The revolution of cryptocurrency is amazingly spreading like wide fire and has been gaining a remarkable level of acceptance.

INTRODUCTION:

A cryptocurrency (or crypto currency) is a digital asset designed to work as a medium of exchange that uses strong cryptography to secure financial transactions, control the creation of additional units, and verify the transfer of assets. Cryptocurrencies are a kind of alternative currency and digital currency (of which virtual currency is a subset). Cryptocurrencies use decentralized control as opposed to centralized digital currency and central banking systems.

While this revolution is gaining wide acceptance Bitex, a decentralized platform that aims to be the first global crypto ban which enables consumers and merchants convert local fiat currency into over 500 currencies at reduced rate and quickly has arrived.

Bitex is a decentralized platform that aims to be the first global crypto ban which enables consumers and merchants convert local fiat currency into over 500 currencies at reduced rate and quickly. The platform also offers users the opportunity to have their own personalized wallets and private keys that will not be shared with the platform. The goal is to avoid volatility of the cryptocurrency market to enable users have the exact amount they requested. Furthermore, users have access to personal loans and their crypto will be used as collateral which will be given back immediately the loan is paid back.

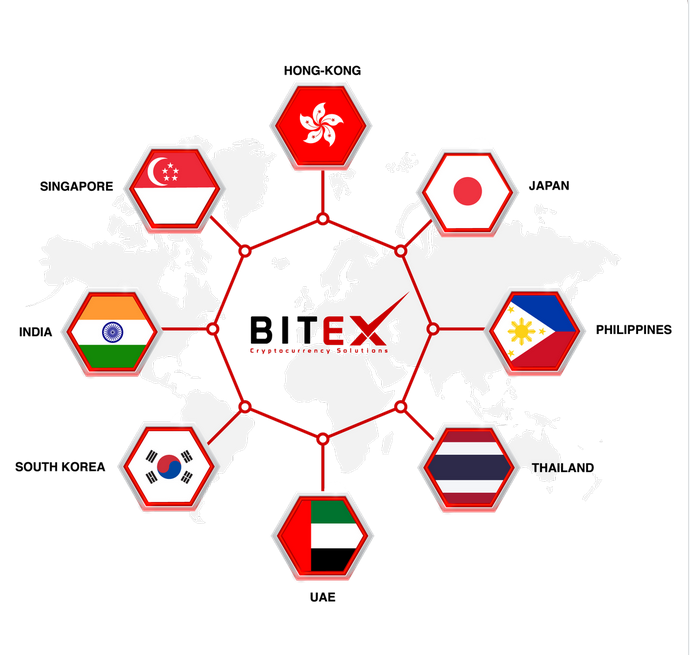

BITEX will provide hyper-localized crypto-banking services through their global platform to promote efficient growth across multiple continents, focusing predominantly on Asia. Cultures differ in their banking preferences - a localized strategy allows for more focused and calculated decision making.

The Bitex crypto-banking solution is created to benefit those that are poorly or not served by traditional banking system. This new cryptobank will re-establish the very purpose for which a bank was created in the first place (an institution that helps the economy function and grow by providing a way to manage savings, provide means for payments and money transfer, and facilitate loans). The Bitex has identified the Asian and Middle East markets as they are growing and, from notice, need a robust cryptocurrency based financial system. It is thought that, the impact of the Bitex platform will be best demonstrated in these markets.

We’re taking the sociable attributes that banks offer, such as community partnerships and building a local presence and combining them with the benefits and the efficiency that a decentralized blockchain provides.

THE BITEX BLOCKCHAIN CRYPTOCURRENCY SOLUTIONS

The component of shock always emerges in each task. it makes the specialty and main issue of availability. Bitex is a network impactful bank meeting its reality worldwide money related network effectively. This "propounds the tasks and hyper-localized"(ico.bitex.global) for an all around characterized digital money saving money activities. The simplification is to make a dependable framework and adjust for clear ideological develop inciting and advancing blockchain keeping money development. This earnestly keeps up the effectiveness, adequacy and beneficial nature of the Bitex activities including the blockchain.

