If you are looking to invest or trade in the cryptocurrency space, it is important to understand the volatility of bitcoin and other cryptocurrencies.

Volatility measures the variance of the price of a certain cryptocoin within a certain period of time. It is commonly associated with the risk level of the coin, a highly volatile coin is regarded as risky and a less volatile coin as less risky. Therefore, it is important to understand the volatility of bitcoin and other cryptocurrencies if you are looking to invest or trade in the cryptocurrency space.

Why a cryptocurrency is typically volatile it in its infancy

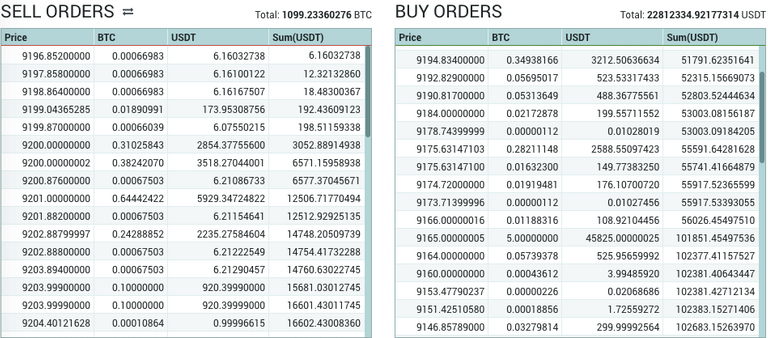

Upon launch, cryptocurrencies tend to be extremely volatile as they operate on a thinly traded market. A thin market refers to the size of the order book, and an order book refers to the list of buys and sells on a particular exchange. To put it in another way: It’s a measure of the number of people wanting to buy and sell at any given moment. The following image of an order book for bitcoin on Poloniex (a widely used cryptocurrency exchange) shows such an order book.

Each order represents one row in the order book. Hence, the more orders there are, the thicker this book. If there are little buys and sells, the order book is deemed to be thin. Having said that, some orders also need to be of sizable amounts. If all the orders represent bids to buy or sell only EUR 1 of the coin, then it does not matter how many orders there are, it will still be a thin order book.

Market liquidity

The thinness of the order book is also called liquidity of the market. A highly liquid market consists of a lot of orders and many of them are likely large. In such a case, a coin can be traded easily. If, however, the market is illiquid, or thin, then sizable price swings with low volume can be observed, as someone trying to buy (or sell) a lot of the coin will fill all the available sell (or buy) orders, which drives the price up (or down). As a consequence, in thin or illiquid markets, when investors are bullish they can drive massive swings to the upside, just as when investors become bearish, strong selling volume can quickly drive the price down.

When a specific cryptocoin is first launched, it has a relatively thin order book because the number of investors is typically smaller, trading is more infrequent, and orders may be small. This may create volatility in the price of a new asset. However, as news of the cryptocurrency spreads, interest will increase as will the trading volume of the coin. The order book will typically get bigger and volatility will often decrease.

A way to deal with volatility

The notion of Dollar cost averaging refers to an investment strategy with the goal of reducing the impact of volatility by avoiding extreme sensitivity to the starting point of investing. As opposed to going all in and dumping all the money into a crypto coin at once, it is often better to divide the total sum to be invested into equal amounts at regular intervals. By doing so, the investor may buy at a coins price peak, but will also – when the market is bearish – be buying all the way to the bottom, ultimately averaging a good price if the underlying crypto coin has long-term potential for capital appreciation.

I created a facebook group. In this group people are welcome to share articles and news about blockchain and cryptocurrency and discuss potential investments. Users can also vote on projects they are interested in. I will try to provide an in-depth analysis about the project that received the most votes.

References: Burniske/Tatar, Cryptoassets: The innovative Investor's Guide to Bitcon and Beyond, 92.

Congratulations @goldfeller! You have received a personal award!

Click on the badge to view your Board of Honor.

Congratulations @goldfeller! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!