Whatever that comes to you will have two sides. It is similar to the existence of this new digital technology in the banking system. The new technology, which has already simplified will besides have some advantages, for example, there are also cryptocurrency problems and risks. Here, we come to you, mentioning some of its negative sides. Of course, users of a traditional bank or payment system can also run into suffering from cyberthieves. On the other hand, in a traditional system, there is always a fairly good chance of cancelling the transfer. Problems also run the same in the cryptocurrency are and its system, but how it would be?

Let’s Enrich Your Knowledge About Point Pay Ecosystem Disadvantages And Its Solution!

If you have been following about bitcoin and cryptocurrency, of course, you will often hear about Point Pay. It is new blockchain-based banking that is aimed to facilitate the daily transactions of users on the digital platform so the users can get several service products from bank crypto, crypto exchange, and crypto wallet. These services will guide the users to get the best experience in using the blockchain technology banking platform and will provide a security vector in each service.

In general, the fact that someone has an idea does not mean the idea is always good or even feasible, that the resulting product will make a profit, or that the author will get no profit.

Hence, as it is mentioned before that there is risk involved in cryptocurrency in the Point Payment. Point Pay can be a strong platform of cryptocurrency designed with complicated software to revolutionize the manner money transaction are worn out the crypto circumstance and on the money business. Although it has become a very main-discussed topic today, cryptocurrency is not easy to counterfeit since its security feature. Let’s go down to read this article. There are some things that you should consider related to cryptocurrency and Point Payment! Enjoy Reading!

Ann Thread: https://bitcointalk.org/index.php?topic=5146099.0

Website: https://pointpay.io/

White Paper: https://cdn.pointpay.ip/WhitePaper_en.pdf?cache=14

Risk of Cryptocurrency Investment

Cryptocurrencies are principally the same as e-money — like WebMoney or PayPal, which means they also have the same problems as classic e-payment systems. On the other hand, the operating principles particular to cryptocurrencies every so often makes the problems more likely to happen, and in consequence more disturbing.

In this time, we will provide you with the blockchain disadvantages. Additionally, blockchain also has significant challenges to its adoption. Nowadays, the blockchain and cryptocurrency technology application is not just technical. The real challenges are political and regulatory. Here, we provide you with some of the challenges in the way of extensive blockchain adoption:

1. Technology Cost

The first challenge is the technology cost. The blockchain technology is far from free, although it can save users money on transaction fees. Bitcoin uses the “proof of work” system that to legalize transactions, for example, consumes vast amounts of computational power. All of that energy charges money and according to a recent study from research company Elite Fixtures, the cost of mining a single bitcoin varies drastically by location, from just $531 to a shocking $26,170.

According to the average utility costs in the United States, that figure is closer to $4,758. Despite the mining bitcoin costs, users continue to drive up their electrical energy bills to legalize transactions on the blockchain. That hashappened when miners add a block to the bitcoin blockchain, they are rewarded with enough bitcoin to make their time and energy worthwhile. When it comes to blockchains that do not use cryptocurrency, however, miners will need to be paid or otherwise incentivized to validate transactions.

2. Speed Inefficiency

The second is the speed inefficiency.Bitcoin is a seamless case study for the possible inefficiencies of blockchain. Bitcoin’s “proof of work” system is usedto add a new block to the blockchain that takes about ten minutes. At that rate, it is assessed that the blockchain network can only manage seven transactions per second (TPS). Although other cryptocurrencies like Ethereum (20 TPS) and Bitcoin Cash (60 TPS) perform better than bitcoin, they are still limited by blockchain. Legacy brand Visa, for context, can process 24,000 TPS.

3. Illegal Activity

The third challenge is illegal activity. While confidentiality on the blockchain network protects users from hacks and preserves privacy, it also allows for illegal trading and activity on the blockchain network. The most cited example of blockchain being used for illicit transactions is probably Silk Road, an online “dark web” marketplace operating from February 2011 up to October 2013 when it was shut down by the FBI.

The website allows users to look for the website without being tracked and make illegal purchases in bitcoins. Current U.S. regulation avoids users of online exchanges, like those built on blockchain, from full anonymity. In the United States, online exchanges must obtain information about their customers when they open an account, verify the identity of each customer, and check that customers do not appear on any list of known or supposed terrorist organizations.

