CBOE Holdings, which regulates the Chicago Board Options Exchange, one of the world's biggest alternatives trades, has cooperated Gemini Trust, a New York-based digital money trade supported by the Winklevoss siblings, which bargains in resources including Bitcoin and Ether.

Under the arrangement, CBOE will utilize Gemini's digital currency showcase information to make new lists, and in the end, in the event that it gets administrative consent, to dispatch cryptographic money subordinates exchanging. CBOE wants to take off Bitcoin fates before the finish of 2017, trailed by fates for different digital forms of money, and perhaps cryptographic money alternatives later on.

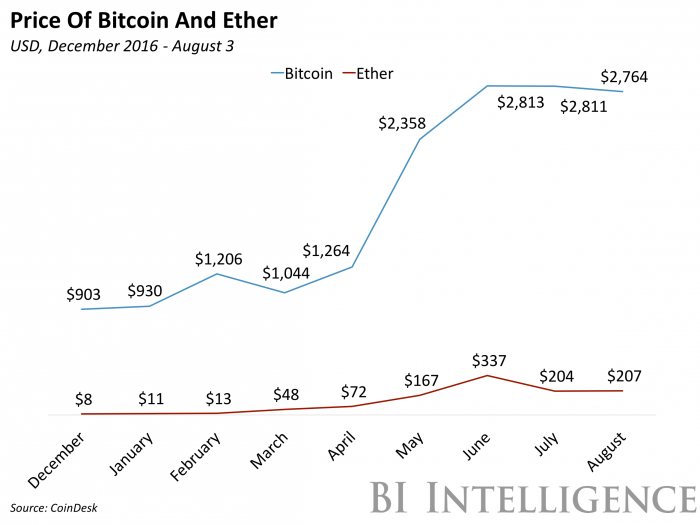

Digital money subordinates could include huge incentive for the two trades and brokers. US alternatives trades in the US have seen bring down exchanging volumes recently, in the midst of a generally quiet worldwide securities exchange condition, as per The Wall Street Journal. Thus, this has likely prompted an absence of commissions for these trades. By differentiate, digital currencies have changed drastically, making them an appealing resource class for subordinates dealers. By including digital money subsidiaries, CBOE would be giving its customers access to a dynamic new market, and boosting its own particular profit in a generally stale condition.

Albeit administrative endorsement for CBOE's wander isn't ensured, there are a few factors to support its. For whatever length of time that standard securities exchanges stay stable, enthusiasm for the digital money subsidiaries space is probably going to continue quickening, in this way keeping up the division's dynamism. Other real trades, similar to Miami International Exchange, which claims a stake in digital money subordinates fintech LedgerX, are likewise arranging comparable activities. As more establishments start searching for approaches to take care of speculator demand for digital money get to, this could put weight on controllers to permit and manage such undertakings, so as to guarantee their multiplication is legitimately checked and expands instead of surprises the more extensive budgetary framework.

Sarah Kocianski, senior research investigator for BI Intelligence, Business Insider's excellent research benefit, has assembled a point by point give an account of blockchain in managing an account that:

Layouts banks' tests with blockchain innovation.

Points of interest blockchain ventures at three noteworthy banks — UBS, Credit Suisse, and Banco Santander — in light of inside and out meetings.

Talks about the imaginable patterns that will rise in the innovation throughout the following quite a long while.

Features the components that will be basic to the achievement of banks executing blockchain-based arrangements.