The reality of the matter is that societies vary, as is inclination. This additionally implies the selections of networks on their monetary dealings is molded in an unexpected way. Along these lines, bitex plans to connect this hole and make a fit connection for managing an account tasks progressively however reliant on blockchain selection instrument and frameworks. In this manner, Bitex will saddle all managing an account activities and make its vital nearness following the inclination of its locale in a more straightforward, adaptable, essential and kept up central occasion by and large. Besides, Bitex will give all required saving money administrations of installments tasks, exchanging, withdrawals, stores and advances by and large with the compelling influence of digital money structures. Bitex is one of a kind in the entirety of its keeping money outlines and hubs.

SERVICES OFFERED

• A decentralized, distributed and immutable ledger which cannot be affected by any single point of failure or compromise.

• A global scale, unhampered by national boundaries, although subject to national/local laws pertaining to banking and finance.

• The ability to conduct escrow payments through cryptography rather than traditional, time consuming payment methods.

• The ability to carry out pseudonymous transactions between parties where trust is captured through cryptographic means rather than written contracts or external supervision.

• Include cryptocurrencies as equal partners to fiat currencies in transactions between individuals, individuals and businesses, and between businesses.

FEATURES

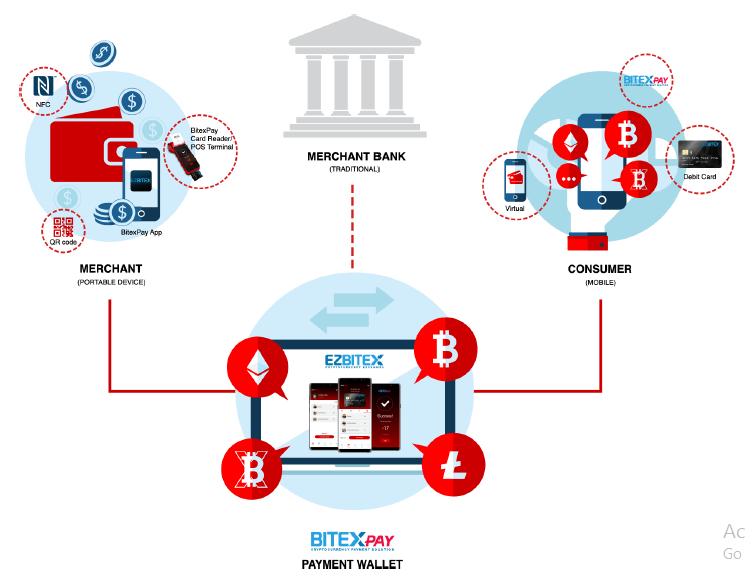

• EZBitex: the currency exchange and banking infrastructure with a decentralized, distributed and immutable ledger provided by Bitex, which underpins the functioning of the entire system

• BitexPay: the next generation payment solution for both consumers and merchants.

Knowing fully well that Bitex is precise in all its banking designs and nodes, This emphatically maintains the efficiency, efficacy and effective nature of the bitex operations related to the blockchain. Blockchain-based solutions built on Ethereum, using public distributed ledgers, cryptotokens and smart contracts offer participants a means of creating value through trusted and transparent interactions on a global scale. This structure is particularly suited for the creation of a banking platform. Hence, bitex hopes to bridge this gap and create a harmonized link for banking operations dynamically but dependent on blockchain adoption mechanism and systems. As a result, bitex will harness all banking operations and create its strategic presence following the preference of its community in a more transparent, scalable, quintessential and maintained focal example commonly. Furthermore, bitex will offer all wanted banking offerings of bills operations, buying and selling, withdrawals, deposits and loans in maximum cases with the powerful strength of cryptocurrency frameworks.

TRADING ON EZBitex PLATFORM

Consumers that wish to trade in cryptocurrencies using the crypto-exchange services of the EZBitex platform will populate a Trading Wallet associated with their account. The crypto assets in this wallet can be used for various orders for margin trading, limit trading, leverage, etc. Consumers participating in trading will pay trading fees denominated in each cryptocurrency they sell whereas for fiat currency the fees will be converted into XBX tokens at the current market price on the EZBitex exchange automatically.

The EZBitex platform will offer APIs to key functions of its global platform to allow developers to create local banking applications. To this end, Bitex will provide the following resources:

● The Bitex Open API will allow local merchants to implement BitexPay and “Powered by Bitex” applications that are tuned to local needs (e.g., language support);

● A Bitex Marketplace where various merchant applications developed through the Bitex Open API are available to other merchants;

● A Bitex Developer Program that encourages local developers to work with local merchants to bring novel applications to the Bitex marketplace

THE BENEFITS

CONSUMERS

The Bitex crypto-banking solution requires consumers to maintain their own crypto wallets (the Holding Wallet) on their mobile devices. No private keys for this wallet are shared with the EzBitex platform. A truly decentralized way of storing the other customer wallets (Payment Wallet, Trading Wallet, etc.) on the Bitex platform and using the platform only when needed will allow Bitex to ensure that customer assets are safe from hacking or other attacks. Alongside with this, Bitex will encrypt development source code as well as use PCI Standard Certification for security in the near future.

A personal, mobile wallet makes the Bitex crypto-banking solution widely available, as recent studies show that mobile penetration is widespread throughout the world and allows a greater percentage of the population in under-developed countries to participate in financial transactions than have access to conventional banking services.

By maintaining control over one’s wallet, and sharing only certain amounts deliberately with Bitex for various purposes such as purchases or transfers, consumers will not have their entire crypto assets under the control of a centralized entity (as is the case with current crypto-exchanges) with all the security risks that it entails.

Consumers will not arbitrarily or capriciously be denied the ability to purchase cryptocurrencies in any exchange using credit cards offered by third parties that are “Powered by Bitex” or their BitexPay debit cards. EZBitex as the card processing network will ensure that such transactions are authorized by the card issuer.

MERCHANTS

Merchants have multiple options for receiving payments - via a mobile EZBitexPay app, QR codes, and card readers.

Online merchants can add BitexPay as a payment option to their e-commerce portals.

Again, for simple merchants (such as street vendors) the ubiquitous mobile device can be the merchant’s receiving wallet. There is no need to have a traditional bank account.

GOVERNANCE

Funds raised during the ICO will be governed jointly by the shareholders of the local, licensed companies in each of the countries where Bitex will operate. A local company will be registered in each country where Bitex will operate, with the company obtaining any licenses necessary to operate as a local crypto bank.

Those shareholders that hold greater than 50% of the shares of the local company can vote on the directions to be taken and use of the funds raised in the ICO. A financial audit will be conducted by three or more companies to reassure investors that the funds raised during the ICO are used to develop the crypto-banking infrastructure.

FINANCES

Bitex Global has already raised USD 2,760,000/- through the sale of Bitex franchise licenses to partners in twelve countries. The money raised from local licensees will be used for creating the local infrastructure needed to support the EZBitex banking platform, including registrations, salaries, legal and regulatory aspects, and localization of the software. The money raised during the ICO will be used for developing the common platform that can serve every country, the overall security infrastructure, and the implementation of common peripherals such as ATMs, card readers and kiosks.

Bitex XBX Token - Token Sale and ICO Details

The XBX token is therefore the utility token that allows various stakeholders in the Bitex financial ecosystem to use its offered services.

BITEX is conducting an Initial Coin Offering of its utility token, XBX.

All transactions regardless of the EZBitex platform will require payment of fees in XBX tokens. Such as BitexPay, Bitex Atm, Bitex Debit Card, Powered By Bitex card and so on.

XBX token utilizes a unique design that not only powers the banking infrastructure but also rewards user loyalty while cultivating a robust developer ecosystem. By developing a mechanism to encourage adoption of the Bitex services, Bitex is able to bring more local services to its users while also increasing the supply of merchants.

Bitex

0.55% of XBX token is burned as transaction fees.

32.75% of the transaction fees collected will be used to provide a discount to consumers staking XBX tokens on their own transaction fees.

