Bilateral patterns are those that can see either a continuation or reversal of the current price movement. There are bullish bilateral patterns as well as more bearish ones. Let's get started...

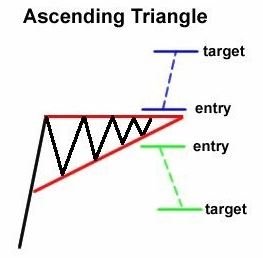

Ascending Triangle

A generally bullish pattern, an Ascending Triangle is formed where the price consistently meets a flat level of resistance, while bouncing to increasing levels of support. The greater number of touches on both the resistance and support lines gives increased confidence that the pattern has formed. The volume is generally decreasing as the price moves up and along the triangle, so the breakout is confirmed when the price pushes above the line of resistance with an increased volume.

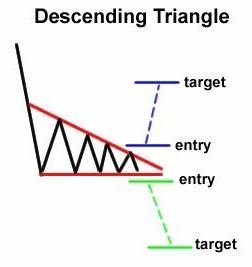

Descending Triangle

The bearish partner of the above Ascending Triangle, the Descending Triangle is formed with a level support line and a decreasing resistance line. If the historically strong support line is broken, a sharp downward turn of the price can follow as confidence leaks out of the market.

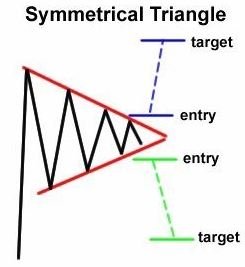

Symmetrical Triangle

The outcome from a Symmetrical Triangle is much harder to predict than the above variations. While the Ascending and Descending Triangles can break both ways they generally tend to favor one way or the other. The best method to follow if coming across a Symmetrical Triangle is to be patient, as always, and wait for that confirmation of breakout in either direction. False breakouts can occur if the volume is too low so always keep an eye on that too.

thanks for the info

You're welcome, hope it helps in some way.