Is it possible that an extra driving factor behind this sell-off was right in front of us this entire time?

Maybe even spelled out to us in clear language by the major US banks?

I think many of us may have overlooked the significance of the recent move to ban crypto purchases using credit in the U.S.

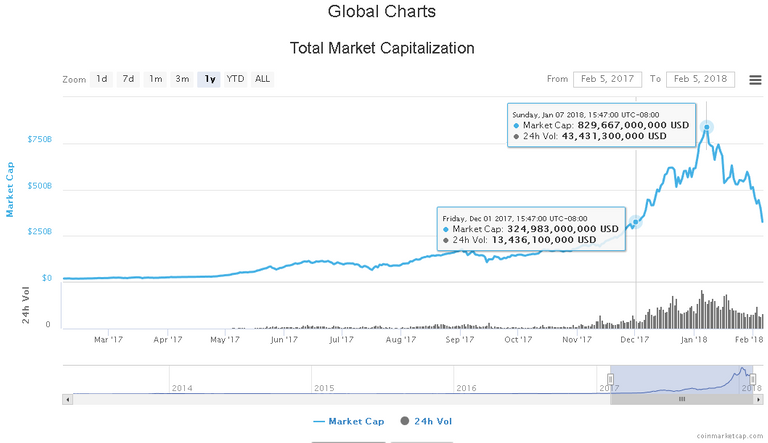

We all know the market gained massively between December 1st and January 7th when it reached it's peak.

In a little over a month, the entire market more than doubled (about 2.5x).

We aslo know that nothing ever goes up in a straight line. And over the course of the last year we've had BTC "crashes" every 2 months or so. I'm not going to go in depth talking about the basics of market behavior because it's not what this post is about, and I'm not a qualified expert here to teach you the market.

The fact is: a market crash was to be expected.

Due to the hugely volatile and speculative nature of crypto investements, market action and news (postive or FUD) can often be enough to set off huge swings like this. We're now down to nearly the same total market cap as we were back on December 1st (the removal of South Korean exchanges from Coinmarketcap's pricing data on January 8th makes this look a little worse than it is).

But is there something else contributing this time? Possibly even big money conspiring to push things lower and create a buying opportunity for themselves?

ENTER the big bank's recent decision to ban crypto purchases by credit card.

As of last friday (Feb. 2nd), all of the top 5 US credit issuers have now banned the use of their cards to buy crypto.

OK. But how many people purchase their crypto using credit anyway?

According to recent polling by lendedu.com, it turns out the answer might be quite a few.

When 672 "active Bitcoin investor" respondents were asked: "Which of the following best describes how you funded your account to purchase Bitcoin?"

33.63% answered "I used a debit card to fund and purchase."

18.60% answered "I used the ACH bank transfer process to fund and purchase."

18.15% answered "I used a credit card to fund and purchase."

16.22% answered "Other."

13.39% answered "I used a bank wire transfer to fund and purchase."

The poll suggests that maybe as many as 18% of us are funding our exchange accounts by credit card. It's more than I expected. And maybe it's even enough to turn a routine sell-off into the monster crash we're seeing now. If this translates into 18% less crypto purchases by individual investors (who still make up the majority of the crypto market by the way), it's definitely not going to help the prices in the short term.

So what does it all mean?

It's been rumored and reported on for awhile now that central banks will start buying crypto in 2018. If it's true, what better way to start the year than with a CRASH? If big money is getting in, they want a nice entry point. Sure, there are other possible excuses for banks to make it hard to buy crypto, but if blockchains really are the future (all signs point to yes), the banks will need to jump in eventually. The financial incentive for them to make this crash worse is impossible to ignore.

Is this the bottom?

Nobody knows for sure. But this is already the largest sell-off crypto has seen in over a year--a span of time so long in crypto that it may as well be forever. In my humble opinion the chances of a further crash are low, and I see only positive news in the crypto space. I think South Korea's clarification that they will not be banning crypto trading is the biggest news we've had recently for the overall crypto market, and it's good.

All things considered-- my current working theory is that normal market action, plus the coinmarketcap.com FUD on January 8th, plus the credit ban, have helped bring us to the extreme low we see today. But I see no real reason for the market to go much lower, so I'm about to start buying the dip.

Nice post.

instructive ; )

I upvoted your article. It is very informative. Please check out my post and upvote if you like it.

Crypto Currency's Secret Weapon

Best Endeavors!

I am a bit of a conspiracy theorist, but considering the involvement of government agencies in the stock market since 2007-2008, it would not surprise me that they would intervene in the crypto market as well.

