Lately news stories are popping up describing how the Bitcoin OTC markets are flourishing and how billions of dollars worth of Bitcoin are traded on these trades. At first glance it sounds as if institutional money and whales are buying in. But is this really good for the rest of us hodlers?

OTC TRADING

OTC trading is interesting precisely because it is a seperate market. It allows huge amounts of value to be transferred without altering the price. This is important when you want to buy up billions of dollars worth of Bitcoin, but don't want to end up overpaying because your own buying is driving the price up. Other whales might accummulate over time, but you could also simply find another party who owns vast amounts of Bitcoin and offer to buy it off of them.

Similarly for the selling party a similar incentive exists: If you want to liquidate a billion dollars worth of Bitcoin, you don't want the price to drop before you're done selling or else you're not going to get your billion dollars.

For as long as the crypto markets don't have enough liquidity to handle these huge orders, the OTC market offers a solution.

COULD BE TROUBLE

While many people seem excited about the news that big money is buying into Bitcoin and cryptocurrency in general, I have my concerns and big ones at that.The question that arises in my mind is: Why would anybody want to buy a billion dollars worth of Bitcoin, without raising the price?

Surely the above explanation that I offered sounds sensible: you don't want to overpay. But on the other hand, if you buy and hodl Bitcoin as an investment, you kind of want the price to go up too don't you?

I can think of one more reason why somebody would want to buy and own a vast amount of Bitcoin off-markets, and it's because somebody might be interested in crashing the price. Think about it: If you want to destroy or manipulate the Bitcoin price, first you have to own Bitcoin in order to dump it. This is where the OTC markets come in, and where the dumping whale could buy in from. Now, with a billion dollars worth of Bitcoin at their disposal it becomes possible to create a billion dollars worth of sell pressure at precisely the right critical moments to crash the markets.

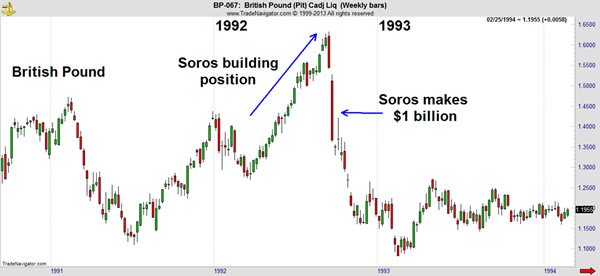

Perhaps you've heard of George Soros and his tactics of destroying markets for profit (he 'broke' the English pound in 1992), and how they are looking at getting into cryptocurrencies. And I do believe that this would fit in well with the tactics the likes of him would employ: First crash the price down as low as you can, and then buy it all up eventually for dirt cheap low prices.

I'm only speculating and I'm not saying this is necessarily what's going. I would be wary of getting too excited over big money getting in, though. They are experts at this and have more money and patience than 90% of the hodlers and believers out there. Of course I will still continue to hodl regardless of how long this bear market may last, including the additional institutional sell pressure. I've got the time and patience for it.

In other short news: I've been super busy this past week with my job, so I couldn't write any posts. I promise to write more again this week though!!

One possible explanation is that buyers don't want price to go up [yet] because they are still buying.

Either way, on exchange or off, if they are long term, it's good news since the available float would be reduced, again, IF they are long term.

On the other hand, if they want to crash the market, they'd better be really good because that is a costly operation that could easily backfire.

I agree that buying a large sum on the OTC markets is probably because they don't want the price to go up.

But I don't know if it's such good news even if 'long term'. We must remember these people are sharks and we would be foolish to think that they would buy in for X amount and just sit and wait for the price to go up. I consider it much more likely that they would get a sizeable position in the market, and then follow up by playing the market in order to increase their stacks. You mentioned long term vs short term, and I'm not sure there's a difference.

