, it's naturally steady and reasonable for all clients.

These are enormous contrasts—one framework grasps disrupted exchanges and considers counterparty chance and uncertain records to be ordinary, while the other doesn't.

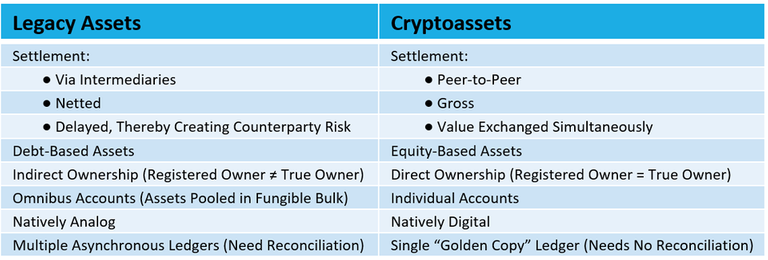

There are other real contrasts as well, and they're outlined here:

I'll review Part 2 by sharing the turn of phrase. Here's the way I would conventionally rank settlement chance by class. Once more, this isn't speculation counsel and each instrument will have one of a kind dangers! Be that as it may, since crypto frameworks equitably have bring down settlement hazard than inheritance frameworks, we can make the accompanying speculation about settlement chance by class:

Most minimal to Highest Settlement Risk:

Most minimal Settlement Risk: (1) Cryptoassets (resources locally issued, exchanged and settled on a blockchain)

Next Lowest Risk: (2) Crypto folded over heritage half breeds (e.g., stablecoins)

Next Lowest Risk: (3) Legacy resources (e.g., the norm—resources are issued, exchanged and settled in heritage frameworks)

Most astounding Risk: (4) Legacy folded over crypto crossovers—most "clumsy" operationally in light of the fact that they "cross the streams." Worst of the two universes.

In Part 2 I'll investigate what these real contrasts in settlement frameworks mean for purchasers of crypto/inheritance cross breeds.

Source

Plagiarism is the copying & pasting of others work without giving credit to the original author or artist. Plagiarized posts are considered spam.

Spam is discouraged by the community, and may result in action from the cheetah bot.

More information and tips on sharing content.

If you believe this comment is in error, please contact us in #disputes on Discord

!cheetah ban

Plagiarism, Comment spam.

Okay, I have banned @richard8.

BOING! You got a 5.84% upvote from @boinger courtesy of @richard8!

Earn daily payouts by delegating to Boinger! We pay out 100% of STEEM/SBD!

You just received a 17.54% upvote from @honestbot, courtesy of @richard8!

Limited Promotion! Use both @t50 and @hybridbot for a chance of receiving extra upvotes!

You got a 7.69% upvote from @t50 courtesy of @richard8!

Anyone can use this service by sending a minimum of 0.010 SBD or STEEM to @t50 with the post you want upvoted as the memo.

Consider investing Steem Power to receive daily payouts from bot income.

10 SP, 25 SP, 50 SP, 75 SP, 100 SP, 125 SP, 150 SP, 200 SP, 250 SP, 300 SP, 350 SP, 400 SP, 450 SP, 500 SP, 600 SP, 700 SP, 800 SP, 900 SP, 1000 SP or use the delegation manager. At any time you can get your investment back by undelegating.

Partners

@upfundme and #upfundme

TASKMANAGER bitshares token

@hybridbot - bid/membership hybrid bot (0.010 SBD minimum)

@memearmy meme support community bot

This post has received a 4.19% upvote from thanks to: @richard8.

thanks to: @richard8.

For more information, click here!!!!

Send minimum 0.010 SBD|STEEM to bid for votes.

Do you know, you can also earn daily passive income simply by delegating your Steem Power to @minnowhelper by clicking following links: 10SP, 100SP, 500SP, 1000SP or Another amount