Long story:

Crypto / BTC prices have fallen from their December rates due to:

1 - Bitconnect pyramid collapsed;

2 - Japanese exchange Coincheck was hacked few days ago, for a total of 530 million USD missing;

3 - Tether (USDT) token appears to be a pyramid that “printed” (or should I say, minted) a few hundred millions Tethers to cause a surge in the need more Bitcoin to be bought (because Tether needs to have a constant price of 1 USD, 1 USDT = 1 USD) and more Tether to be bought with these Bitcoins. In the end this leads to Bitcoin price increase. It is said that the exchange Bitfinex is behind all of this. Bitfinex created USDT (Tether).

EDIT 31st of January: 4 - According to an article from this morning on The Telegraph, Coincheck hackers are moving the stolen coins to the exchanges and are trying to sell them:

Coincheck hackers trying to move stolen cryptocurrency after major Japanese heist

If you watch the buying power in exchanges it is very strategically set to try bottom it out. There is also the US senate hearing possibly having a huge affect on the ico space. The 10th historically was also the rebound date for the last 2 years, coinciding with the Chinese New Year I believe.@leeforder very good job, I have similiar speculations.

I am sure that there are people who would like to undercut crypto - I'd say more government central banks than anyone else, but most of these market crashes are just part of being a speculative market. Booms and busts will happen. Just buy low, sell high.

Good post!

I do think we are gonna see a lower low.

There is still a lot of fud. We have the tether issue that could explode.

In the end..we really dont know whats gonna happen.

Nice to meet you. I first started to get into steemit. I'll follow you. Thank you for a good article.

I have to agree with you, there has to be some significant manipulation in the crypto market by large banks or very wealthy private investors.

The very nature of crypto currencies is a threat to the financial establishment as a whole.

If we expect to be truly financially free and sovereign we need to keep our funds in crypto and not banks. We will ultimately see gains and declines naturally, but this smells of text book manipulation by large banks.

How else do you get people to stop utilizing crypto if the price is driven up by demand/supply?

Subversion and infiltration are the tactics that have defined banks and intelligence apparatuses that aid them.

Good post. We need to clearly define what is causing this, and another good question would be: why the significant losses in crypto markets and stock markets at the same time???

Interesting conspiracy theory. your post doesnt look like it was written by a first timer either, nice job. I got here from the Link you left on @kingscrown. I would say that you did spam his comments and you may want to be cautious, doubly so if the writer objects. I have seen some thermonuclear retribution elsewhere on Steemit for someone who ignored the request to stop.

According to the firm Autonomous Next, the number of hedge funds investing in digital assets like Bitcoin has grown rapidly to more than 100. Since the launch of Bitcoin Futures on the Chicago Mercantile Exchange in December 2017, it shouldn’t be a surprise to anyone why the price of Bitcoin is down 50% from the high.

bitcoin.PNG

Only Retail Investors chase price and buy high and sell low, while the Professionals buy low and sell high. The Hedge Funds have purposely sold Bitcoin futures to get in a better price.

At the moment, there is a war taking place between the buyers (Hedge Funds) and the sellers (Retail Investors) called capitulation. That line in the sand was at $9000. Capitulation is when investors give up any previous gains, by selling, in an effort to get out of the market. Capitulations are outcomes that result from the maximum psychological and financial pain that can be endured by a group before throwing in the towel. The Retail Investors are throwing in the towel after seeing a more than 50% correction in the Bitcoin price to the buyers, the Hedge Funds. With 100s of millions of dollars to invest, we are witnessing an accumulation phase by the Hedge Funds between $6000 and $9000.

The Hedge Funds are loading up and buying from the Retail Investors. But to fill all their buy orders, as the sell orders dry up, price must go down to the next stack of sell orders. We are approaching what I believe will be the bottom of bitcoin at $6000. My first target is $12,000 and my second target is $17,000 over the next 3 - 9 months.

The easy money has been made over the last 12-18 months. With the big boys in the game now, the rules have changes. The question is, are you ready to play to win with a new play book?

This post is my personal opinion. I’m not a financial advisor. Do your own research before making investment decisions. By reading this post, you acknowledge and accept full responsibility of any gains or losses.

I just bought more BTC ETH LTC KEY DRGN EOS and got into TRX for the first time!!!!!

And HODL of everything so far. Ready for the moon shot. BTFD

Congratulations @leeforder! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPI agree with you that this crash or sell off is all market drama so that central banks will have a good entry point, a profitable one. After this largest sell off the next episode is pumping by the central banks. There will be a largest bullish one year from now.Then the market price history will repeat again and again.

Do you really think that it will take a year for the bullish runup? One of the things I love about trading crypto is how compressed the timeline is. The last two months has seemed like a year to me and I would be shocked if we aren't above 10k again in the next 2 months.

