Yesterday I wrote Is there a correlation on day of week to BTC price?

and found that at a short term, there is data to suggest just that. Today, I've expanded that data a bit (to 1yr from 9wks) and ran some scenarios based on that data.

Disclaimer: I am not your financial adviser. I'm just a dude that likes to play with data.

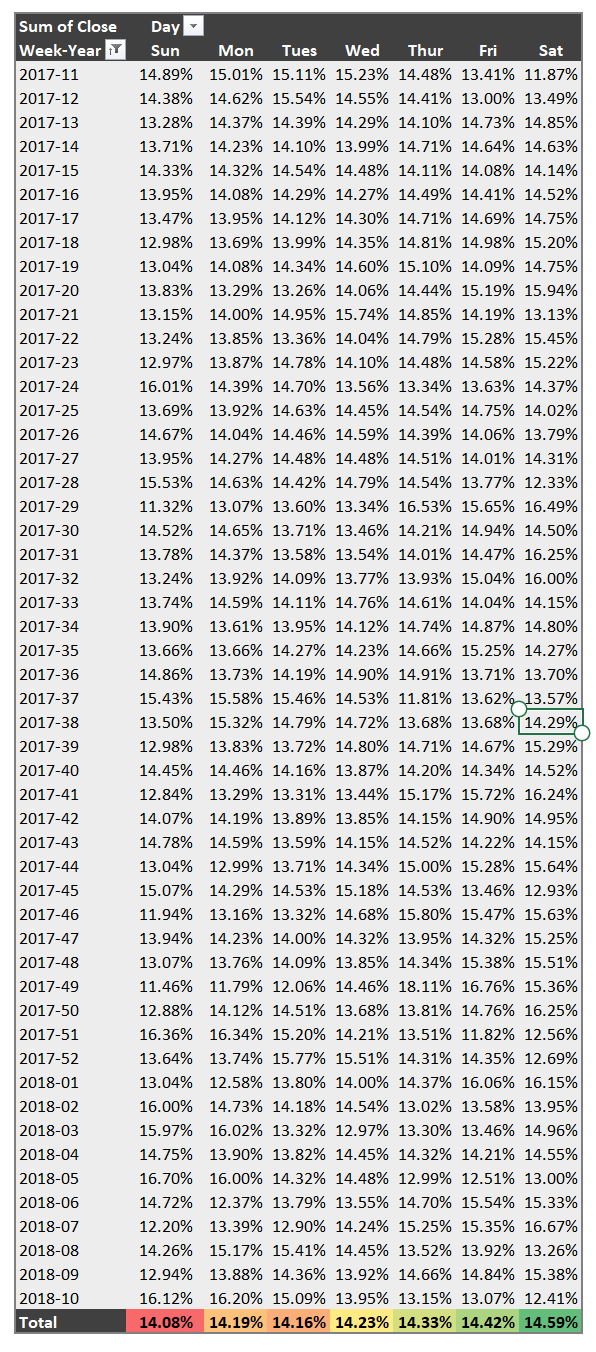

Lets start off with a table showing the pattern of price by day/week over the past year...it gets more interesting after this. (sorry for the random cell selected).

Small explanation, this table shows the day of week with the highest price per week. Basically add up the daily price for all days and take the single day as a percentage. This is just a baseline to easier see the highest price per day of the week.

As you can tell, when the data is moved from 9wks to a year, there is a much smaller difference between the days of the week for the average, though, it still has similar traits to the original chart. That being said, the best way to run an IWP like this is to take the previous 6-9wks rolling and keep updating it each week to see what pattern the market is taking. Any more than this, and the volatility we want to see just becomes noise. We can't make much of a plan off of this, but based on the average Wednesday to Thursday and Friday to Saturday, we are going to use those as our buy and sell days (YAY! 4 day work week!).

