The nature of news is to distort people’s view of the world. Those who base their investment decisions on the news alone are bound to lose money.

QUICK SUMMARY

November 2018 was one of the worst months for cryptocurrencies in recent years.

The media paints an extremely negative picture of the current situation, which usually signals the end of the bear market.

The fundamentals are getting stronger — there is a continuous increase of activity in the crypto economy.

MARKET OVERVIEW

November started with the continuation of low volatility and minor price movements — a trend which had originated in September. However, after two weeks of equilibrium, the market began to crack down and the total cryptocurrency market capitalization decreased by 42% in 13 days. In total, the market lost 36.7% of its value in November and it will go down in history as a month with one of the most significant declines in crypto prices.

Solidum 20 Market Cap Weight Index | November 2018 (Source: CoinMarketCap, own calculations)

There are many speculations on the cause of the drop: some point to the Bitcoin Cash hard fork war, others cite weak technical setup, etc. The fact is, nobody knows. There is a myriad of factors which affect the market prices. Michael Moro from Genesis Trading, one of the largest crypto OTC dealers, stated that people who bought cryptocurrencies in early 2017, started selling them in November for the first time. It is also important to note that Bitcoin breached significant support levels in November which is a reminder that we are still firmly in the grip of a bear market. These two factors increased the supply which pushed the prices down.

MEDIA AS A COUNTER INDICATOR

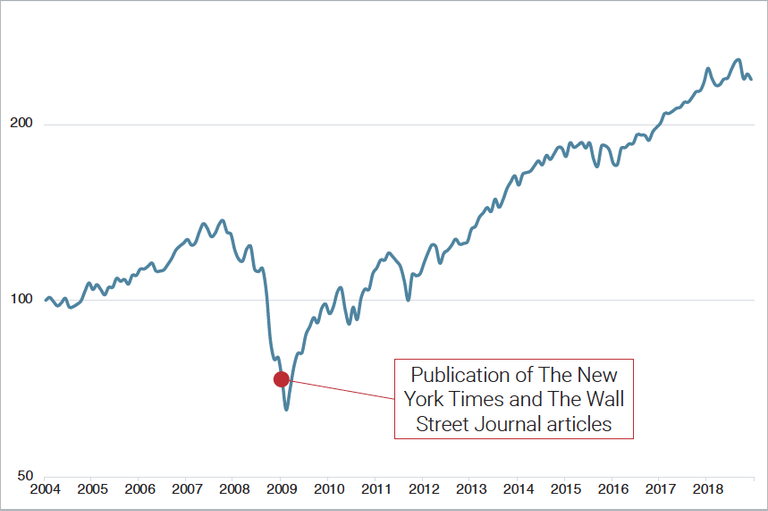

In recent weeks, the mainstream media has been bursting with gloomy articles about blockchain and cryptocurrencies, and the current market sentiment is extremely negative. However, from my experience in the traditional stock markets, this level of negativity usually marks an end of the downturn. For instance, at the end of 2008, when the financial crisis was in full swing, the major newspapers’ front pages were covered with titles like “The End of the Financial World as We Know It” (The New York Times) and “The Weekend That Wall Street Died” (The Wall Street Journal). The sentiment was extremely negative, but this was, in fact, the best time to buy stocks. The nature of news is to distort people’s view of the world, and those who base their investment decisions on the news alone are bound to lose money.

S&P 500 | 1 Jan 2004–30 Nov 2018 (Source: Bloomberg, own calculations)

THE LONG-TERM PERSPECTIVE

It is always important to focus on the fundamentals, and this is particularly true during a negative market sentiment. If we take a closer look, we can see a continuous increase in activity in the crypto economy despite the market situation. Coinbase, one of the world’s leading crypto exchanges, has raised $300 million recently which brings its valuation to $8 billion. Grayscale Investments, the largest crypto asset manager in the world, saw the year-to-date inflows of nearly $330 million, which is 13 times the inflows of the same period in 2017. Both examples clearly demonstrate an increased appetite of the institutional investors, a trend we expect to strengthen in 2019.

There are also many positive developments in different countries which will lead toward a broader adoption of cryptocurrencies. A prominent example is South Korea, where several nation’s largest companies have recently entered the crypto economy and, consequently, now own the top five cryptocurrency exchanges in the country. The latest giant to enter the crypto economy is Shinhan Bank, the country’s second largest bank, with $375 billion in assets. Its entrance brings security, efficiency, and regulatory compliance to the crypto industry. South Korea is emerging as one of the global leaders in the crypto economy.

In the early days of the internet, nobody could have imagined how it would transform our lives in the years to come. We expect the same to happen with blockchain and cryptocurrencies — both will have a significant impact on our society in ways we cannot even imagine today. We firmly believe in the long-term potential of the blockchain technology and the emerging crypto asset class. This is reflected in our investment approach: we build portfolios with a long-term perspective, undisturbed by the market fluctuation.

If you find value in this article, please share it with the community.

Share your thoughts in our Telegram Group and help us ignite an active discussion within the crypto community.

I also regularly share my thoughts on crypto markets on social media. You can find me on Twitter,LinkedIn, Instagram and Facebook.

DISCLAIMER:

This article is for informational and discussion purposes only and does not constitute a marketing message, an investment survey, an investment recommendation, or an investment advice. The article was prepared exclusively for a better understanding of cryptocurrencies and the functioning of the cryptocurrency market.