Short term simply wanting to crash the market makes little sense, unless it is in order to buy it all up cheap which would make them a long term investor rather than short term. I doubt any party would simply throw billions 'just to kill Bitcoin'. After all, profit makes the world go around. But if there's profit to be made by crashing Bitcoin, then buying it all up for cheap, then I definitely think they're going to try it. It wouldn't be costly if it turned out to be the most profitable thing ever. And what's a few billion here and there, for these kind of people?

There are only 21 million eventual BTC possible (and that number is even lower given lost BTC over time) and it wouldn't take much from serious long term investors to push price higher on a sustainable basis. Long term types are usually very smart at this stage of a great long term investment (you have to be in order to be at the right place at the right time) and their buying habits are quiet savvy. I'm confident that strong hands are accumulating BTC, and other quality alts, for the long term.

This is a valid concern, and the reason of existence and activity of OTC market for bitcoin is very real. However, any instrument that has an audacity to be traded in an open market must be able to handle this. This is free market. A free market can be manipulated, will be manipulated, and perhaps should be manipulated.

GBP did fall at that particular juncture, but it was just a trade. Many people, perhaps countries impacted by it. But it is still a trade. GBP still is around and traded. If BTC can't handle this, then perhaps it shouldn't be traded. In other words, what I am trying to say, if you want mass adaption, then you must be able to handle short sellers, delta hedgers, risk arbitrage maker..... all these. Because these things happen on a min by min basis in any fiat currency market. If we want to be big boy or girl, we got to come out of diaper :)

Bottom line deal with it. Because, much worse than Soros is coming our way :)

Oh yes, you make some very good points. And I do think that indeed this is inevitable and much worse is coming our way. But I think it's good to speculate on what might happen and how this might negatively affect us in the short and not-so-short term! I've read that on the gold markets the price supression and manipulation after the futures introduction took decades.

Hi pandorasbox,

I would only trade OTC, Bitcoin if I had plenty extra money I wanted to essentially gamble with to trade for fun otherwise, I rather hold BTC long term like I am doing now....If the price would go up faster and up to ATH would be nice...lol

I agree the best and most safe way to stay in this market is to just hodl!

I just put more onto BTC yesterday from my paper wallet in thinking that this week is the big bull run so, BTC will go up more than normal...

I hope so! My own gut is saying it may take a while longer before a recovery. I am still considering the potential of dropping down to $4000. I base that on the 2013/2014 historical chart of Bitcoin's bubble back then.

You raise a good point with this. With crypto being mostly unregulated, it is vulnerable to all sorts of these manipulative tactics. I guess its something to keep in mind before investing. As always, only invest what you are willing to lose because loss is a huge possibility with crypto.

Yep, as small fish we can only watch and follow the tides. But it's fun to stay informed and keep up with all the drama :)

It's the best part of crypto!

Yes I agree. The fear makes it exciting hahaha

But don't forget that if they can buy low by selling massive amounts (true except if the market gets regulated, wich will be the case one day), they will also make the price skyrocket to sell at MASSIVE profit, it's also easy in the opposite sens... You buy some TV advertising (disguised or not) and you use an algo bot on Bitfinex/Binance/Kraken/Okex to increase the price continuously, then you sell after uncle joe and aunt tati has put his life saving in it ;)

Also I don't think that crashing the market to 1K USD is a good idea because you could KILL BTC forever... So maybe the bottom is 6.5K. What a wonderful time to be alive ! Please don't forget that XRP is building the biggest use case for banks. And when Swift will be at 100% replaced by Ripple (matter of time), the Ripple team will explain on TV the part two of their whitepaper wich explain that using XRP will give 60% discount to use the Ripple network for the banks (already 150 are using Ripple). At this time maybe in 1 or 5 years. Ripple will be the biggest. Mostly that XRP will be more and more scarce because of the burning process. ;)

The OTC market is very complicated. When people want to buy huge amount they usually buy it below market price and then resell it to smaller OTC traders, some of the sellers are mining farms whom would like to keep the price of the BTC high but still need to pay the bills so they settled on selling below market rate. Some sellers don't have a lot of time so they prefer to do 50K transaction OTC instead of 50 times 1k transaction, It's a very interesting world out there.