Hedge Funds are finding it much easier to flip ICOs than it is to actually try and trade/invest in Bitcoin or other virtual currencies.

As you may have heard Hedge Funds are starting to enter the crypto space in larger numbers.

Per a report out the other day by financial research firm Autonomous Next, there are approximately 75 hedge funds currently in the space:

As we are hearing more and more though, many of them are not exactly investing in the space...

The Game:

The game is simple.

These hedge funds, through their name and their wealth, are able to score deep discounts on upcoming ICOs via pre-sales.

The pre-sales are basically sales of the currency at a discount to whatever the ICO price intends to be.

Currently the going rate seems to be somewhere around a 30% discount, but there are reports of even steeper discounts on several projects.

Then, in most cases, the tokens purchased at a discount also have no holding period for at least half of the investment.

(Substitute "player" with "hedge fund" and you get the idea)

Why is this a problem?

It is a problem for a couple reasons.

The biggest one is that hedge funds have no stake in seeing their investment and the project through to completion.

They get their discounted tokens, with no holding period requirement for a large portion of their investment, and then they dump the tokens immediately once the coins begin trading.

They collect their 30% profit (at the very least), and then move on to the next ICO project.

Rinse and repeat.

This is exacerbated by the fact that the size of the hedge fund investment, in most cases, represents the majority of the cash raised by the ICO project.

Which means them selling has an overwhelmingly negative affect on the price.

In comes regulation.

This entire setup is exactly why the ICO process is being so heavily scrutinized currently and is about to be heavily regulated going forward.

Mom and pop investors are holding the bag while hedge funds dump their discounted pre-sale coins on the unsuspecting masses.

And this doesn't even take into account some ICOs that are outright scams themselves. This is just talking about the legitimate ones!

Keep in mind that this isn't happening in every instance, and hedge funds that become known as flippers often find it difficult to get in on the next ICO pre-sale, but nevertheless, it is happening for more often than I'd like to admit.

Especially when there are so many projects out there desperate to get some kind of funding. They often take deals they know are not great because they don't have many other options...

My take away from all of this:

Regulations are coming for the ICO markets, and it's going to be great news for the rest of the market place. Coins that did things correctly and are on the up and up are going to receive more investment dollars that might have otherwise found it's way to pump and dump schemes.

I am not sure how all of this will affect Steem and its SMT project going forward as they seem to be separate things.

Perhaps steem and SMT can even pick up where the ICO market leaves off?

Ironically, the next leg up for the crypto space likely will be fueled by more regulations instead of less. Which is ironic in a currency that was created with hopes of being mostly regulation free, or at the very least, as a way to circumvent them.

Stay safe my friends.

Sources:

http://www.gulf-times.com/story/566026/Hedge-funds-flip-ICOs-leave-other-investors-holdin

Image Sources:

http://www.safetysign.com/products/2967/no-dumping-sign

https://www.cryptocoinsnews.com/pump-dump-know-signs-trading-altcoins/

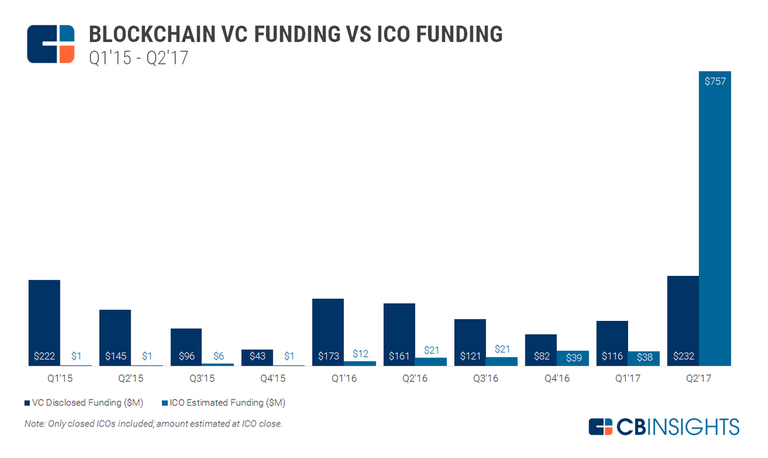

https://www.cbinsights.com/research/blockchain-startup-deals-ico-trend/

Follow me: @jrcornel

Funny how the hedge fund guys from places like Seeking Alpha are the first ones to yell 'fraud' or 'scam' at ICO's when they are the scammers and fraudsters as well...

Regulation will get things under control and ease people's uncertainty. Everyday my friends complain about their banks more and more. Eventually, I hope they join the dark side aha

I think you hit the nail on the head. Wall Street is starting to get involved which means the regulators are going to have to look at things. The funds are known to be willing to do whatever it takes to make money. There is no line they are not willing to bend (if not outright cross). Hence, it is imperative that the regulators add some legitimacy to this sector.

