This post is a look at the recently released Bitmex Up and Down contracts and the lack of clarity around them and the issues that has caused. There will be a little bit of maths and options terminology, but I'll do my best to try to keep it simple.

Background and Contract Specification

Bitmex released the Weekly Up Contract (XBT7D_U110) for live trading on the 30th Apr, with the Weekly Down contract (XBT7D_D90) coming later, on the 14th May. Both contracts are essentially European style options contracts (with the addition of a knock out price for the Down Contract), which settle weekly on Fridays.

This was an interesting development on the part of Bitmex. They made 2 posts on their blog (1, 2) explaining the situation. Although, the blog posts weren't posted on the website announcement feed nor (to my knowledge) on their twitter, so many people (including myself) missed them.

While the contracts came with the usual Bitmex explanation of specification and example, what struck me was the fact that:

- Throughout the whole contract guide there wasn't a single reference to "Options", despite that being the nature of the contacts.

- Traders aren't allowed to short them - "Only the BitMEX anchor market maker can be net short".

(Full screen shots of the guides as of 15th May 2018 can be found at the bottom of the article)

We now have the issue of a contract that many traders will have no idea how to price, that is consequently trading over 10x higher than fair value, and only the market makers are allowed to short.

Options pricing and Fair Value

The Up contract is equivalent to a European style options call, while the Down contract is a slightly modified European options put. Options contracts give the buyer the right (but not obligation) to buy (call) or sell (put) at the given strike price on the settlement time (European style).

European style options contracts are generally prices using the Black-Scholes model, which is used to calculate the fair price of a contract along with measures of its sensitivity to various factors such as underlying price and volatility (known as Greeks).

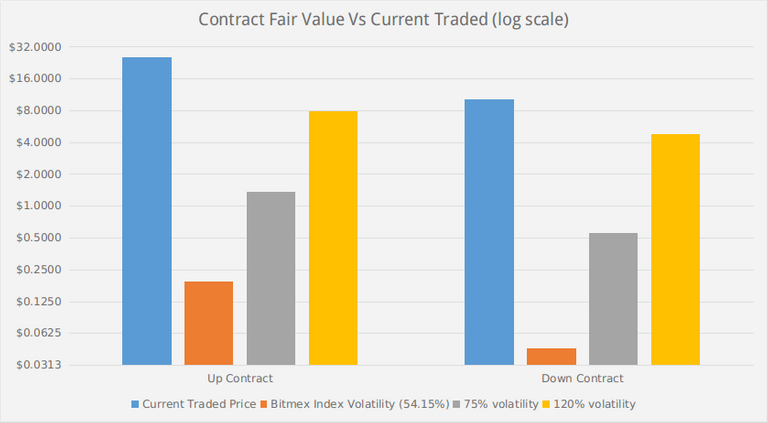

At time of writing the Up contract (XBT7D_U110) last trade price is 0.00300 BTC (~$25.57), with 2.89 days until expiry. The Bitmex historical volatility index is currently 54.15%, strike price is $9500 and Bitcoin is $8530.

The black-scholes calculator suggests that the fair price is actually $1.916. And that is the calculation for a 1 Bitcoin contract. Where as the Bitmex contracts represent 0.1 XBT each. Making the fair value $0.1916, rather than the current $25.57. Which is a bit insane.

What if we use a higher value of volatility for our calculations, will the price be a bit more reasonable? Similar contracts trading on a different exchange have an implied volatility of ~75% annualised. This gives a fair value of $1.351 for each Up contract.

I've also occasionally seen Bitcoin volatility reach up to 120% or higher. This value still gives a fair value of $7.870.

In other words, even by the craziest stretch, the Bitmex contracts are trading way higher than their fair value - and only the Bitmex designated market makers are allowed to short.

Options profit outlook

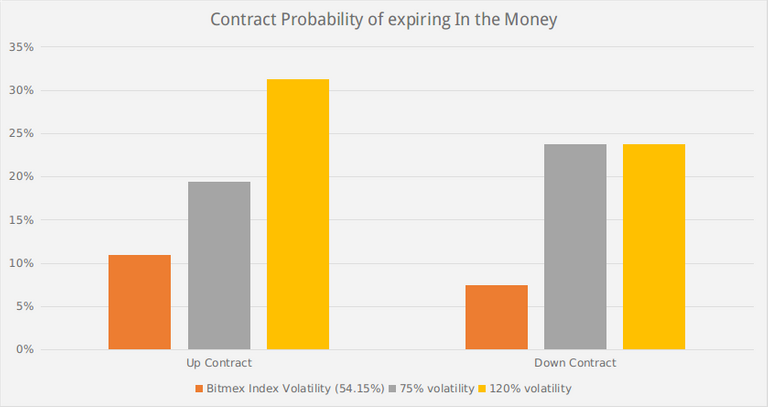

Now, what if the contracts were trading at fair value, what is the probability that the options would actually expire "In the money" (payout not zero).

One of the "Greeks" calculated under the black-scholes model, Delta, is generally used as a measure of exposure to the underlying asset, but can also be used as a probability that the option will expire in the money.

The absolute of Delta (non negative value) gives said probability. A call contract with Delta 0.75 has a 75% chance of expiring ITM. A put contract with a delta of -0.3 has a 30% chance of expiring ITM.

So, what are the chances of our Up and Down contracts expiring ITM?

The Up contract's ticker is "XBT7D_U110", meaning that it expires every 7 days and its strike is placed at 110% of the trading price at the start of the trading period.

Again looking at the Bitmex volatility index at 54.15%, the Delta of this contract over 7 days comes to 0.1087, only an 11% chance of expiring in the money. 75% volatility gives Delta at 0.1933 and 120% gives Delta 0.3119. Not the best bet however you look at it.

For the Down contracts its even worse, with Delta being -0.07458 (7.458%), -0.1431 and -0.2367 for 54.15%, 75% and 120% volatility respectively.

The likelihood that any of these contracts actually pays out any money is rather stacked against the trader. And, as I've mentioned before, only the designated market makers are allowed to short these contracts to collect the price premium.

Are Options ever worth it?

Options trading is a wide and very mathematical discipline to master. When contracts are traded fairly (with reasonable pricing and without restrictions) options trading can be very profitable and allow all sorts of novel trades, such as betting on volatility.

However, in its current state, I personally wouldn't touch the Bitmex Up and Down contracts with a 10 foot pole. They are over priced and restricted from the ability to short.

I have seen Bitmex as a generally reputable exchange in the past, however situations like this make be question that assessment.

Contract Guide Screenshot

I tried to archive the Bitmex contract guides with both archive.fo/ and archive.org/web/, however neither worked, so I used web-capture.net/ for screenshots instead.

The full screen shots can be found here: Up Contracts, Down Contracts.

Disclaimer

This does not constitute professional financial investment advice.

edit:

Thanks to /u/happy__hippo on Reddit for pointing out the Bitmex posts about the contracts. I've amended the article to reflect this.

do you find bitmex options useful in any other way?