Token cap or unlimited emission?

When attempting to value different cryptocurrencies in what can be appropriately referred to as the Wild West of the digital/tech space, one finds himself pondering upon the different properties of the wide array of cryptocurrencies. One of these has been in the forefront of analysis and some simple deductive conclusions have been made.

Apart from the data analytics of different currencies from a trading perspective, there is no use in utilizing any of the base principles of stock or company analysis when sp eculating upon the long term potential of different currencies. While trend following and other traditional techniques can be utilized to make sense of the daily/weekly/monthly fluctuations in token price, some properties are simply not analogous to anything in the traditional investment world.

The 3 supply classes I've chosen to examine

1. Finite supply with no emission

2. Finite supply with controlled emission

3. Infinite supply with uncontrolled emission

Note: not considering infinite supply with controlled emission as no large tokens follow that emission structure.

Is any system superior? Are they even comparable?

The type of emission of each token can aid one in analyzing the token and one must resist the trap of attempting to apply a universal criteria. There are base implications of these systems that must be considered when examining each protocol in the short-term and long-term. Since most of us in this space share a bullish mind-state we will examine the long-term implications of these different classes.

1. Finite supply with no emission

For the sake of simplicity let us examine three digital assets, all with a different supply structure. The first cryptocurrency we will examine is NEM. NEM is a cryptocurrency with the 7th highest market capitalization and has a fixed supply of 8,999,999,999 XEM and is a cryptocurrency that is up and coming, especially in the Japanese financial markets. Recently, NEM implemented a soft-fork to their protocol enabling their users to send transactions free of charge. NEM does not have miners and XEM is generated by harvesting which serves many of the same purposes as mining without the actual hardware necessities from the user.

This system has finite supply with all tokens outstanding upon network inception. This implies that all of the inflation will be seen in the price rather than the supply as it is fixed as a property of the system. If this network is to gain value into the future and able to facilitate more and capture a larger chunk of markets like remittance, there is an added advantage in buying large amounts of tokens in the early stages of development.

2. Finite supply with controlled emission

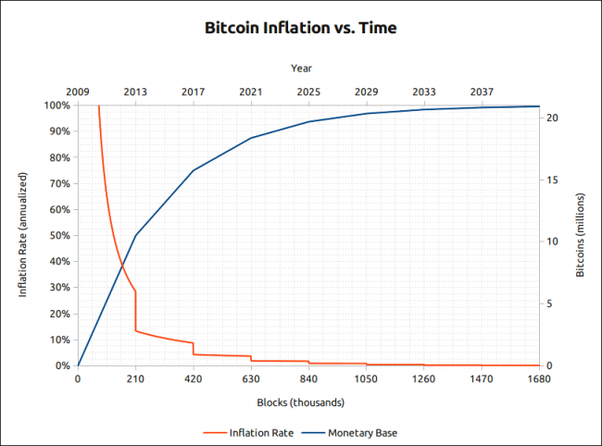

The next digital asset we will examine is Bitcoin. Bitcoin is the original cryptocurrency and currently has ~$70 billion market capitalization. Bitcoin awards blocks every 10 minutes and halves its block reward every 210,000 blocks, ensuring that the supply converges to 21 million tokens in circulation. Therefore, the rate of inflation of Bitcoin will decrease as time goes on and the number of tokens in circulation is known at any point in time.

Bitcoin has a finite supply and a controlled emission, which has certain advantages and disadvantages. There is the possibility of the over-valuation of Bitcoin during its early stages when inflation is high but as seen in the graph, there is an exponential decrease in the rates of inflation as time goes on. An added advantage of this supply structure is the ability to project the price using the utility of the network at any point in time.

3. Infinite supply with uncontrolled emission

The final digital asset we will consider is Ethereum. Ethereum has a variable rate of emission and no supply cap. In 2017, Ethereum was projected to have an inflation rate of 14.75%. This rate of inflation is projected to decline to 1.59% by 2065 but this still leaves the situation quite open ended. That being said, there are new implementations that may reduce the rate significantly. The general consensus on the supply cap of the network based on the protocol's properties is 100 million tokens. Time will tell.

Ethereum is, fittingly, the most ethereal of the digital assets we've examined so far. Since there is no stated supply cap or actual fixed supply rate for different times, projecting the future value of the actual unit of Ether is near impossible. One can only speculate on the value of the overall network derived from the protocols overall utility. This does also have the implication that the emission will be more tailored to the actual use of the network and that the supply rate can be monitored to a level that is deemed best for the network.

Not better, just different

In conclusion, there is no superiority between the supply structures as they all have different implications, but they all must be analyzed through their specific lens when trying to get an in depth picture of the long-term for each token.

Good conclusion

Thank you!

thanks for this. I'm beginning to do research on how crypto's work and I found this article straightforward and the language easy to understand. I'm surprised that this doesn't have more votes. upvoted.

Where's the "S Curve"

This is in need of an update. The S curve emission is omitted here and is very worthy of discussion. Daniel Dabek of Safex employed a banking economist to decide that this was the single best emission curve for cryptocurrency.

Safex emisison curve with Daniel Dabek.

For those looking to educate themselves - Safex

Great post :)