In the end, the scammers and easy money cons will be removed. We are at the beginning stages so I see a huge amount of growth. It is interesting that you bring up Steem and SMT...I find that to be a fascinating question. I have no concluded how I think it will turn out so I have to trust that there are people who developed all this who has some insight. So far, even though the Steem price appears locked in to a range, the platform looks spectacular. Steem is already processing a ton more transactions than either BTC or ETH can even dream of handling at the moment.

^ Agreed

12 months from now,ICO market will be completely different. The argument countries like US,EU,CANADA and many more are making is not banning ICO but consider them as equities .This space will be heavily regulated just like IPO and stock market.Easy days are numbered for ICOs

good post! thank you for sharing a good story, success always! take a moment to see my post, if possible !!!

https://steemit.com/steem/@alfa-good/how-is-steem-power-and-steem-dollars-in-steemit-steem-is-a-liquid-currency

Thanks!

@jrcornel

@originalworks

The @OriginalWorks bot has determined this post by @jrcornel to be original material and upvoted it!

To call @OriginalWorks, simply reply to any post with @originalworks or !originalworks in your message!

To enter this post into the daily RESTEEM contest, upvote this comment! The user with the most upvotes on their @OriginalWorks comment will win!

For more information, Click Here! || Click here to participate in the @OriginalWorks writing contest!

Special thanks to @reggaemuffin for being a supporter! Vote him as a witness to help make Steemit a better place!

Your post is very interesting ,, because it can add insight for me and everyone who is in stemeet, hopefully others also like your post, hopefully the next post can give a better thing again, so that i can know many things in my life , I like your post thanks :)

wow love what am seeing

The crackdown on ICO's will be a great thing for the cryptocurrency community, the only goal of hedge funds are to make money and because of that if they are purchasing ICO tokens at values 30% less or more they can then just dump them as soon as market is live causing even more issues and concerns.

cheers

Dante

Hedge funds aren't the only people "ICO flipping". I know countless retail investors in the space that have made an absolute killing with it.

I also disagree with the sentiment from people that if you an invest in an ICO, you are somehow responsible to "not sell" or HODL. In my mind, the market is the market. If people want to sell, great. If people want to buy, great. But when people complain about sellers, it's silly.

Agreed, the difference is that most retail investors don't get that 30% discounted price...

Some do, but the vast majority don't..

I think with increased regulation, future ICO's are going to be limited to Accredited Investors and it's basically just going to be the reincarnation of the current VC world on the blockchain. (which would suck)

That would indeed suck pretty horribly, though it's plausible there won't be universal agreement from all the major hotspots, ex., Russia might be incentivized to keep the "wild west" status going, which would benefit platforms like Waves.

Hi Cryptobobby& Jrcornel,

I think the original article that inspired this discussion was on Bloomberg, for those people, who might be interested in the details.

But coming back to the cryptobobby argument that retail investors also make money flipping tokens on ICO price pop I would like to point out that w/o a discount they actually assume the risk of the loss, unlike Hedgies w 30% discount. 30% discount not only serves as a trading cushion, but also means that they stand to gain 43%, along with some other tricks, way more than that if price is at par! That's imho the main difference.

As to OP's question on SMT's I think we would see more of HF financial wizardy over here, as Steemit being a media platform, naturally lends it self to self-promotion abuse...

Flipping Out

It's a shame that some of the worst elements of the establishment are the first ones in.

Hi @jrcornel, Hope you're doing good. I gone through your blog post and found it very useful. So I must say that regarding CRYPTOCURRENCY you're the MASTER now onward. Your information and knowledge on it is unbeatable. And I selected these lines from your post as a result:

They collect their 30% profit (at the very least), and then move on to the next ICO project.

Rinse and repeat.

Keep posting amazing stuff for community. Stay blessed!

good good think you

think you

This is very incisive.

Thanks!

If this is a known procedure, a natural consequence should be to add some serious obligatory holding period to these pre-ICO investments. That does not need a regulatory framework. It would even be a selling argument for such a project.

I suppose it had to happen sooner or later... Hedge fund managers could screw up a free lunch!!!

Really useful. I think any legitimate ICO that enacts real due diligence would want to be wary of any massive single investments for the simple reason that a dump could hamper the token's value at the very beginning where it's probably at its most critical phase. That said, the strategy works even in the context of a fraudulent ICO - so, yes, regulation is needed. The sooner, the better...

This issue and market manipulation in general are the things that really bother me about the current market.

That is interesting. Hopefully they start to "actually" Invest long term in these projects.

My blog provides analysis of coins per request and I've seen many who got burned by ICO pump and dumps. Also, there are YouTube personalities shilling for these ICOs and getting paid to do so. Not cool. I have many followers who were sadly the bag holders.

good article...resteem