Cryptocurrency is all around - it’s discussed in the Net and on TV, and a rare person would miss a chance to earn Bitcoin. However, for the vast majority of residents, crypto is something they don’t want to deal simply because they don’t know how. There is a serious gap between the real world and virtual money, and all you can spend cryptocurrency on is just another cryptocurrency.

Neluns project has been established to destroy this vicious circle and introduce crypto into retail and banking system. A hybrid of an exchange platform, banks, and an insurance company, it can make cryptocurrency way more available to usual people.

Problems of Cryptocurrency Market

Although the number of cryptocurrency investors has reached 500 mln already, many people still are not willing to enter the market. Why? There is no way to utilize virtual coins in the modern business models: in fact, only a few companies in developed countries introduced payments with Bitcoin. But what about other cryptocurrencies? And when developing countries will witness the integration of crypto payments?

The second reason for people to reject dealing with crypto is lack of knowledge and awareness. Most view cryptocurrencies as trading and investment assets, not like real means of payment. Besides, some have no idea what cryptocurrency and blockchain are, and how these work.

At the same time, cryptocurrency owners also face a myriad of issues including:

- Lack of authorized banking services.

- Difficulty converting crypto into fiat.

- Lack of financial instruments.

- Imperfection of exchange platforms (downtime, withdrawal limits, problems with registration and personality verification, hacker attacks).

- Poor insurance options.

Neluns – a Comprehensive Approach to Crypto

In order to change the current situation to the better, Neluns team has stepped up with a versatile solution. They offer a new business model aimed at eliminating the above-mentioned issues and increase the set of possibilities for the crypto community.

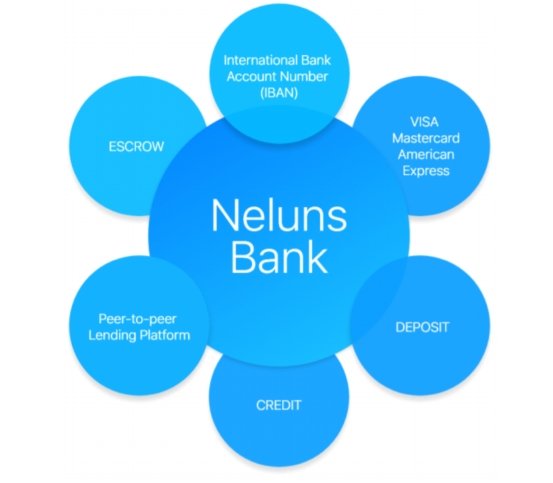

Neluns platform combines the benefits of both traditional and Blockchain banking and appears to be a fusion of:

- Cryptocurrency exchange;

- Insurance agency;

- Bank.

Such an ecosystem will open up the whole gamut of opportunities for all users. What are they?

Neluns Use Cases

First and foremost, Neluns serves as an exchange platform which means every registered user can sell and purchase coins in a couple of clicks. Besides, this is a comprehensive option for trading – there are a handful of useful functions for efficient trading. The process of deposit and withdrawal is quick and easy and can be done wherever the user is.

Neluns is tailored for working with both corporate and individual users – they can create IBAN accounts which support multiple currencies. Besides, there’s a possibility to release credit and debit cards that will work by connecting to SWIFT.

The third sphere of application is a peer-to-peer exchange. System users will be able to transfer funds to each other – international transfers are supported. At the same time, users may also lend and borrow money from one another.

The last but not the least is banking: Neluns possesses a full functionality of bank. Users can store their fiat assets to gain interest and receive profits from lending them. Dividends are paid to active participants and contributors, not mentioning reduced risk level.

Why Neluns?

Since it is a blockchain-project, its security is strengthened by encryption and other protection measures. The team has cared to ensure an unbeatable level of service quality. Let’s see what the creators promise:

- Bank guarantee approach means that users’ assets stay insured and protected legally.

- Exceptional transaction speed and simple asset withdrawal. Blockchain eliminates the risk of mistakes and accelerates transfers.

- Protection against hackers. Neluns implements technologies used by leading companies to keep intruders at the bay.

- Decent performance even during peak load times. During website downtime, users can have problems accessing and managing their funds. Neluns leverages technologies of the banking sphere and implements an advanced approach to data processing which allows performing millions of transactions every minute.

- Efficient and reliable customer support service. The company will provide 24/7 user support in different languages. It will be available on mobile devices, messengers, the official website, and via the hotline.

Bottom Line

Presenting a fusion of bank, insurance company, and cryptocurrency exchange, Neluns promises to become one of the most convenient applications for funds management. It allows transferring crypto in fiat in a couple of clicks and trading efficiently.

Despite the fact that Neluns emits plastic cards (Visa, MasterCard, American Express and others), it’s not clear whether holders will be able to pay with cryptocurrency. Turns out they would still have to transfer the funds into fiat. That doesn’t eliminate the problem of slow crypto integration in real life.

All in all, if you need a one-fits-all solution for managing your cryptocurrency assets, Neluns would be a great solution.

Website | Whitepaper | Telegram | Bounty

Author profile: https://bitcointalk.org/index.php?action=profile;u=993461

Hey. Very constructive review. Easy to read. I follow you. I will be glad if you follow back.

This post was resteemed by @steemvote and received a 90.4% Upvote. Send 0.5 SBD or STEEM to @steemvote

You got a 4.15% upvote from @upme thanks to @icotelegraph! Send at least 3 SBD or 3 STEEM to get upvote for next round. Delegate STEEM POWER and start earning 100% daily payouts ( no commission ).