The price of Bitcoin has fallen a stomach-wrenching 64.5% since December 17, 2017. The combined market capitalization of the industry now stands at just $338 billion. That’s a big drop for any market. However, a price crash in Bitcoin or any other cryptocurrency is nothing new. Bitcoin dies and comes back to life on a regular basis. One website estimates Bitcoin’s death toll stands at 249 and counting, dating back to 2010. 2017 has been the most deadly with 109 stories proclaiming the end of bitcoin. What’s Causing The BitcoinCrash? A whole slew of bad news has led to a huge downturn in the crypto economy.

.gif)

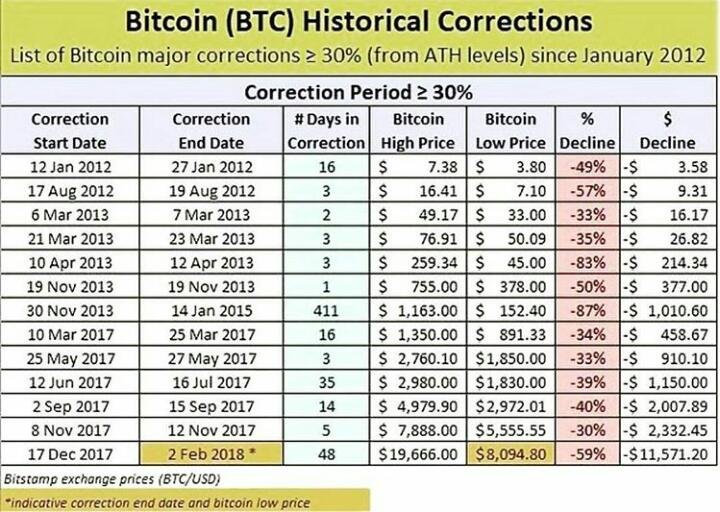

Estimates hint that $3.5 billion in transactions has found its way through India in the last 17 months leading into 2018. And then there is South Korea. The country has no intention to ban cryptocurrency trading outright. But the government has taken steps to remove anonymity from the equation. South Korean traders must now use their real names. All of this has contributed to the crypto bloodbath. By the way. The Dow Jones Industrial Average just hit a three-week low thanks to rising US government bond yields. It’s not just the crypto market that’s feeling the burn. So is the fiat world. Finding Rock Bottom Even most beginner investors are aware of the old adage ‘buy low, sell high’. The question is, when will low be low enough? The truth is no one really knows. Looking at the above chart, Bitcoin’s worst crash lasted 411 days, ending in January of 2015. The nose dive sent bitcoin’s price plummeting 87%. As of today, the price is down 64.5% in just the last 51 days.

Bitfinex is drawing the ire of the US Commodity Futures Trading Commission because the exchange site offers users an option to tether their currency to the American dollar. The suspicious thing about that is neither Bitfinex nor Tether can necessarily prove they have enough money in bank accounts to back up the USDT token. Overseas, India is cracking down on traders. The country’s government is surveying transactions on multiple exchanges in order to try and collect tax revenue.

Price Predictions

American government handing out subprime mortgages to consumers who couldn’t afford to pay for the homes they were living in. In the case of cryptocurrency, increased regulation is the reason for the crash. That’s definitely bad news for short-term investors. Those bullish on the long-run however see regulation as a necessary step in the continuing fight to legitimize cryptocurrency and bring it further into the land of mass adoption.

Good information & nice post.... @gajanan-wankhede

Most welcome.gif) @steemjohncrypto

@steemjohncrypto