Libra Credit (LBA) is a decentralized lending ecosystem that will feature coin-to-coin and coin-to-fiat opportunities for borrowers and will utilize the LBA Token. The project finished a successful ICO on the 5th of May and has so far achieved the addition to 4 major exchanges from which the most notable is probably Huobi.Pro as the exchange also offers most of the token's trade volume so far.

History

Libra Credit launched with a mission to provide "Credit for the Real World" in the form of decentralized lending as detailed in the whitepaper. The business is not a new one as the planning has already started around 2012 via a Chinese game credit venture that accumulated 33M users by 2015.

2017 marked a very important milestone technology-wise as the company successfully adopted machine learning to provide full loan cycle monitor and feedback after establishing a payday lending business in China. This resulted in a loan book value of $850M with only a 3.5% default rate.

LBA's edge

The company that has been co-founded by two ex-PayPal executives, Lu Hua and Dan Schatt, has a business model that revolves around it's partnership networks, the proprietary AI-based credit assessment framework and the flexibility for participants.

Partnerships with exchanges, stablecoin providers (e.g. Maker DAO), 3rd party identity verification providers and financial institutions allow the network to build up a complete lending platform without major shortcomings.

Exchanges for example offer crypto market liquidity while providing the borrowers the best rates for their lending and also allow the platform to instantly liquidate any collateral. Liquidity of course goes both ways, the borrowers also provide the exchange with more volume and fees as a return.

Stablecoins enable crypto holders to hedge the volatility of their portfolio, but this is only one of the benefits provided. The platform users will in turn raise the liquidity on these stablecoins.

Partnership with identity verification services and financial institutions allow the startup to broaden the scope of their activity towards fiat markets as well, which require strict compliance with KYC/AML regulations and also a secure loan network.

The AI-based credit assessment framework has been used as an in-house risk management technology which has been previously tested and deployed with the Chinese venture we previously mentioned. This enables the company to leverage a dual-credit assessment framework that considers collateral viability and borrower credit score.

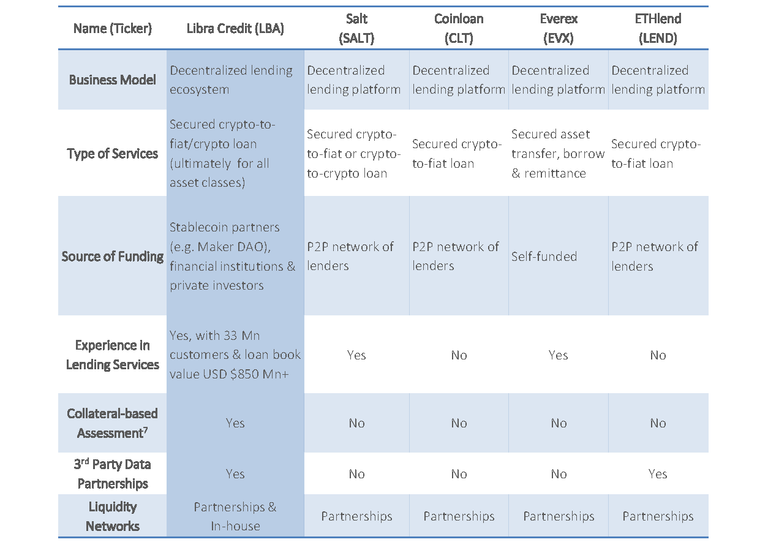

Lastly the flexibility towards participants includes such options as crypto-to-fiat, crypto-to-stablecoin and crypto-to-crypto loans. This makes Libra Credit a one-of-a-kind as no other platform previously offered all these options especially with a proven track record in the lending industry. Here is a comparison to the competition that was included in the whitepaper:

Backing

There is a clear reason why Libra Credit managed to raise over $16 million in institutional investment for the LBA Token as they seem to have a competitive edge above other similar platforms. Institutional investors like FBG Capital, DFund, BlockTower, Signum Capital, Block VC and DHVC have given their trust to the team behind the project.

The developments are progressing at a fast speed, the Libra Credit platform (desktop version) will launch during July with the ability to take part in crypto-to-crypto and crypto-to-fiat lending.

The complete roadmap can be viewed on the project's website.

Libra Credit on Huobi Talk

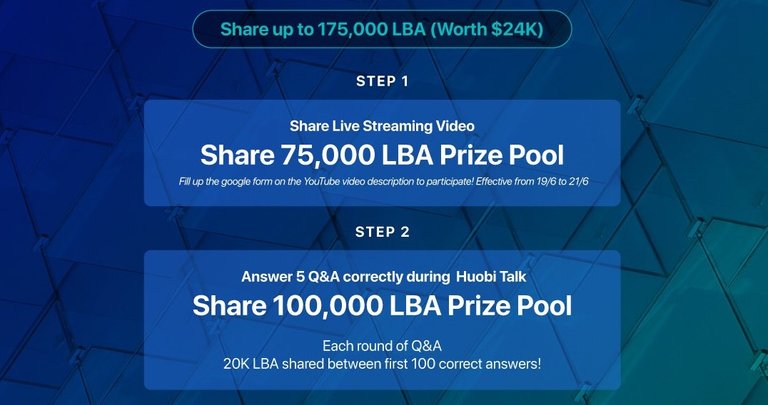

Now Libra Credit's CEO Lu Hua has also been invited to Huobi Pro's Huobi Talk which will be live again on the 21st of June and will also feature a prize pool of 175,000 LBA for sharing the live streaming video and answering a Q&A during the talk. Topics will include the decentralized lending business, LBA's developments and cryptocurrencies in general.

Hi Dear Join My Facebook Group 'Crypto' And Share Your Links! Thanks :)