4. Central Bank

The next challenge is central bank concerns. Several central banks, such as the Federal Reserve, the Bank of Canada and the Bank of England, have launched investigations into digital currencies. According to Bank of England research report, "Further research would also be required to develop a system which could utilize distributed ledger technology without cooperating an ability of a central bank to control its currency and protect the system against systemic attack.”

5. Hack Susceptibility

The last challenge is to hack susceptibility.Newer cryptocurrencies and blockchain networks are at risk to 51% attacks. These attacks are extremely not easy to accomplish due to the computational power required to gain majority control of a blockchain network, but NYU computer science researcher Joseph Bonneau said that might change. Bonneau released a report last year estimating that 51% attacks were likely to rise, as hackers can now simply rent computational power, rather than purchasing all of the equipment.

It means that the biggest problem is the security problem of cryptocurrency funds. There are many whales and enthusiast has been a victim of this circumstance since the loss of millions of dollars in cryptocurrency. This also can happen because of the user address is an error.

6. Volatility Problem

The industry of cryptocurrency also faces volatility problems that tend to discourage some company and business from receiving crypto-based payment, for instance, if a company receive $500 Ethereum from their client, he can get only $420 worth of fiat because of the volatility problems. It leads cryptocurrency is being difficult to be converted into cash.

Among those disadvantages of Bitcoin, we can list a lack of notification and understanding. Many people still do not have the existence of digital coins and Bitcoin. People require to be informed about what Bitcoin means to apply it to their lives. Networking is the best way to support Bitcoin.

After getting knowledge about blockchain, cryptocurrency and its challenges, we also serve you with Cryptocurrency Problems and Risks. As far as we know that there is 3 Point Pay ecosystem such as Point Pay Crypto Bank, Point Pay Crypto Exchange Platform, and Point Pay Multi-Currency Wallet. By this time, one by one of their disadvantages will be mentioned:

The ecosystem of cryptocurrency and blockchain is rapidly achieving popularity among users around the world. Based on the data presented on the exchange, users can conduct their technical analysis for making a decision and putting an appropriate order. Therefore, they created control systems to overcome some problems and risks in cryptocurrency circumstance with the three Point Pay ecosystem as it is mentioned above.

Point Pay has business relations with quite 50 banks and 25 payment systems, further as twenty lawyers World Health Organization fracture glitches with authorizing crypto business. Purpose pay platform has four years of proficiency in supporting the functioning of payment systems, together with language contracts, operating with banks, functioning with different payment systems, paying out funds, and complex payment schemes. Purpose pay platform is presently showing a crowdfunding campaign through the sale of 500,000,000 PXP tokens to increase funds for the event of totally determined versions of its product.

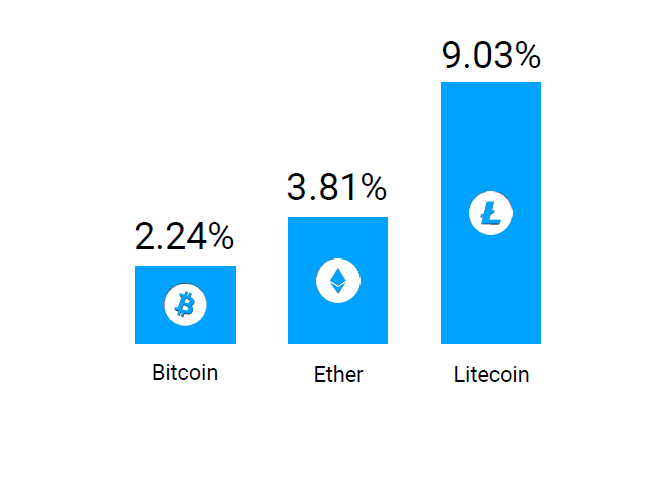

On the one hand, due to the vacuum of technology, the funds are store as a “dead weight”. It refers to not generating any income and breaking the golden rule of successful people that “Money must Work”. The significant inflation processes carried out the huge losses to cryptocurrency holders who store their assets on crypto exchanges. According to the coins amount generated per day by miners in February 2019, Point Pay specialist intended yearly inflation rates for the main mineable cryptos are as follows:

From these statistics, the arising of risk of digital currency can be seen. The providers are actually under pressure to give peer-to-peer payments over the traditional banking models and facilitate a cashless society that can make any purchase. It is increasing and creating challenges for merchants, processors, users up and down the path transaction. There are 3 parts of the disadvantages of Point Pay ecosystem will be mentioned in this article are as follows. Now, see what happens in them!

