What’s Vena Network?

This aims to create a decentralized digital asset financing and exchange network through Vena Protocol. Thera are two layers: they are Basic protocol layer, which mainly includes registration, configuration, routing, and management of upper layer financial businesses And The asset protocol layer, based on assets, completes user-defined financial businesses through the implementation of the terms contract interfaces.terms of pledge and repayment can be written into terms contract to make collateral loan; inheriting of ERC721 standard realizes value-added pledge for asset portfolio; injecting on-chain and off-chain data to achieve open and transparent credit. In Vena Ecosystem,

The Vena Protocol is a set of design and description specifications that are compatible for deployment on any blockchain network that supports smart contract platforms. Since the various public chains are heterogeneous and the differentiation characteristics are obvious, the Vena protocol will do more adaptation and performance optimization for specific public chains under the principle of maintaining the uniformity of the protocol itself to fit the chain. In the future, when more public chains become the growth soil of the Vena protocol, we will implement the Vena business dispatching system in the upper layer of the protocol, that is, the business traffic probes are buried on the public chain that has already deployed the Vena protocol, and then the distribution of traffic is uniformly scheduled to alleviate the congestion of blockchain network transactions.

The smart contract can resolve disputes by controlling transactions on the chain, but it cannot control transactions under the chain. The network of jurors is used to handle situations which cannot be judged by the smart contract and submit the results to the smart contract. When users apply for arbitration during the transaction, the juror network will initiate. The network of jurors is designed to establish a decentralized dispute resolution mechanism through economic incentives, avoiding absolute trust from a single arbitral institution and thereby providing a higher degree of security. The full set of The arbitration software runs on the infrastructure built by Ethereum and IPFS. Through a simple user interface, the juror can easily receive the evidence submitted by the parties to the dispute and arbitrate. All records for arbitration will be permanently stored on the Ethereum blockchain. All tamper-proof cryptographic evidence (generated by PageSigner) will be permanently stored in the nodes of the IPFS network.

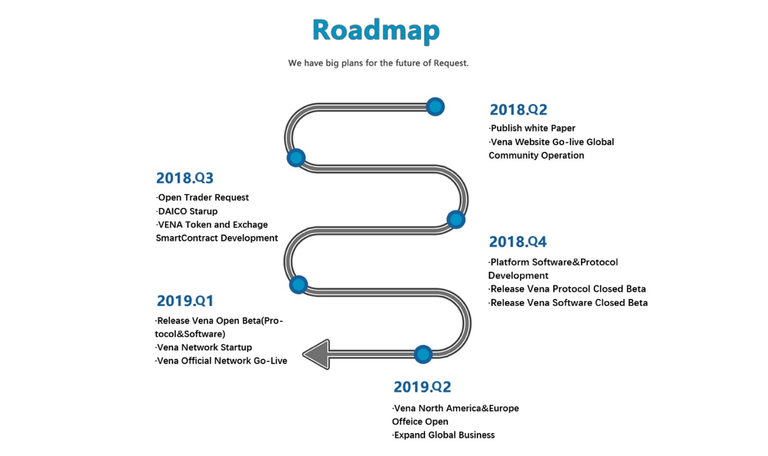

It guarantees that the underlying interface can be The freely defined, while providing a contract standard library including debt class (debt financing, credit, collateral loan) and transaction class, helping users build an interactive, fast, convenient and secure Financial DApp (Decentralized Application).The protocol itself is a set of design and description specifications that is compatible with any block chain network that supports smart contract platforms and breaks through the “Information Island Predicament” via cross-chain technology which, according to the Vena team, will fully allow the protocol ecosystem to prosper. Governance and impartiality “From its inception, Vena Network fully absorbed the principles of market competition, resource composition and distribution,” explained a company representative. This covers the methods of compensation of different roles in the Vena Network and the value-added collateral of NFT (non fungible tokens) asset portfolio and etc., improving operability for lending and trading activities built on protocol. the same time,Establishment of fiat-to-cryptocurrency exchange channel gives rise to a decentralized jury network for arbitrating off-chain trade disputes, and uses VENA token as an economic incentive to guarantee the fairness of the network.VENA Network guarantees that they will have zero partiality towards any party of the protocol, and no fees are to be charged by the protocol itself. According to their plan, A Decentralized Autonomous Organization (DAO) will be responsible for upgrading, safety, and compatibility of the protocol, while the ENS to the contract address mapping will make access and upgrade to smart contracts accessible and user-friendly. In essence, VENA Network aims to build an open standard and cornerstone for a global digital asset financing and exchange network. The team, the funders, and what’s next The project is based in Chengdu, China, with total 18 team members. The product development team is composed of 11 people in total, including the senior block chain engineer Jeremy Lan, a PhD from NUS block chain lab, contributors from R3 Corda Ledger, and an operations team in Singapore. Investors include LD Capital, Homerun Capital, Phoneixfin Fund, Mars Financial Ecological Investment Fund, Higgs Capital, Block Chain Fund (Australia), New do Venture, Byte Capital, Future Global Capital, Fire blue Capital and VRF Capital.VENA Network completed its cornerstone funding in late June and the project is currently in development. Vena’s first cryptocurrency collateral loan super node is expected to be launched at the end of July and VENA Network will have a global meetup on the 24th of July. Its private sale financing round will be carried out after the first-generation product is launched.

Website : https://vena.network/en

Twitter : https://twitter.com/VenaProtocol

Facebook : https://www.facebook.com/Vena-Network-207271413455484/

Telegram : https://t.me/vena_network

Github : https://github.com/venanetwork

Username: dinubult

Bitcointalk Profile Url: https://bitcointalk.org/index.php?action=profile;u=1564734