Right now, many are losing their head over the total market value of crypto currencies. While some predict "200 billion by the end of the year", others get desperate and press the panic button, predicting “crash and burn” or “bubble popping”. As always, the truth is somewhere in between and depends on many factors like e.g.:

- when do the authorities crack down on Bitfinex and Tether (which is a topic for itself)

- how much trust blockchain tech can create in the general public (which can be discussed also in a different topic and can probably fill books)

- how institutions and governments deal with the technology in general (which is also a legal issue...)

and so on...

However I think, that we should get the numbers right first, before we start to discuss the market size in the first place.

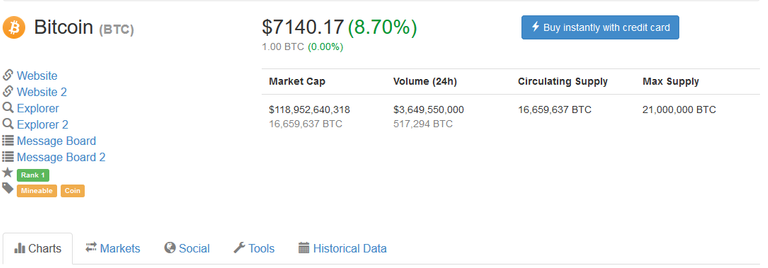

So, let’s start straight away with Bitcoin:

BTC takes more than 50% of the whole crypto currency market – and it is not likely for this to change significantly in the immediate future. The impact of the best news of a single currency can be diminished to a side note, if BTC makes a move in the meanwhile. It is safe to say, that BTC dictates the whole market.

But the value of BTC at 110 billion is – in theory as well as in reality – wrong. Because we do not consider the BTC “lost” in the equation.

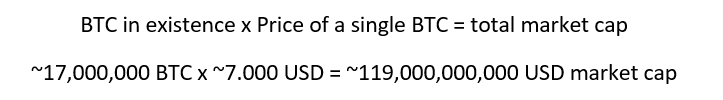

We calculate it right now like this:

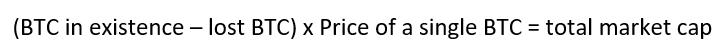

While it should look more like this:

Cases, where a large amount of BTC is lost are well known – people like James Howells for example. He lost a hard drive with about 7,500 BTC, which is equal to more than 50 million USD right now.

I feel you, pal.

Other cases with smaller amounts are most likely an everyday occurrence. If you mined back in 2010/11, you might have mined one or two blocks, stashed the 100 BTC away on a USB drive and then forgot about it. In the meanwhile, you maybe had to move a couple of times and the USB drive fell from the truck.

Or your child might took the drive a couple of years ago and needed to make space for a science project or the newest album of Justin Bieber. Of course your child put it back afterwards, as you raised it to be an orderly person.

Girl: Hey mom, I by the way used this stick to store the music of Justin for the sleepover a couple of years ago.

Mom: Well, you are not smart enough for college anyways...

(In this moment, some people might want to check their backups.)

It is the same with crypto currencies and backups – sometimes, even the best backup-system will not work. Sometimes, it is just “shit happens”.

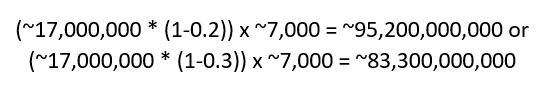

Anyways: it is hard to tell exactly, how many Bitcoin are not accessible anymore and therefore lost. We for sure know about the stories, but the general estimation is, that about 20-30% of all BTC sit on wallets, that are impossible to access. 2014, this number was assumed to be between 2 and 4 million (including the BTC owned by Satoshi Nakamoto).

We will roughly end up with this equation:

The total estimation is now suddenly between 23 and 36 billion USD lower. Let’s just settle down with about 30 billion.

Bitcoin cash amounts to another ~2 billion, if we assume the same share of coins lost.

And what about other coins lost? What if just 5% of all miners had a similar disaster like James Howells in the early days, but with just one hundred dollars in value? Or thousand dollars on a botched transaction? In this case, we see another 3.5 billion USD lost on the market cap.

And what about the obvious scams? We start to look at the majority of the currencies outside of the top 200 market cap, like e.g. “Putincoin” or “Sexcoin” – still well within the range of a couple of million dollars in market cap. But in the end, most of them are likely to be worthless. Total value of these currencies (spot 200-954 on coinmarketcap) is about 1,5 billion USD.

Let’s assume the total amount of these currencies with about another billion USD, considering that not all of them are scams or inactive projects.

So right now, the total amount of capitalization is reduced from 190 – 30 – 2 – 3 – 1 = 154 billion USD. And even now, some might consider this calculation too high, because factors like "frozen coins" from the devs are not included in this. Some might even consider it too low, because major players like Ripple have 60 billion XRP locked up, which totals to about 10 billion USD. Others do not even consider Ripple a "true" crypto currency and deduct it completely.

In this calculation however, we end up with around 80% of the total value. It might not seem much – but if we are talking about comparisons, this value is far away from insignificant.

And we need the actual amount of circulating BTC for another issue: the "inflation" of BTC. Which will be the topic in the next post.