As the crypto revolution really gathers pace I’ve noticed among the detractors of Bitcoin and everything blockchain the argument that “Bitcoin has no Intrinsic value”. This seems to be a mantra repeated in comments sections and social media particularly among fans of precious metals. Is this true? Do cryptocurrencies really have NO intrinsic value? Well lets do what very few of these detractors seem to do and take a look at what intrinsic value actually is ......

Definition

intrinsic

adjective

belonging naturally; essential

The intrinsic value of something is said to be the value that a thing has “in itself,” or “for its own sake,”. Many philosophers take intrinsic value to be crucial to a variety of moral judgments.

So the definition of intrinsic value is quite abstract and is something philosophy has taken a great interest in for many years including Plato. Its a shame Plato isn’t around today because it appears many internet trolls seem to be so smart they know exactly what intrinsic value is, maybe he could of learned something!

Putting Philosophy to one side what do we mean by intrinsic value in the context of economics which is what we are discussing here.

According to Investopedia “The intrinsic value is the actual value of a company or an asset based on an underlying perception of its true value including all aspects of the business, in terms of both tangible and intangible factors”

Its very interesting that the word “perception” is used here. Reminds me of the Gordon Gekko quote from Wall Street ...

Most interesting though is the use of the words “tangible and intangible” and I believe this is the vital point. The haters of Crypto believe there is no value in something “intangible” when they talk of intrinsic value this is what they really mean. What they believe is only something “tangible” a material that they can hold in their hand actually has value.

This clearly is complete nonsense , knowledge for one is not material nor are memories or joy or pain or love. Reputation is very important in business and is intangible. So to is intellectual property, brand recognition, ideas, patents and copyright. Elon Musk occupies pretty much the same physiology as the rest of us yet his imagination and entrepreneurship, drive, ambition and intellect have made him successful, meaning the intangible things about him have value. The old soft toy you had as a child or the biscuit barrel your Grandmother left you have no material value to anyone, but the memories attached to those items make them valuable to you. Perception creates value and so does utility and not all utility is physical.

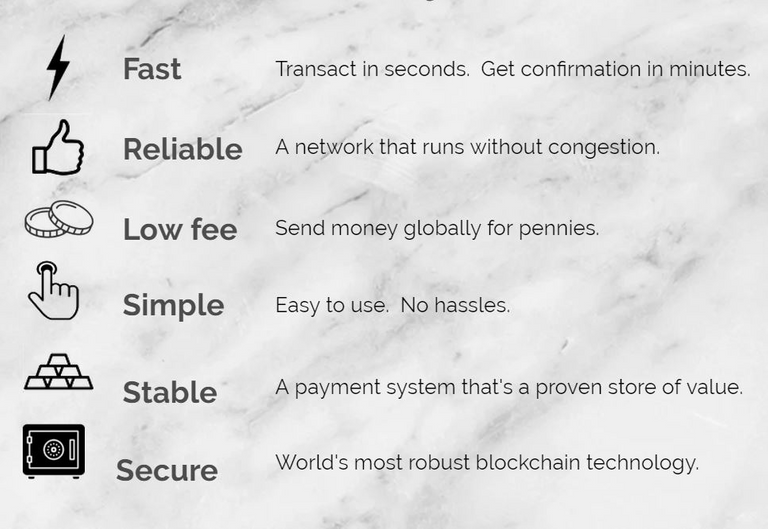

Do any of these people who claim Crypto has no intrinsic value realise we live in the digital age? Staying secure online has value, thats why Mr McAfee is a millionaire and rightly so. So cryptography is of value. The convenience of lightning fast transactions around the globe of course has value in comparison to moving lumps of metal physically around.

Stability has value, Speed has value, Reliability has value and so does simplicity of use. Innovation is valuable ask Zuckerberg about that. Transparency in the public ledger has value too. Most of all though the possibility of a truly decentralised technology has enormous value for us all. Centralised power is the great cancer on this world, rewarding the few while the many get nothing. Decentralising the Internet is going to bring about the biggest leap forward in human development since the Enlightenment .... What could possibly have more intrinsic value than that.

Thanks for this great post. Honestly, I have been researching this topic with many sources, and I don't think any of them made the case about the utility value of digital currencies as well as you did.

Hey thanks for the kind words much appreciated

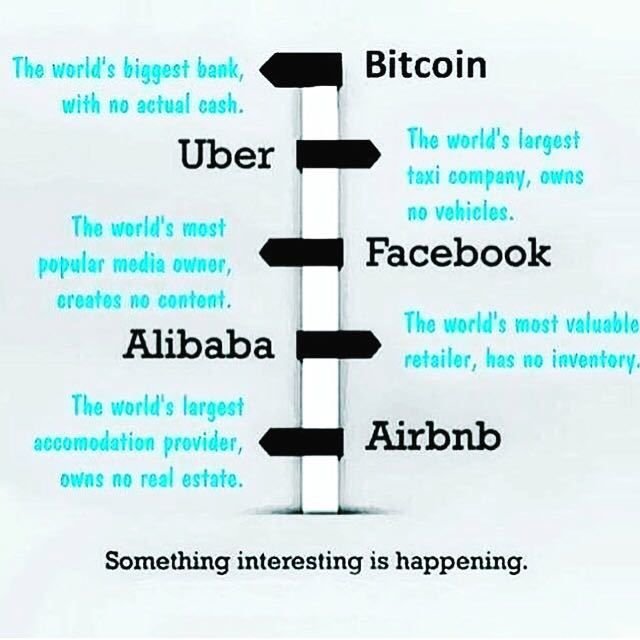

Great post. One thing to notice that all these projects like Uber,BTC,Airbnb have their value in the utility/function they have. Lots of people ignorantly tries to view Cryptos as assets. They are NOT assets. They are more of a function/service. A medium of value transferring doesn't need to have value but function.

This is the reason I'm very vocal against BTC and support Dash, NEM, PIVX, WTC, Monaco, Factom, Sia, MaidSafe etc. They serve a valuable function. Cryptos are all the features of Gold Supercharged and then hypercharged at the cost of tangibility. Cryptos are not real assets; they are real functions.

https://steemit.com/steemit/@vimukthi/we-are-human-asics-steem-ponzi-scheme-explained-debunked

I couldn't agree more my friend, its nice to see someone who has the ability to see that most people attack crypto on 'intrinsic' value when they are really talking about tangibility. Crypto's great utility is that it isn't physical, hence why the internet is a better learning tool in the 21st century than paper books. In the digital age a physical asset has value but a digital asset has far more utility added value. Thanks for your support I've followed you and look forward to communicating with someone on the same page 🙏🏻

See, This is why STEEM isn't a ponzi scheme. We mined some crypto coins while making great friends instead of just burning some electricity trying to have brute force security. I've already followed you. Great to meet you.

Steemit proves to me one of the most important intangible things that has intrinsic value ...... CREATIVITY ..... nice to meet you too, look forward to your contributions and content

Interesting concept.

'Value' seems to be a concept that is becoming 'loose' in the traditional sense. when it comes to digital spheres, value looks strange compared to physical things, but the inner human factors involved seem to be exactly the same. I pondered on this in the following article: https://steemit.com/cryptocurrency/@wekkel/bitcoin-price-is-that-air-you-are-breathing

Yes I agree. i think this is part of a bigger Paradigm too where by the directors of humanity understand we are easier to control when we are forced into a simplistic material view of everything. Many people want to throw words around but rarely investigate the definitions or abstractions of the words. Value is an intriguing concept, it appears to be an agreed upon consensus that could theoretically change in an instant given the perfect storm of circumstances.

Intrinsic value also has elements of supply and demand. Sure, it's a digital currency with all the features you identify, above. What will happen when, instead of moving lumps of metal around, these lumps of metal stay securely stored in the same place, but their tokens are moved around digitally?

I think that's what Bytom is trying to do. They want to connect the atomic world with the digital.

Thank you, @vimukthi :) your positive comments are always appreciated in the spirit of community and sharing

You are welcome!

Your advocating a cryprocurrency backed by metals, therefore you clearly see metals are no match for crypto in everyday use. The flaw in your argument is that crypto is backed by cryptography, backing it with metals is a pointless exercise in my opinion but if you like the extra reassurance these cryptos are available.

Of course value also comes from supply and demand I don't really understand the point your making there? If your saying there is no limited supply of a given cryptocurrency that would be wrong, If your saying their is no demand for cryptocurrency that would be wrong. I didn't go into detail about supply and demand contributing to intrinsic value as I thought this was obvious.

Greetings @gamma-rat, I was talking about value - intrinsic and perceived :)

My reply was in response to your article, above, in which you state, “The convenience of lightning fast transactions around the globe of course has value in comparison to moving lumps of metal physically around. “ I was stating that there was no need to cart it around, it would have its own tokens that could be traded digitally, using blockchain technology, like any cryptocurrency. Value is a subjective notion. There is intrinsic value – that relates to the object itself and would include its utility and perceived value. There is also relative value – is the object valuable in relation to other objects. This gives a standard against which it can be measured and appraised. I am not anti-cryptocurrency, but I do believe that some values have been inflated by their perceived scarcity and difficulty to produce, or “mine”. I watched a fascinating video yesterday, posted by @marketanalysis, and I will post a link to it. In it, Charles Hoskinson suggested that Ethereum was an early-stage project. So many of these new ICOs are emergent ideas. We are pricing ideas – not functioning entities. I also think that this bubble needs to deflate slowly so as not to adversely affect the entire cryptoverse. My worry is that Bitcoin is overinflated because it has been used to finance ICOs, so many Bitcoin owners have amassed enormous fortunes through financing ICOs and this has given them an inflated view of its value, as well as a desire to shore up this value, because their wealth relies on Bitcoin’s continued pre-eminence. The first ICO I bought into accepted Litecoin. In what way does this threaten Bitcoin’s value? I am not anti-cryptocurrency. The main reason Bitcoin has acquired value is because Bitcoin holders have used it to finance ICOs that have made them wealthy beyond their wildest dreams and they can’t send their money back to fiat without having to pay enormous taxes. We have already this morning news that The Wolf of Wall Street is throwing in his 10 cents worth. But his arguments are barely noteworthy.

The link to the video I discuss, here: https://steemit.com/bitcoin/@marketanalysis/video-roger-ver-max-keiser-charles-hoskinson-on-nexus-conference-2017#@katyclark/re-marketanalysis-video-roger-ver-max-keiser-charles-hoskinson-on-nexus-conference-2017-20170927t071223941z

Interestingly, I have earned more fiat speculating in the gold space than in the crypto space over the same time frame (two months), in a ratio of 3:4.

I think that comment says more about your inability to trade crypto than proving your point. Almost everyone in crypto knew for instance that WTC would go up and it went up 800% in the last month. Im not anti gold either Im simply pro-maths and pro-profit.

I don't see myself as a trader :)

Its irrelevant wether your a trader or not, you have stated you made more speculating on PMs than on Crypto in the last two months. This is absolutely no indication that the gold market is more profitable it is simply an indication that you personally have not profited from crypto. Wether gold is more profitable than crypto over the last two months isn't up for discussion the proof is there for all to see in the figures. If your not capitalising on that then thats your choice and i wish you all the best but your experience is by far and away the exception not the rule :)

Its irrelevant wether your a trader or not, you have stated you made more speculating on PMs than on Crypto in the last two months. This is absolutely no indication that the gold market is more profitable it is simply an indication that you personally have not profited from crypto. Wether gold is more profitable than crypto over the last two months isn't up for discussion the proof is there for all to see in the figures. If your not capitalising on that then thats your choice and i wish you all the best but your experience is by far and away the exception not the rule :)

Congratulations @gamma-rat! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP