Bitcoin

(Bitstamp:BTCUSD 1h)

Bitcoin ended up following the break of the ascending channel, dropping hard towards the 50% retracement after failing to hold the support.

This movement is already showing signs of bullish divergence on both the RSI and MACD, and a clear drop in volume on the second dip. While we may push a bit lower with the formation of a bearish continuation pattern, a strong bounce seems more likely than another major leg down.

This is starting to look like a more attractive opportunity to build up longs. However, I'd still recommend waiting for a good bounce and/or second rejection of support first.

Ethereum

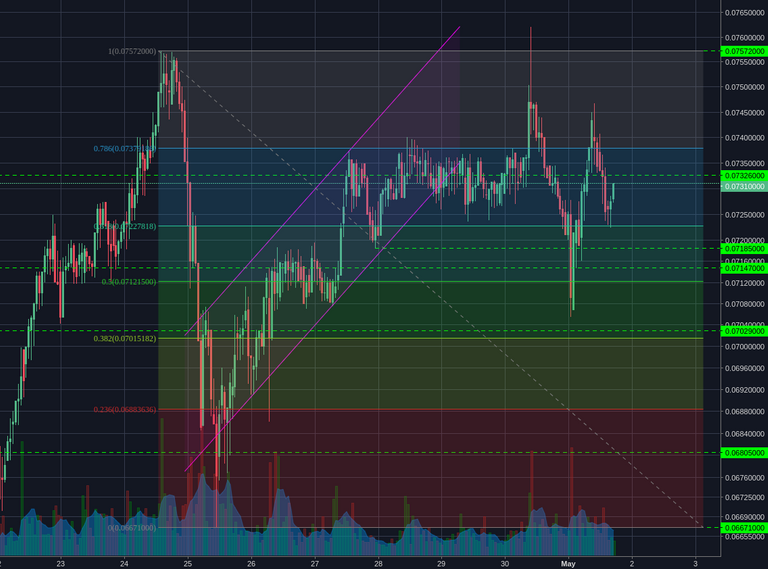

(Bittrex:ETHBTC 1h)

As expected, ETHBTC continued its drop to retest 0.07185 and below (although, I wasn't expecting it to be quite this strong). This was followed by an equally sharp bounce back to the consolidation level before currently holding around the 61.8% retracement.

This sudden injection of volatility is a worrying so near highs, as it breaks any hope of a bullish consolidation for the near future. Such high volatility also signals a level of fear in the market, so a further retest of lows and the confirmation a strong support is likely required before the market is ready for another bull run.

Bitcoin Cash

(Bittrex:BCCBTC 1h)

In a dramatic turn of events, Bitcoin Cash broke downwards from our consolidation of the last few days. It ended up bouncing at 0.1391 and we wait to see if we'll form a second bounce. If 0.1391 holds, this would form a good double bottom from the 0.1357 of the first pullback, but it remains to be seen.

Volume remained relatively low during the dip, so this still looks like a bullish pullback rather than a major bearish reversal. However, you may wish to hold off on buying back into any positions until a second bounce is confirmed, to reduce risk of being stopped out a second time.

Litecoin

(Bittrex:LTCBTC 2h)

Litecoin has continued its low volume drift downwards, tapping the 0.01590 support today. The RSI and MACD are signalling bullish divergence, however it may not hold much weight as we barely touched 0.01590. More interestingly, volume and volatility are still near lows on the test of support.

Overall, its hard to tell whether this is forming bullish divergence or a bearish consolidation zone. I recommend holding off here until the market gives a much clearer signal as to its direction.

Monero

(Poloniex:XMRBTC 2h)

After a failed attempt at a bounce, Monero's still drifting lower against bullish divergence. Volume is, again, pretty low, so we await another bounce and a break of resistance. However, another sharp retracement of a bounce could signal greater weakness to Monero and a test back towards 0.02370.

That being said, its best to simply avoid holding a position here until we have a held break above the 0.02760 resistance at least.

Disclaimer

I will do my best to give unbiased, objective analysis, but I can make no promises about my accuracy.

All posts are based on my personal opinions and ideas and do not constitute professional financial investment advice.

Coins mentioned in post: