UBS recently released a statement in which they as a company think that "bitcoin is neither money nor a viable asset class". It is a pretty strong statement and even more when they are talking about a revolutionary invention that is a threat to their business. I have to say that for the moment I partially agree with UBS in the fact that in its current state Bitcoin is not very good as money.

Although some Bitcoin maximalists disagree with UBS, let's be realistic, how far can you go today with using only Bitcoin? Most people that own it have never used it, few merchants/people accept it as payment, the price is highly volatile and even if it has improved a lot recently, transaction costs are still significant.

There are a lot of negatives and many valid reasons to support UBS in their belief that Bitcoin is not very good as "money" but it doesn't mean that it will never be. On the contrary, I am extremely optimistic about its future. Just because it doesn't work now doesn't mean that it will never work, sometimes it can take a while for people to catch up with technology and even longer for society to do.

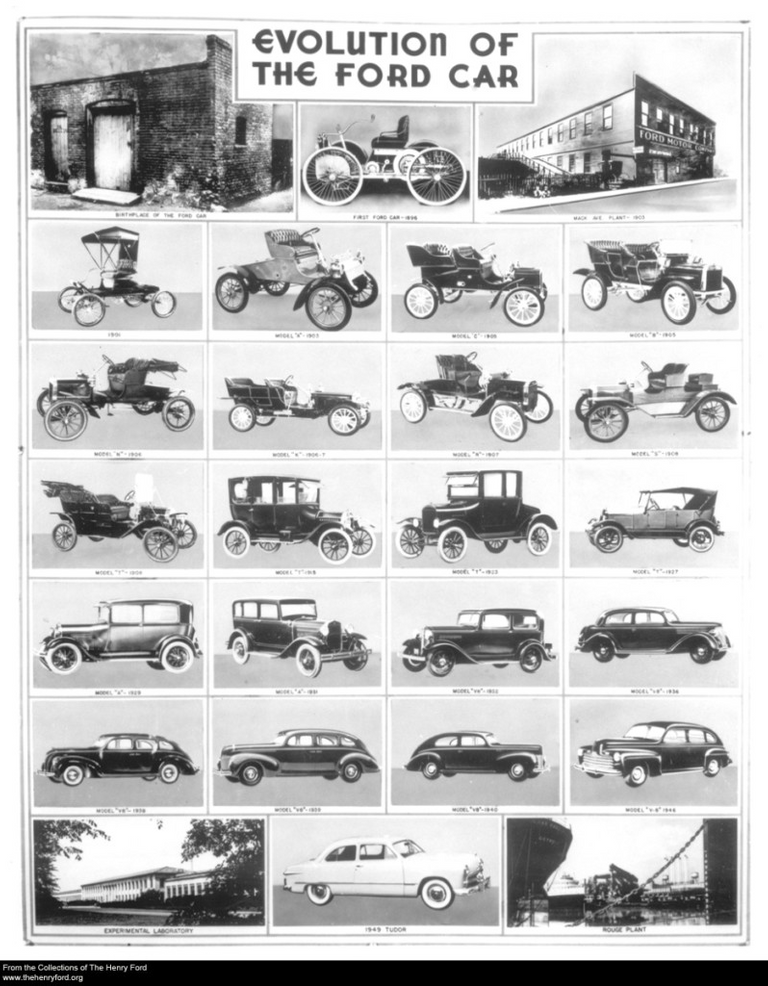

There are many examples on how it takes time for technology to spread and compare it to Bitcoin in terms of potential. Regardless of how superior the technology may be, it is difficult to gain adoption when it is inconvenient to use it in first place. Let's look at cars for example, even if now it is obvious on how they are superior than carriages for transportation, there was a time where this wasn't the case. The concept of a car came across in the 17th century, but it took 200 years and the development of the internal combustion engine, mass production and major improvements for cars to become a thing in the late 19th century and early 1900s. Even then there were a lot of issues, cars were very expensive, it was complicated to drive them, they needed fuel which was difficult to get, there were few roads and a lot of them weren't suitable for cars, the cars weren't reliable and broke down quite often and worse of all they weren't much faster than alternatives like carriages.

This is why Ford's lawyer told him to forget about cars because they were just a fad, horses have been around for centuries and where here to stay, the state of the cars at the moment wasn't better than the alternative. Fast forward 100 years, we live in a world in which cars are everywhere. This didn't happen by chance, in those years we have spent hundreds of billions on infrastructure for cars (roads, bridges, etc), we can get fuel almost everywhere in the world, the cars are made to be very easy to drive and are relatively cheap, they work for years without breaking down and more important they are faster and safer than any other alternative. In hindsight it was obvious cars were better but without all the investments on infrastructure and developments over the years, we would still be using horses because "they were more convenient" at the beginning.

It took a long time to get to where we are on cars, will it be the same for Bitcoin?

The point with this example is that Bitcoin is currently at that late 19th century moment, it is an interesting and groundbreaking technology but it is only starting, for all the controversy it has stirred, it is only 9 years old. It will most likely spread faster than cars, but we are only at the beginning. Bitcoin is competing in a financial space that has been developing and consolidating for hundreds of years. Just think about all the billions spent on infrastructure for the financial system to ensure that there is communication and compatibility across all institutions around the world, banks have been working with governments (sometimes against) for decades to ensure they are along the same lines and also worked with people and other companies to ensure that they are compatible with our needs. This took years in the making but it doesn't mean that it shouldn't be replaced.

There are still a lot of things to figure out for Bitcoin, in its current state it is not ready to replace money in our financial system but that doesn't mean it won't. For all the complains and issues that Bitcoin has which makes it unsuitable today, there will be a solution. People don't know how to use it? Then we should make it easier to use and educate people to become more familiar with it. Few merchants/people accept it? It will take some time and money to develop the infrastructure, anyways this was a problem for credit cards not so long ago and they did it. The price is too volatile? I explained this thoroughly in a previous article, but this is just a symptom of being on its early stage, not a characteristic of Bitcoin (https://steemit.com/cryptocurrency/@mvaisberg/bitcoin-is-not-a-volatile-asset), also this was the same problem that government backed currencies had at their beginning (check out the history of the french livre for example). What about the transaction costs? As the network improves the Tx costs should drop.

There is nothing new for groundbreaking technology to meet some resistance at the beginning and it is true that for some period of time it will be more inconvenient to use the new technology which is where we are at with Bitcoin but as it happened with cars and many other new technologies at some point it wont not going to be the case anymore, so yeah for now Bitcoin is not good nor convenient to use as money but at some point it can certainly will be. As opposed to criticizing Bitcoin while it is on its baby stages for not being good enough, UBS should be looking not at what Bitcoin is but to what it can be in a few years and how are they going to adapt to it.

Links:

https://www.coindesk.com/ubs-bitcoin-is-too-unstable-and-limited-to-function-as-money/

Twitter - https://twitter.com/Mvais3