GOOD AFTERNOON STEEMIT,

Crypto is often once touted as a type of digital gold, or store of value that should see money sheltering from exposure to risk assets during times of market turmoil. But with crypto markets being a relatively new phenomenon, we really don’t know the full extent of their market correlations and whether this is actually the case when scenarios start to actually play out.

One current scenario that is playing out right now, is the phenomenon of a stock market sell off. Now if you’re a young trader who has come into the market post GFC, you really haven’t had a chance to experience this sort of price action. Now remember that crypto markets were born out of the GFC’s ashes so if you haven’t experienced a stock market plunge, then nether have crypto markets themselves.

To fuel the economic recovery after the GFC, central banks globally, led by the US Federal Reserve, have been slashing interest rates and keeping the printing presses working on overdrive. All this has meant that there has been a ton of free money available to business’ and investors to literally borrow and invest straight into stocks for an instant higher return.

This free money has literally been a drug and everyone has enjoyed getting high off it, especially the stock market itself which has literally gone parabolic vertical. But as we are endlessly told in crypto (by financial experts who are balls deep in stocks fuelled by the free money drug mind you), the party can’t last forever.

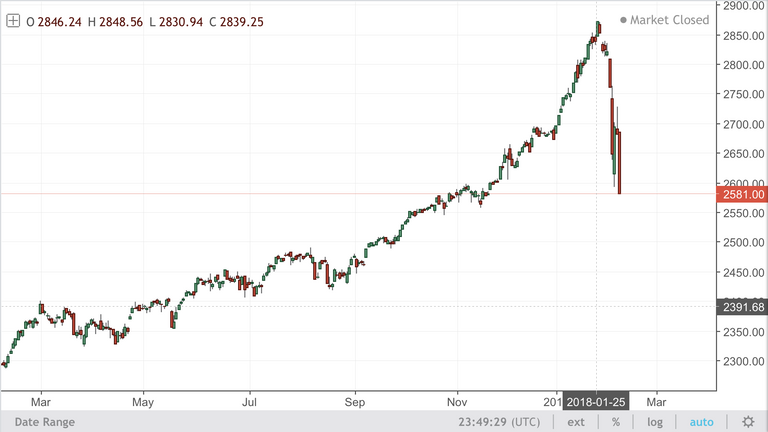

With the Federal Reserve now forced into an interest rate hiking cycle and looking like continuing at a higher pace than expected through 2018, it looks like the party has now officially come to an end. Just take a look at the S&P 500 stock market index:

S&P 500 Daily

Yep, that’s not a good look...

But now back to our original question, what is the correlation between crypto markets and the stock market? The answer? We really don’t know yet!

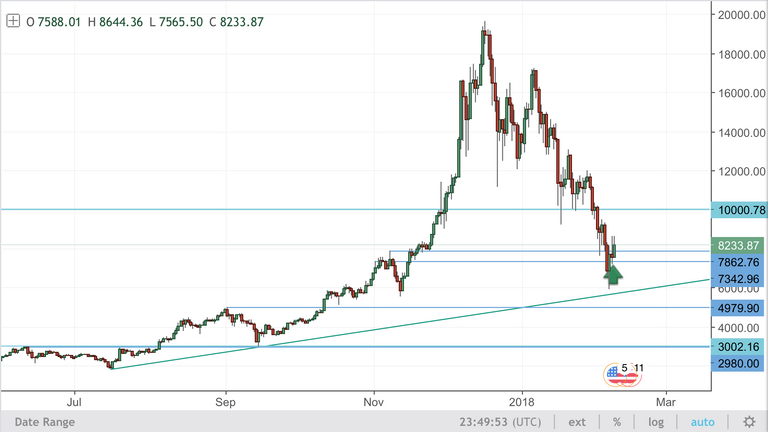

Take a look at the Bitcoin daily chart and let’s compare some candles:

BTC/USD Daily

As you can see on the above chart, Bitcoin initially fell with the first big stock market dump. But since then, the cryptocurrency has found major trend line support and is now heading in the opposite direction to the still dumping stock market.

This is a great sign for Bitcoin and crypto markets as a whole. If support has held like this and in the midst of a stock market dump, we’re seeing money flow into Bitcoin as a safe haven, then the correlation might finally be sorting its self out. An exciting market development!

Best of probabilities to you.

Peace ✌🏻.

Instagram: @forexbrokr

Website: www.forexbrokr.com

The big question is how many margin traders have been speculating in the stock market....are also crypto holders. If they get margin called they may need to liquidate cryptos to raise cash.

Hmm that’s an interesting way of looking at it. But you can say the same for any of the risk on assets too.

Absolutely. I wrote a little bit about it this week in my post about why Gold Dumped in the 2008 Credit Crunch if you're interested.

I am, cheers for giving me the heads up!

.... and the mainstream media continues its attempts at putting the fear of God into everyone about cryptos.

This has been the main headline on smh.com.au for most of today ... "Get ready for most cryptocurrencies to hit zero: Goldman".

It's only just been replaced now with "Everything's a sell in China after $848 billion wipeout"

The funny thing is, I'm sure I read that very same article about Goldman's Steve Strongin predicting cryptos going to zero a day or two ago. So, today's headline is actually old news.

The major investment banks and centralised governments like China are exactly the same. They don’t want to lose the control they have, so will do everything to keep crypto out.

The louder these voices get, the more you know that they’re losing control. This is a good thing 😎.

Great info brother!

Cheers mate!

Indeed, crypto market is going through much needed correction from 2017 bull run. Its only matter of time when this bugger starts rallying.

Patience my friend. Patience 😇.

Dear Mr. ForexBrokr.... You inspired me to start posting about precious metals. Here is my first one:

https://steemit.com/preciousmetals/@zetetrahedron369/favorite-places-to-get-gold-and-silver-bullion

Thanks for the heads up :)