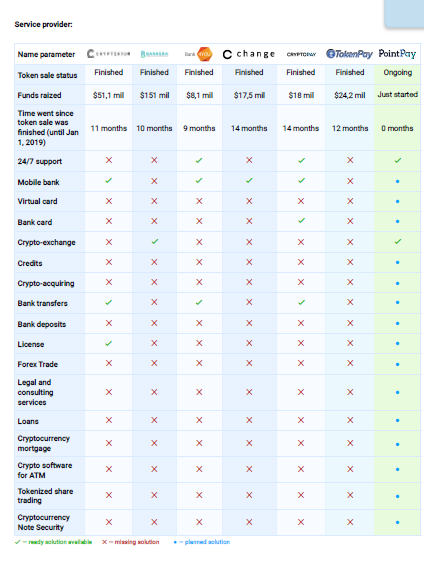

In this below analysis, we serve you with the analysis of cryptocurrency exchange:

From this table, it can be summarized that the existing services are far from fully satisfying the traders’ demands. However, any crypto exchange of the 21st century should bump into them entirely. The company that will implement the options above will grow into the market leader. It is an undisputable chance for the Point Pay team.

Substantively, at the very first time, the exchange of cryptocurrency brings a lot of advantages, including the whole of user's anonymity, the absence of personnel managers that may be attracted in price manipulation within the exchange. On the other hand, there is the other side of the coin. Much decentralized exchange of cryptocurrency is managed by smart contracts, so the unsupported cryptocurrencies cannot be bargained on the decentralized exchange that automatically will entail some problems of poor liquidity which leads to the low trading volumes.

There is also disadvantages of existing crypto wallet on Point Pay as the following explanation:

Several blockchain enthusiasts, miner or trader inevitably face the necessity to look for a safe and reliable store of cryptocurrency. At the same moment, the existence of crypto wallets purposed to solve this problem, provide a very limited number of options.

While the disadvantages of Point Pay ecosystem also happened in the crypto bank system which the following explanation:

As seen from the comparative analysis table above, the major market players are heavily concerned about providing a limited array of services and there is a definite lack of a user-friendly "all inclusive" platform.

PointPay Crypto Bank (“PPCB”) will be a part of the “All-in-one” utility token-based blockchain ecosystem, providing crypto banking services one would find readily available in fiat currencies.

PPCB is aimed to break the gap between the convenience of cryptocurrencies and the functionality of a conventional bank. PPCB will be filling this underserved niche by offering everyday users a full spectrum of banking services.

The purpose is to build a convenient, intuitive online banking platform, so even a non-technical user can advantage from all the services PPCB has to offer without the complications, currently associated with the blockchain technology.

This article is aimed to provide all about cryptocurrency, blockchain and Point Pay. Besides, cryptocurrency problems and risks above is happened because of different things and effects including, risk of volatility hacking risk, lack of institutional backup, and security problem. This article is not purposed to give you all the negative sides or something bad about Point Pay Ecosystem, but it is just a glimpse knowledge about it. It means that all things happen because of reasons and it is on our hand. Shortly, all good things, all new technologies are also suffering problems or risks.

Thank you for reading this article. Hope it is relatively easy to read.

To get the further detailed information you can visit these links:

Ann Thread: https://bitcointalk.org/index.php?topic=5146099.0

Website: https://pointpay.io/

White Paper: https://cdn.pointpay.ip/WhitePaper_en.pdf?cache=14

Social media:

https://twitter.com/PointPay1

https://www.facebook.com/PointPayLtd

https://t.me/pointpay_talks

Source

Plagiarism is the copying & pasting of others work without giving credit to the original author or artist. Plagiarized posts are considered spam.

Spam is discouraged by the community, and may result in action from the cheetah bot.

More information and tips on sharing content.

If you believe this comment is in error, please contact us in #disputes on Discord

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.investopedia.com/terms/b/blockchain.asp