You could think of an ICO as the "IPO of cryptocurrency", understanding an IPO as the first time a stock of a company is offered to the public, with it the smaller or younger companies try to raise capital being the main objective to expand. It is also used by larger private firms trying to be traded publicly. Until this point is pretty much the same, but here is when everything starts to get tricky.

The greatest difference between both tools is the underlying asset that you're trying to get, in an IPO the underlying asset is a share of the company while in the ICO the asset you get is a token of a cryptocurrency, this is a big difference because of what implies; when you participate of an IPO you get to own a piece of that company and you have the right to vote and the right to have a participation in the profits while in the ICO what you're getting is the token of cryptocurrency that is going to be used in the future in the platform, DApp or ecosystem.

The entire business model of a company trying to raise funds of an ICO relies of that cryptocurrency as an intrinsic part of it, but you need to have clear that most of the times the capital appreciation you're getting is not because the core value of the company or necessarily the fundamentals of it but the success or failure of the project they're developing.

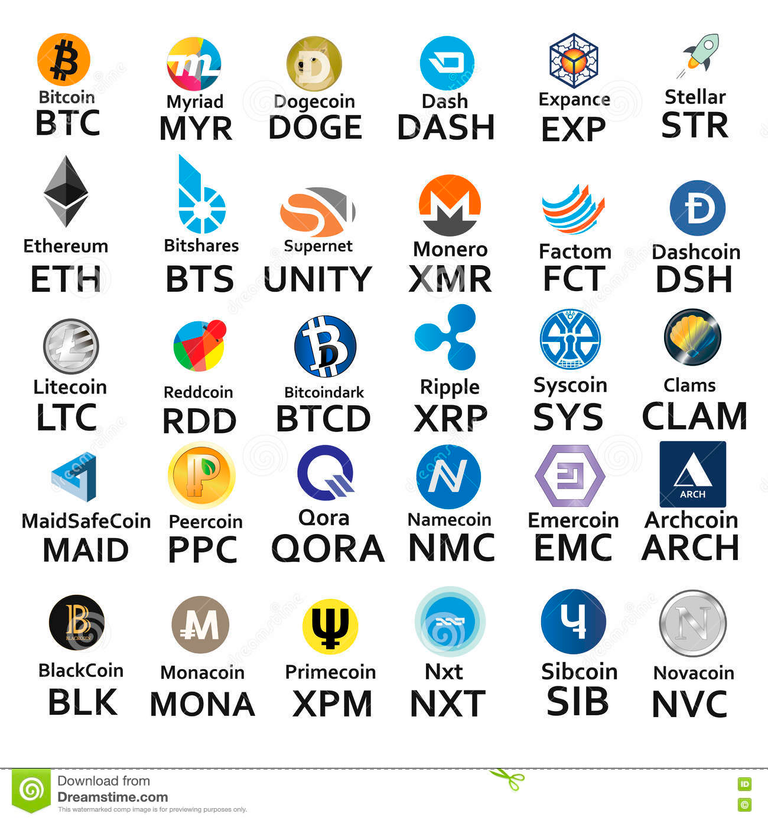

But, can you really profit of an ICO? the answer is that depends, most of the top cryptocurrencies started with an ICO with prices of cents of the dollar, raising an average of a couple dozens of millions of USD at first but now with a market cap of hundreds of dollars, this is the case of golem, augur, ethereum and even bitcoin. But not every project is a success and not every token get to capitalize in the market. The important thing here is the time that you're willing to hold those tokens, because as i said before what you're buying is the fuel of the project under construction, ergo the assets acquired in an ICO are supposed to be held for a long run, that's because the entrepeneurs are not looking to raise funds that can be easily erased by the market in any minute.

The way i see it, if you're looking to participate in an ICO, learn everything you can about the project, invest in those that you really believe is going to succeed, try to secure some profit when you can and hold the rest until the core of the project is fully developed, there's when you can REALLY profit.

Finally, i'd appreciate any opinions or comments as i'm just learning from the matter.

Prices usually dump after the ICO hype. It's risky to profit from there, plus you have the risk of losing your investment if it's some shady ICO. There's no regulations yet.

I hope there never is regulation. That means government. people need to due their own due diligence.

True.

And they would start ripping you on taxes, i think that part of the value of the projects developed on blockchain technology relies just in the fact that's unregulated and decentralized.

This is good advice for a rookie like myself ! Well written

I started looking into these ICO's as i noticed a lot of people are just buying them without knowing anything. I started discussing 1 ICO a day. As I am sure some people would be concerned if they knew 41% of all tokens would only go to the people participating in the ICO or if 8.5% would directly be transferred to another company also owned by the founders.

Exactly, some people believe that is a sure thing just because you're buying cheap when really what they're buying is totally worthless.

Using irrelevant tags, especially popular tags, makes it hard to find good and relevant content.

Please try to use only relevant tags when posting!

#steemit

Please only use the “steemit” tag for articles distinctly related to Steemit, the website, itself.

It is related, not the main idea but totally related, steemit is based on a token whose purpose is not for the short term because of the inflation and exactly because of the reasons i described (according to your white paper).

Appreciate the advice though