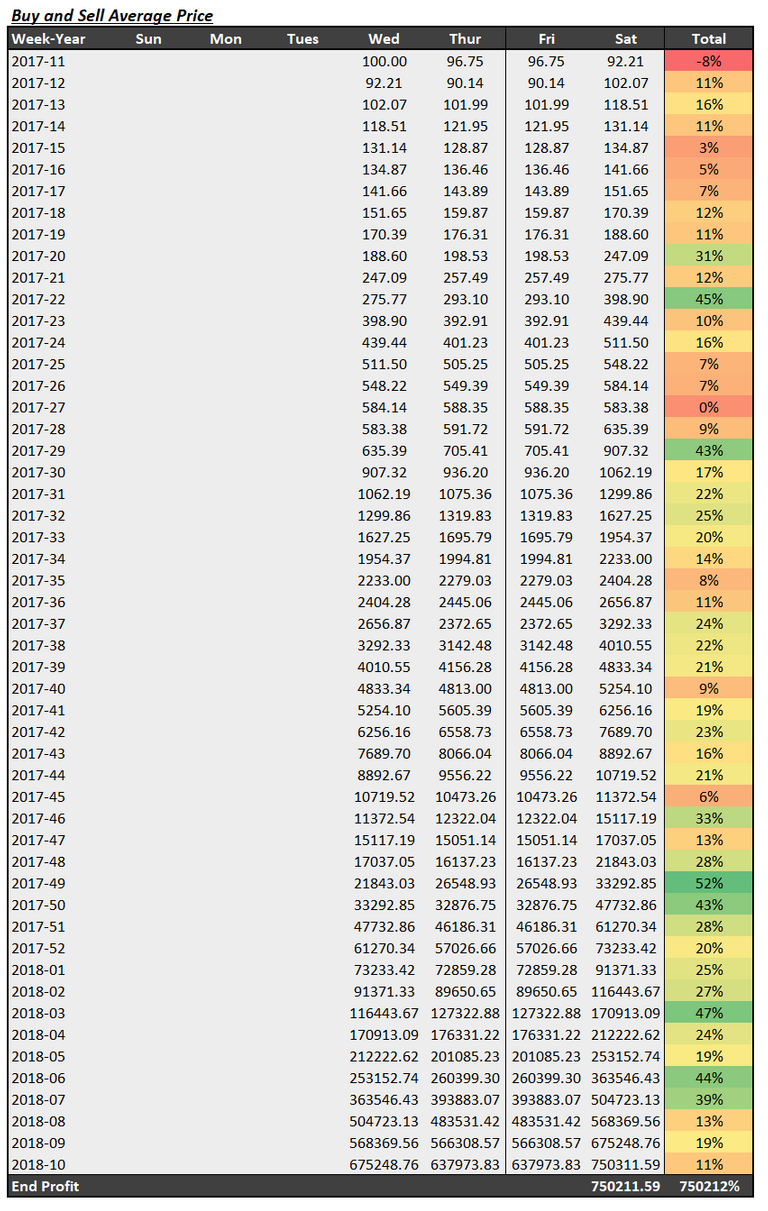

Lets start with looking at trading the average price for the next days average price. We will start with $100 and run it through last week:

DAMN! Just trading the averages for the last year would get you to an EOY total of $750,000 USD! WHAT!..

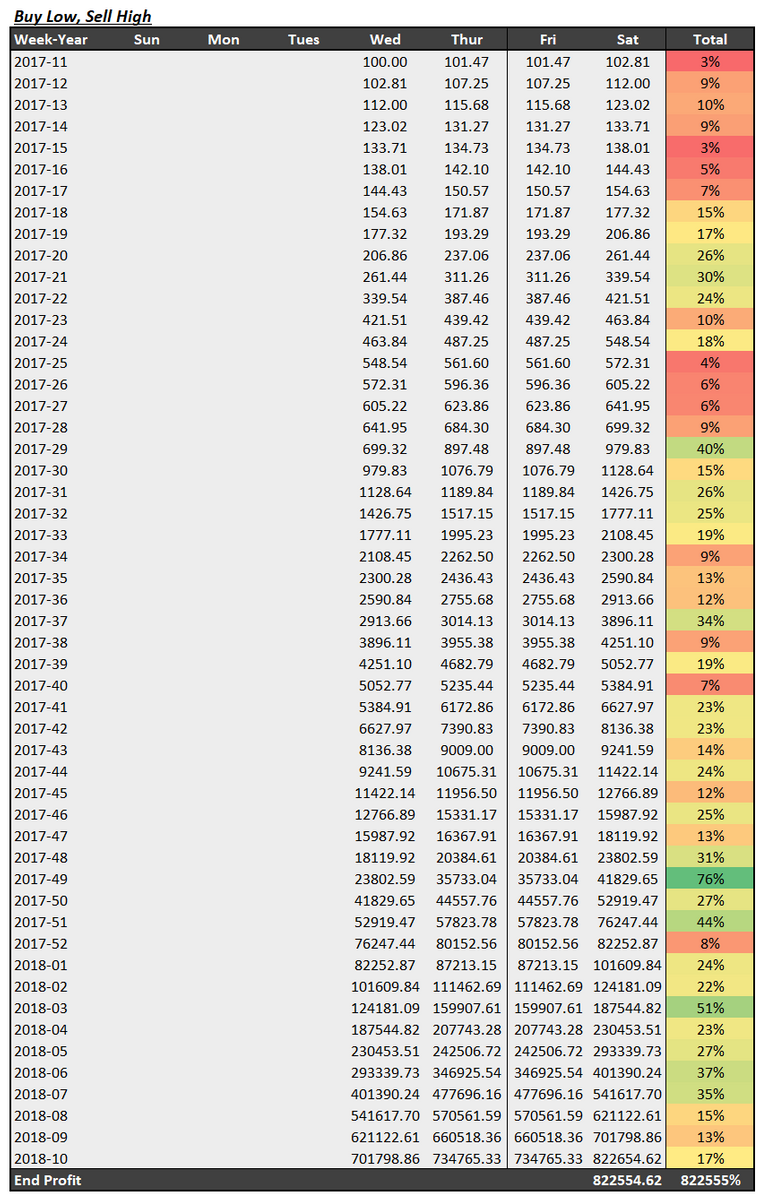

But wait, what if you were some trading savant that could buy the low and sell the high for the same days:

You read that right, that is $822,000 USD by EOY! I...wouldn't even be able to contain myself. Imagine this was a start of $1000 USD or $2000...you would be a multi-millionaire!

