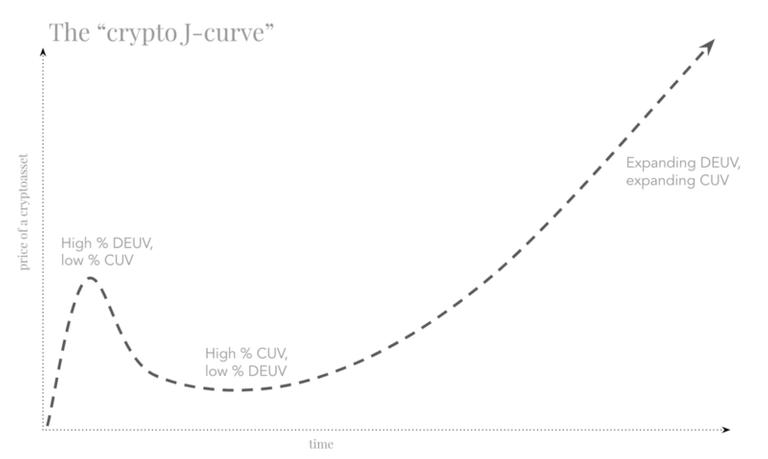

As time progresses, various cryptocoins seem to stick to a specific pattern: the cryptocurrency J-Curve. By applying this notion, investors can time investment entry points and, generally, get a better understanding of the mechanics of the crypto-market.

Today I would like to share an interesting concept developed by Chris Burniske that I first heard about at the Token Regulation Summit in Vienna. The concept is called the Cryptocurrency J-Curve and describes patterns a cryptocoin typically passes through as it evolves.

The boom-bust cycle

As the markets for cryptocurrencies develop we can see many booms and busts as people perceive different levels of utility and enthusiasm to the various cryptocoins.

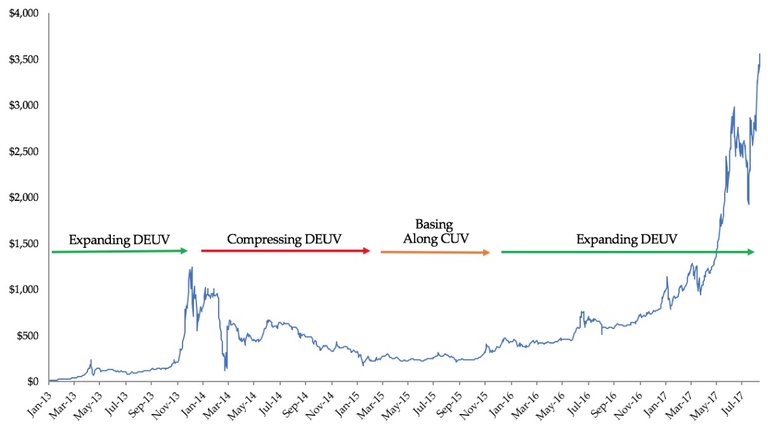

Bitcoin has been through a few boom-bust cycles already, most notably the enthusiasm in late 2013, when bitcoin first broke $1,000, followed by the painful decline that lasted until January 2015 and bitcoin’s bottom at $175. With bitcoin now pushing towards $6,000, up already more than 5x in 2017 alone, we are once again in a period of increasing enthusiasm. For the crypto coins that have actual utility value, this rise and decline pattern will create a price chart that resembles a familiar pattern: the J-curve.