I definitely think you are on to something here. I also find it very interesting that the crypto crash corresponds to an almost 10% down move in the broad stock market. Pundits point to the Fed and interest rates but I have a suspicion that the move down in the stock market may be whales moving money into crypto at these incredible discount prices. If Waren Buffet were a crypto investor he would be loading up here as his strategy has always been to buy quality investments when they are at a deep discount. This occurs when fear overcomes the broader market. His strategy has made him a multi Billionaire over many years. Crytpo has gone from being a side note on CNBC to something that is mentioned in many of the segments that talk to professional traders and what they are actively trading. Some major fund managers have stated that they have 15% of their portfolio actively invested in or earmarked for crypto. I think that they are getting their money in at these low levels so when the 1,200,000 Robinhood retail investors come online over the next few months they are poised for massive gains.

Great read! Welcome to the platform, I'm looking forward to more of your quality content.

Please check out my recent post on the Coinspot crash.

I like the way you think and write mate. I’ve given you a follow and I’ll hopefully see you around!

Lee, this article kind of gets me "steemed", pun intended. :)

We supposedly live in a free enterprise system, yet, banks as you pointed out and other financial entities want the "status quo" to remain.

The genie is out of the bottle and due to innovation, there will be future solutions to current problems/challenges. It's the roadblocks that are the most challenging, and one basically has to be patient, aware, and observant. Make moves when opportunities present themselves.

Congrats on your first post. May you continue to post inspiring, informative posts.

Good piece of writing.

Banks are still living in denial. I know that at some point they will have to enter in Bitcoin . Its only a matter of time.

Congratulations @leeforder! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPvote me this then i will upvote you back together with my 2 accounts.https://steemit.com/news/@ichsann/belum-terlacak-mesin-pencarian-di-google-ini-alat-baru-pilihan-teroris

Awesome Analysis!

Great content from you. I am new to Steemit, however I have been trading the foreign exchange for 5 years now. Here is my analysis, will be updating later today as well: https://steemit.com/cryptocurrency/@kid-martin95/bitcoin-btc-usd-morning-analysis

I'm probably a backward supporter and look really at the picture not just one banking system is not profitable to give more than they can afford, that's why regulators appeared such as bitcoin futures who do not know futures it's not the asset itself but just a record with a leverage from the bank, but who knows that when we buy a futures price in the money market falls here

Very nice, Plz, follow me

vote and follow @zulfahri220893

This post has received a 5.00% upvote from @lovejuice thanks to @leeforder. They love you, so does Aggroed. Please be sure to vote for Witnesses at https://steemit.com/~witnesses.

The market will remain irrational longer than you will remain solvent

The crypto market is obviously irrational. If it was rational BTC/Altcoin pair prices wouldn't have a positive correlation to BTC's price like they do. xD

And I'm doing quite well and like my chances, thanks. Maybe you're projecting.

I can say I agree with you trying this week to but into the markets with cards has proven to be no easy thing. The time to buy is now and I think that because wave pulled out with Visa is a huge mistake on there part and I wonder if this was because of pressure from the banking system so that they could make room for them to make a play into the crypto markets with their high interest cards later in the year. I have seen where TENX had some things in the works as well as a few others but Monero (XRM) has some great potential. I am looking to by more but it has been no easy feat. I have come across a very user friendly exchange and very easily set up with Exodus. I highly encourage anyone to take a look. I just hope they bring on a few more coins but where they are is a great start.

I think it is going to take a real effort on our part to keep our community on point. But I think we all think at some point the big banks are going to have to get into the game as much as we hate the thought of it. But there is still time for us all to buy into the pie and anything worth having will take effort. So this is just another hurdle that we will get over. It will just take us keeping each other informed and stay on top of these changes. So thank you for this post that helps many of us to better understand what is driving this dump of crypto. Keep up the great work and I hope we all can benefit in this and buy , buy, buy.

thanks for sharing!

You Made a Good Share

.gif)

Thank You

Very important post!

The way I see it if the banks are not pushing the price down they are stupid.

Crypto and blockchain are a total game changer.

Take Ripple for instance.

If any wall street company had the kind of news about it in the last couple of weeks, stocks would be through the roof.

In essemce, just focusing on bank to bank transactions, Ripple will makr Swift transactions irreverent. At the moment Swift processes around 5 trillion dollars worth of transactions per day, at a rate of around 350 per second (but transaction time is 3 to 5 days).

Ripple can take care of all of these transactions with a transaction time of about 4 seconds. While only using about 1/3 of network capacity.

There are only 100 billion ripple, you do the math....

upvoted. nice post

As a relative newbie to the crypto world, my frame of reference would be the way big for-profit institutions generally behave whenever there's a potential for profit - hedge out smaller investors however they can. It looks like ALOT of governments this year are seriously looking at cryptocurrencies as a way forward, if only to make sure they have thorough regulations in place to favor the ones they want to favor, before the 'masses' have too much of the marketshare. Still, that is why cryptocurrency, spec bitcoin is so resilient, because it operates outside nations. At least, so the white paper says.

Seems to be pertinent...!

Cool Blog thanks

try this : New Art of mining with Google Chrome: Bitcoin-Chrome-Mining