The crypto advertise has marginally bounced back by $4 billion in the course of recent hours, giving speculators a breathing room in a noteworthy mid-term auction and downtrend.

In a sideways market, a period in which significant cryptographic forms of money like bitcoin, Ethereum, Ripple, and Bitcoin Cash scarcely move yet at the same time secure some strength, tokens and little scale digital currencies have a tendency to perform incredibly well against both the US dollar and major advanced resources.

Fascinating Trend of Tokens and Their Strong Performances

The crypto advertise is still to a great extent reliant on two noteworthy advanced resources: bitcoin and Ethereum. At the point when the cost of bitcoin rises, tokens encounter increased developments on the upside and when the cost of bitcoin drops, tokens encounter heightened developments on the drawback.

Affected developments of tokens in view of the execution of bitcoin and Ethereum are to a great extent owing to the distinctive level of dangers financial specialists will take in a bull rally and a bear cycle. Given their high instability and shorter track records, tokens are much more hazardous ventures than bitcoin and Ethereum.

The American Institute for Economic Research found that even among major advanced resources including Ethereum, Ripple, and Bitcoin Cash, bitcoin is altogether less unpredictable. The analysts at AIER expressed:

"Financial experts and analysts measure a variable's unpredictability from numerous points of view. We pick a generally basic metric: the normal every day rate change in cost. We normal the supreme estimation of every day rate returns for every cryptographic money and year. By our measure, in consistently, Bitcoin is minimal unstable of the five digital currencies we think about. Bitcoin achieved its most minimal normal day by day value development, under 2 percent, in 2016, preceding rising again to levels not seen since 2013."

Accordingly, financial specialists have a tendency to reallocate their assets from tokens to bitcoin or stablecoins like Tether amid a bear cycle and in bull energizes, both here and now and long haul, speculators like to see bigger picks up on the upside with more unstable resources.

In a sideways market, tokens likewise have a tendency to perform well, as found in the ongoing execution of Theta, Golem, Kyber Network, Aelf, Zilliqa, and Ontology. In the course of recent days, a large portion of these tokens expanded by around 10 to 20 percent against bitcoin, which additionally has ascended from $5,800 to $6,250 inside a 48 hour time span.

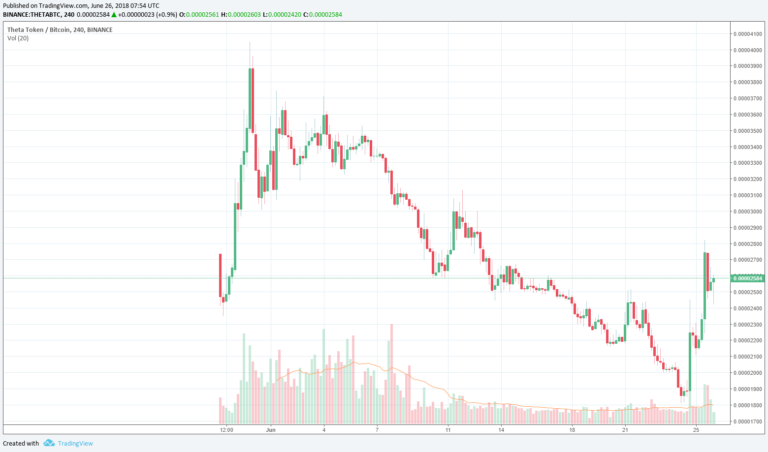

Theta up 43% Against Bitcoin Since June 24

Theta specifically, the exceptionally foreseen and built up Ethereum-based token contributed and prompted by YouTube fellow benefactor Steve Chen, Samsung, Sony, and Sierra Ventures, has ascended by in excess of 30 percent on June 26 and by another 20 percent on June 24.

Against bitcoin, Theta has expanded from 0.000018 to 0.00002584, by 43 percent, since June 24. Different specialized markers including both exponential and basic moving midpoints and additionally the Relative Strength Index (RSI) point towards an unbiased zone for Theta, which may lead the token to increment advance in esteem if significant digital forms of money can stay stable all through the following couple of days.