There is a saying that crime would not pay if the government ran it. There is also a saying that there are no certain things in life except death and taxes. The real question for those interested in cryptocurrency is when the government will start directly intervening in the market. Government meddling might range from increasing regulations through taxes. Who knows, perhaps outright seizure is in the cards. Anyone familiar with asset seizure in Cyprus will understand that this is not an idle threat.

In order to join many cryptocurrency exchanges a prospect has to provide personal information that would make it easy for the government to identify that person. They typically keep things like a photo ID, physical address, and phone number on file. The reasoning, most of the time, is that this is required to prevent crime. History teaches us that individuals have every right to be more skeptical. Where there is money to be made, government control is not far behind. While it may happen in stages, and start with the best intentions, once the monster is created it will gain ever more power. From a legal perspective it is a good idea to start a lobbying now to prevent this from happening sooner rather than later.

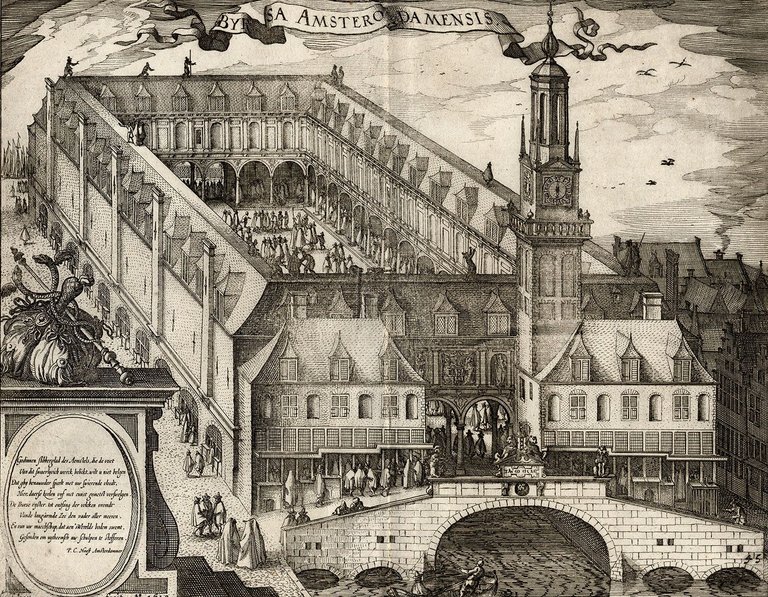

It might be instructive to look at the history of the first major stock exchange in Europe and the first company listed on it. As with so many other major institutions, they arose not by design but more by accident. The Amsterdam Bourse (AB) was originally an open air exchange for commodities that was built in 1530. Of course at that time it had more in common with a market than a modern stock exchange. However, unlike a market that met at intervals, the AB met on a regular basis. This allowed investors to speculate on everything from agricultural goods though tulip bulbs. From the start the city of Amsterdam realized that a bourse was a public facility that facilitated trade. As the bourse grew, newer and bigger buildings were erected. The Dutch East India Company (DEI) was established in 1602. It was the first company to be listed on an official stock exchange. The DEI was granted a government charter to trade with Asia and to establish colonies. There were high risks - including piracy and shipwreck - and the government did not mind granting powers to a private enterprise. Simply put, a single investor (who bought bonds or shares) would be unlikely to support the risky voyage of a single ship. In contrast investing in a company meant losses as well as profits were distributed between investors. Complex bookkeeping needed to be developed to deal with the gains and losses of a huge company that were shared between investors. Shares of the DEI could be sold to third parties using an official bookkeeper. This is the origin of the Amsterdam securities market.

By the late 17th century investors were used to investing for the short term, and investments became highly speculative. Brokers who found willing buyers and sellers were increasingly trusted. On the other hand, those who bought and held shares in the company were rewarded with an 18% PA interest rate. Almost 200 years after it was founded, the DEI was taken over by the government in 1800. By that time it had extensive interests throughout Indonesia, and was arguably a government unto itself. History does not preserve what people at the time felt about the government takeover. Even if there was a payout to investors, the company was a lucrative earner for a very long period of time.

The DEI is a good example of a company that became so powerful that the government stepped in. The exchange, which was driven by the need to trade DEI bonds and shares, was left alone. In some ways the exchange was an idea. Once the genie was out of the bottle no one wanted to go back. Cryptocurrency is in a different position because the government does not know who has the currency. The only way the government has records (barring wide scale tapping) is to gain access to the exchanges. This has already been done. The idea might be universal, but the currency itself is subject to controls. Governments can stamp out crypto currency by over-regulation as well as taxation. If they needed the money it could be nationalized. Given that the world is borderless in ways that it has not been before, individuals need to think about how to store value safely. We are all waiting for the next phase of history to unfold.

Image of the Amsterdam Royal Exchange Stock Market published in 1649.

Yep, We are witnessing a shift in the monetary & economic creation. The world will surely adapt in this new world as it unfold.

Certainly food for thought. It would seem that modern bureaucracies likely move too slowly to fully take advantage, or control for that matter, of cryptocurrencies as a whole. Personally, I think it would be entertaining to watch a cryptocurrency get nationalized as it would likely take a nose-dive shortly thereafter

keep posting more articles like this..it is helpful..thanks..