The Daily: Rethinking Bitcoin’s Market Cap, ICOs Printing cash

Souece iMage: Google imagess

What's going on guys? Nayabali here bringing you a brand new blog today. We got another killer blog for you guys. Full of information. The Daily: Rethinking Bitcoin’s Market Cap, ICOs Printing cash

Also Read : Longhash Launches Bitcoin huntsman to search out ‘Dirty Money’

Also Read : Longhash Launches Bitcoin huntsman to search out ‘Dirty Money’

A16z Crypto Snaps Up 6 June 1944 of MKR

Stablecoins ar all the trend at once, particularly if you’re a risk capital firm seeking AN gumptious crypto project to back. A16z Crypto has simply noninheritable 6 June 1944 of the MKR token offer for $15 million, which can provides it a stake within the DAI stablecoin issued by Makerdao from each a money and a governance perspective. The dedicated crypto fund created by Andreessen pianist can lend its support to the Makerdao foundation for ensuing 3 years, and supply experience on adoption and restrictive matters.

“As a primary mover and trailblazer in stablecoins, Makerdao represents a awfully compelling chance within the crypto house,” same A16z Crypto’s general partner Katie Haun. “Makerdao’s technology, system and talent have place theory into action to deliver a suburbanised stablecoin that we tend to believe can facilitate drive the long run of the crypto conviction of Ross Ulbricht to be excessive and unjust. Since getting into the crypto house regular, however, the Andreessen pianist ANd A16z Crypto partner has become an advocate for the cryptocurrencies 1st pioneered on early BTC-friendly sites like Silk Road.

Nic Carter: Replace Market Cap With “Realized Cap”

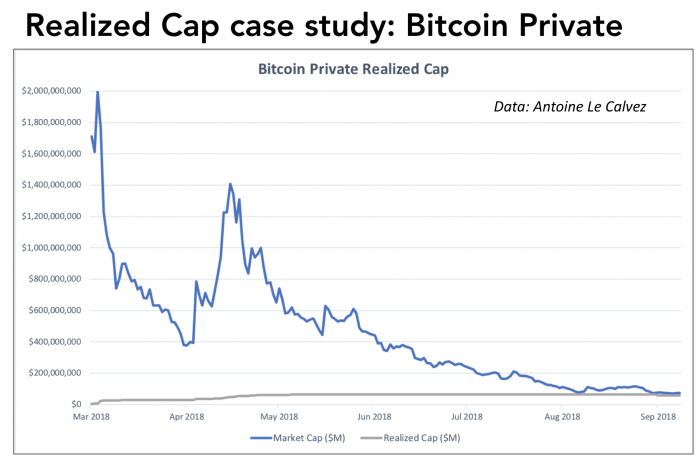

At the Baltic Honeybadger conference in Republic of Latvia on, variety of well-known figures from the Bitcoin world have delivered keynote addresses, among them Castle Island Ventures’ Nic Carter. In “Bitcoin as a completely unique economic institution” he advocates for dynamic the manner we tend to calculate the capitalisation of cryptocurrencies. It’s long been acknowledged that multiplying the quantity of coins minted by their market value could be a crude reckoner, however within the absence of a additional correct however easy metric, it’s stuck. This has junction rectifier to such anomalies, as Nic Carter points out, as Bitcoin personal having a $2 billion market cap upon launch, despite the actual fact that the overwhelming majority of coins were ne'er claimed by BTC and ZCL holders.

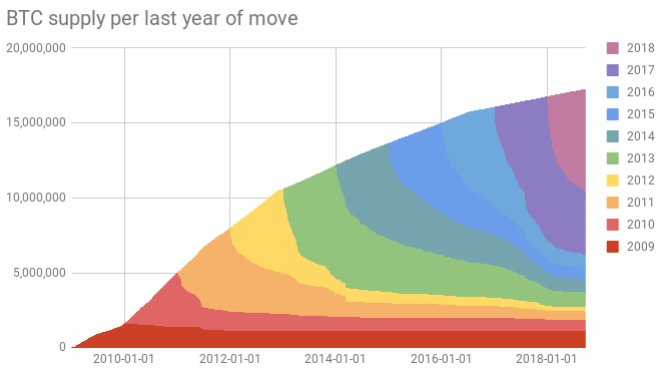

The alternative model Nic Carter proposes, “realized cap” is additional correct, however could struggle to realize widespread adoption thanks to being additional advanced. It involves conniving the combination price of UTXOs priced on their price after they last affected i.e. if a whale-sized notecase of ten,000 BTC hasn’t seen any activity since 2011, those BTC ar valued at the worth they were at the time, instead of exploitation 2018 valuations. cyberspace results of all this might mean BTC’s market cap being cut from $110 billion to around $88 billion. whereas Nic Carter’s model is unlikely to switch customary market cap any time presently, the existence of latest systems for valuing crypto networks will solely be a decent issue, and “realized cap” could however earn its place on cryptocurrency hunter sites.

Edenchain Enrages Investors once Covertly Increasing Its offer

As proof of market cap manipulation, take into account the case of Edenchain, one among the few sold token sales to own emerged this quarter, that has run into contestation. The project had already been pertinacious with issues over allegations of major investors, together with Ian Balina, receiving discriminatory discounts and interesting in pooling, a follow that is usually frowned upon.

It has currently been unconcealed that Edenchain has covertly magnified its current offer by one hundred fifty million tokens – a rise of around four-hundredth – once finishing its crowdsale. The tokens were discharged as a result of the project succeeded in raising additional funds from “strategic investors”. Edenchain has currently revealed a post description its revised current offer. Its unfortunate selection of a whale because the incidental to featured image has additional bolstered the suspicion that crypto whales ar being favored over standard retail investors World Health Organization returned early however have since been squeezed out.

@nayabali >>>>Follow ! Upvote - For My Effort For You:

All in all, what do you consider this? Just offer your perspectives and considerations in the remark area beneath.

Upvote And Follow For More Details >>> @nayabali