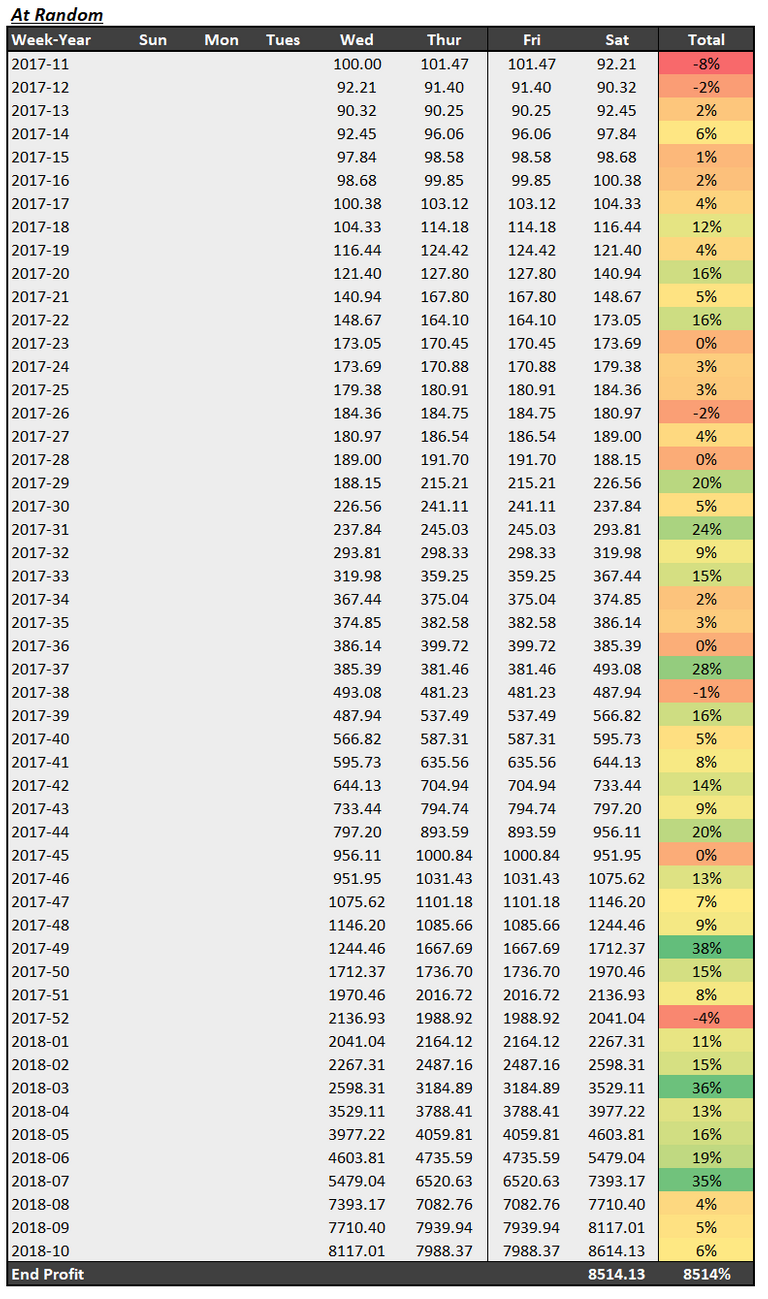

The thing is, the odds of getting this right or even close to right every day like this...is low. So, instead let's look at a more random buy/sell. In this assumption, I'm still not selling at the next days low...as that just sounds like it would be silly far more often than not.

In this one we have MUCH more realistic gains. This one clocking in at $8,500 USD by EOY....

So, what is the morale of the story here? Its that even in a bear market, traders can make money but they have to know when to put their money in, take it out, and sometimes lose a little to gain more later.

The next step is to find a data source for hourly prices. With that, I can see what the best time of day is to make the trades to get that massive 822555% gain...maybe. :)

Let me know your thoughts in the comments below if you get a moment! Till next time!

What if you just execute the trade at the same time each day? (I assume you'd need hourly data for this)

Yeah, I'm working on hourly data. I've already got it put together for the past 5 months and am watching the current week trend as well. I think I'll need to add some weighting to make it come out right.

Congratulations @jiffythekid! You received a personal award!

Click here to view your Board

Do not miss the last post from @steemitboard:

Congratulations @jiffythekid! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Thanks, bot.