2017 can be marked as the year the ICO went mainstream as a way of raising money for (blockchain companies). It can be compared to Venture Capital, with the difference that almost any private investor has access to it.

ICOs also got a lot of attention because of their huge returns over a short period of time. Ripple, Ethereum, EOS, NEO, Stratis, … these are just a couple of tokens that gained over 1000% (some even 10.000%) in less than a year since their ICO.

Appealing, right?

But the bigger picture looks very different. A lot of these ICOs aren’t that profitable, or even losing you money. And with more ICOs than ever, it becomes harder to pick out these winners.

To keep up in this space you need to read white papers, evaluate teams, projects and so much more in order to find the real gems.

This takes a lot of time, and to be honest, time is the one thing I have too little of, and if I had more, I’m sure I wouldn’t spend it on reading white papers :)

Invictus Hyperion Fund - The ICO for ICOs

That doesn’t mean I don’t want to take part in the profits of ICOs like the ones listed above, and that’s exactly what the Invictus Hyperion Fund provides me: the Invictus Hyperion Fund (IHF) is an ICO that uses the funds that it collects during their ICO to invest in other early stage ICOs.

This way I can invest in only 1 ICO, but in reality I get exposed to many other ICOs that are vetted by the Invictus team.

A token backed by underlying fund assets

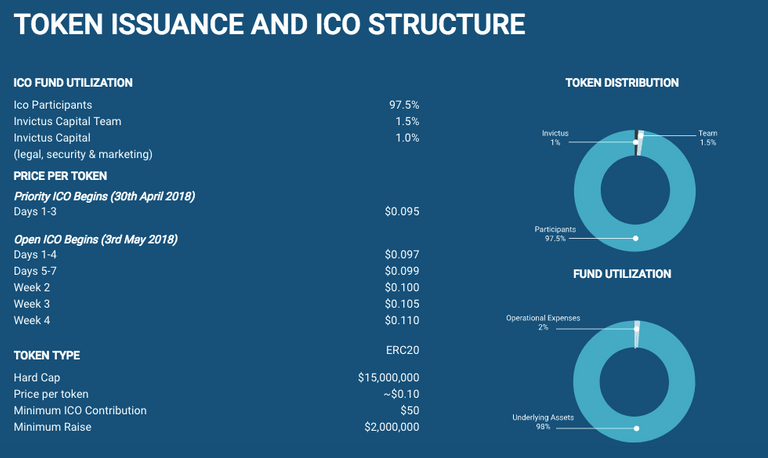

Hyperion gives you access to a diversified portfolio of early stage blockchain projects through a single ERC20 token.

The fund has a hard cap of $15 million, tokens can be acquired for +/- $0,1 and the minimum investment is $50.

Once the fund reaches a value of $30 million, the quarterly returns will be used to “buy-and-burn”. This means the returns will be used to buy IHF tokens that will then be burnt and seize to exist. This increases the value and price of tokens remaining.

Why I invest in IHF?

There are a lot of reasons I invest in IHF. One of them I already shared with you: time!

You can do your own (time consuming) research, but when you invest in IHF the people at Invictus takes care of this part :) Every ICO they invest in will be analysed by experts and they will perform extensive due diligence on your behalf.

The second reason is the low fee structure of this mutual fund. No annual management fees are charged, so the fund managers incentives are aligned with the investors’ interests.

The third one is the team! This is not the first ICO the team at Invictus launches. They have experience, have always delivered and are backed by a big community. It’s one of the few teams I know that works with Big 4 consultancy firms to audit their ICO.

I’m also a big fan of these kinds of funds. Historically they have proven that they outperform actively managed funds so for me these plays are set and forget.

I can also imagine that if Invictus invests in pre-ICO stages, they will get better prices, and in investing every % counts ;)

Of course you need to do your own research, so make sure to check out these links for more information:

✅ @jbrabants, congratulations on making your first post! I gave you an upvote!

Please take a moment to read this post regarding commenting and spam. (tl;dr - if you spam, you will be flagged!)