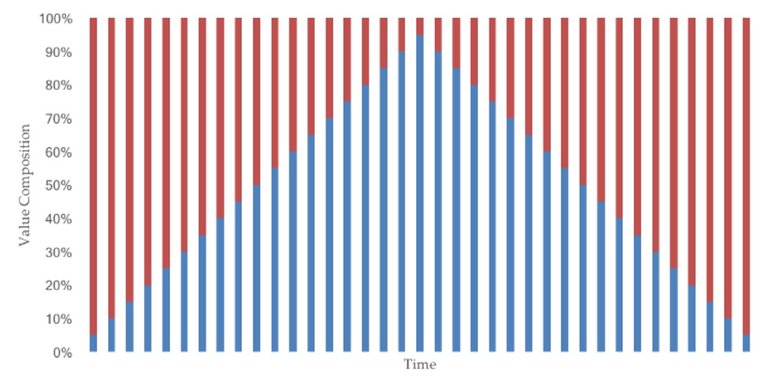

The basic idea of a crypto J-curve stems from how the market values a cryptocoin over time. Burniske argues that a cryptocoin's price is composed of two forms of value: “current utility value” (CUV) and “discounted expected utility value" (DEUV), the latter of which some prefer to call speculative value.

High enthusiasm

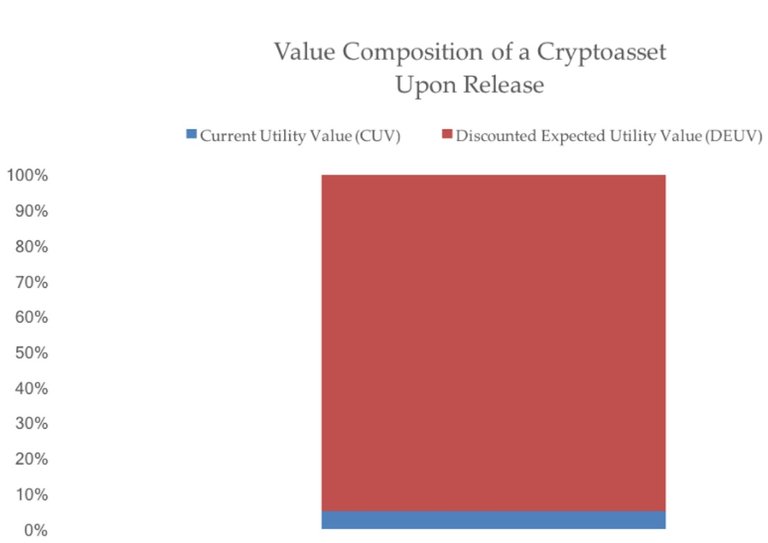

When a specific coin starts trading, enthusiasm for it is usually high, and typically continues to increase for a while. In this period, the CUV of the asset is minimal, or non-existent if there’s no protocol ore alike. The asset is then largely composed of DEUV, and thereby largely exposed to the market forces. This initial period of high enthusiasm is the first (mini) peak of a crypto J-curve, as shown above.

Especially at early stages, it is not uncommon for the value composition of a cryptcoin to look something like the below. Initially inflated price, initially inflated DEUV as people are very enthusiastic about a specific cryptocoin.

Roadblocks on the way to the moon

As the cryptocoin progresses through time, the developer team and cryptonetwork inevitably encounters unforeseen roadblocks. Building distributed systems is hard, and so too is managing the people within them. With such roadblocks market enthusiasm declines, weighing on the DEUV. The compression of the DEUV can be traced back to different factors like:

- The chances of success are deemed to be smaller and thus the asset riskier

- Components of the road map and planned functionality are deemed unrealistic

- New competitors enter the market

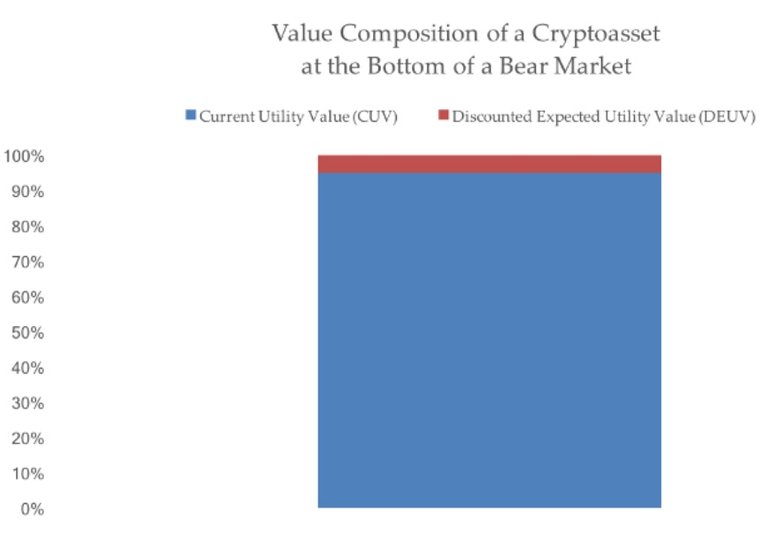

All these factors lead to tough market conditions and hence, speculators start selling off. Eventually, the DEUV gets squeezed, and with little current utility value, the price of the coin gets crushed. Ask any bitcoiner about 2014 — they know what we are talking about!

However, a dedicated developer team will keep their head down and remain indifferent to the forces of the market. As a result, the protocol improves and more users (not speculators) will join which ultimately leads to an increasing CUV. A growing CUV can occur even as the DEUV of the token continues to decline. If the market is bearish enough, the price of the asset may compress DEUV all the way to zero, leaving only CUV, and a drastically diminished price. Potentially, the market may even discount the coin to the point of trading below CUV, somewhat similar to a stock trading below book value.

However, a "die-hard group" of investors hangs on, representing a small piece of the DEUV that once was. This is what happened to bitcoin through the first three quarters of 2015, as it based in the low $200’s. This is the bottom of the crypto J-curve.

Rocket to the moon takes off as utility increases

The curve will start to steepen as investors realize the growing CUV of the asset and hence, attribute more DEUV back the price. The DEUV expands as expectations around future utility value grow based upon the growth in CUV. Shown below is how this pattern can be seen for bitcoin from the start of 2013 to present.

What happens next may varies widely. Ideally, CUV and DEUV will expand in tandem, finding a healthy equilibrium. In strong bull markets, however, often DEUV will start to quickly outpace the growth of CUV. Speculators start to get back in, expanding the DEUV at a speeded-up rate, and divorcing financials from reality. This is why a crypto J-curve typically steepens in its later stages.

At this point, a full cycle has played out. A cryptocoin has gone from being primarily composed of DEUV upon release, falling to the depths of a bear market and basing along CUV support, before once again expanding to be majority composed of DEUV.

The percent composition of a cryptocoins price during this period is shown below. When expectations are initially high, so too is the price, but often largely composed of DEUV. As expectations diminsh, so too does the price, even if CUV grows. Ultimately, as DEUV expands once again, the price of the cryptocoin should exceed its prior high as it is supported by more CUV.

Put it another way, with a higher current utility value, the increase of discounted expected utility value can be greater. Therefore, expect some intense bull markets in the years to come 😊

Ultimately, at steady-state, a cryptocoin should be mostly composed of CUV, with a bit of speculation happening at the margin. At this point, the mid-term J-curve should start to taper, ultimately resembling an S-curve as the years of utility roll on. Of course, this is all theory, so don’t expect perfect patterns in reality. But as long as utility increases over the long-run, we’ll make it to the (full) moon!

I also created a facebook group. In this group people are welcome to share articles and news about blockchain and cryptocurrency and discuss potential investments. Users can also vote on projects they are interested in. I will try to provide an in-depth analysis about the project that received the most votes.

References

The notion of the J-Curve was developed by Chris Burniske. I collected all necessary information and pictures from his webpage: https://medium.com/@cburniske/the-crypto-j-curve-be5fdddafa26

Kind of post I like ! thanks to share this info I never heard about the J-curve but gosh it makes a lot of sense =)

Thx a lot :)

Quite interesting!! Thanks for sharing :)

So based on the information I learned from your article. Could we say that steem is in between the

COMPRESSING DEUV / BASING Along CUV

fase?