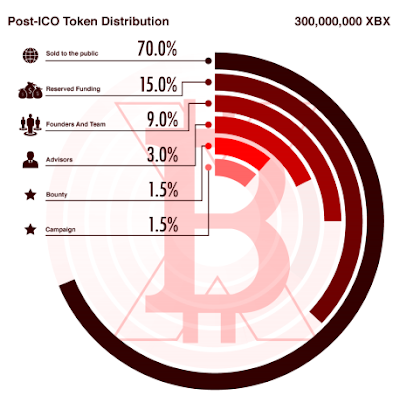

TOKEN Distribution Model and Economics

70% - Sold to public

15% - Reserved funding

9% - Founders and Team

3% - Advisors

1.5% - Bounty

1.5% - Campaign

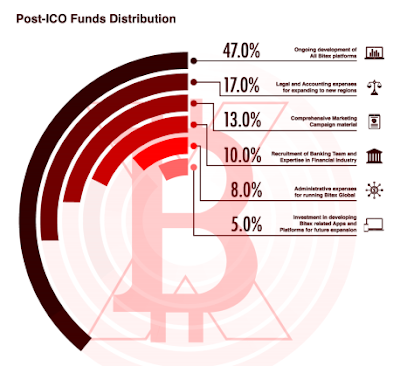

FUNDS DISTRIBUTION

17% - Legal and accounting expenses for expanding to new regions

47% - Ongoing development of all Bitex platforms

13% - Comprehensive marketing campaign material

10% - Recruitment of banking team and expertise in financial industry

5% - Investment in developing Bitex related Apps and platforms for future expansion

8% - Administrative expenses for running Bitex global

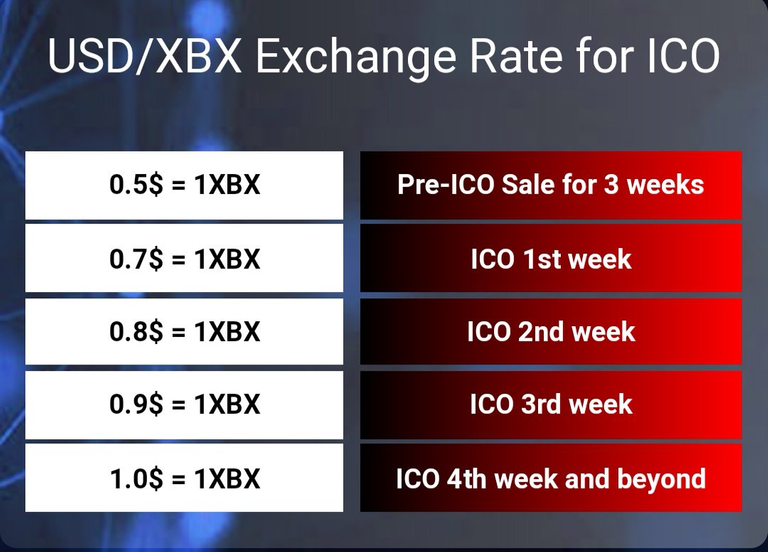

ICO Structure

Symbol: XBX

Token name: Bitex Coin

Total supply: 300,000,000 XBX

Soft-cap: 1,000,000 XBX

Hard-cap: None

Pre-ICO Token price:

0.5$ = 1 XBX

Cost of 1 token XBX:

$0.7 to $1.0 at end of token sale

Term of token sale:

90 days with the possibility of an automatic early completion in pursuing the final goals of ICO.

Expanded goals after start of ICO: Impossible

The technical limitation of the number of tokens: 300,000,000 XBX

Adjustable emission:

The tokens remaining unsold after the pre-ICO and ICO phases will be vested in a Bitex company account controlled by a smart contract. The smart contract will be programmed to release each month to the Bitex community 1⅔ % of the total tokens initially held.

Secured ways to purchase tokens:

XBX tokens will be available for purchase using Ether (ETH), and the following fiat currencies: CHF, EUR, USD, GBP, DKK and SGD and Bitcoins (BTC) will be updated soon.

ROADMAP

Q2 2017: Bitex Business project structure constructed

Q3 2017: Company registration and beginning of development. Work on:

Holding Wallet

XBX Token (ERC20 Protocol)

Trading Wallet and EZBitex platform

Mobile App (Android and iOS)

BitexPay and “Powered by Bitex” software kit

Q2 2018: Beta test and launch

EZBitex Platform V 1.0 with Trading wallet, Payment wallet and the Holding Wallet

Mobile App EZBitex

Upgrade of security structure and support center

Q3 2018: EZBitex Platform V 2.0 with BitexPay and Powered by Bitex & savings Wallet.

Bitex B2B and B2C payment platform and BitexPay Merchant App with GPS locator and BitexPay Merchant App Kiosk

Q4 2018: EZBitex Platform V 3.0 with Loan Wallet

BitexPay Module and POS

BitexPay API key develop and bug testing “Powered by Bitex” card

BitexPay API key release for corporate payments

Q1 2019: EZBitex Platform V 4.0 – API based card and its integration for POS (via Bitex API)

Q2 2019: BitexPay Escrow Account V 5.0 – payment Gateway implementation

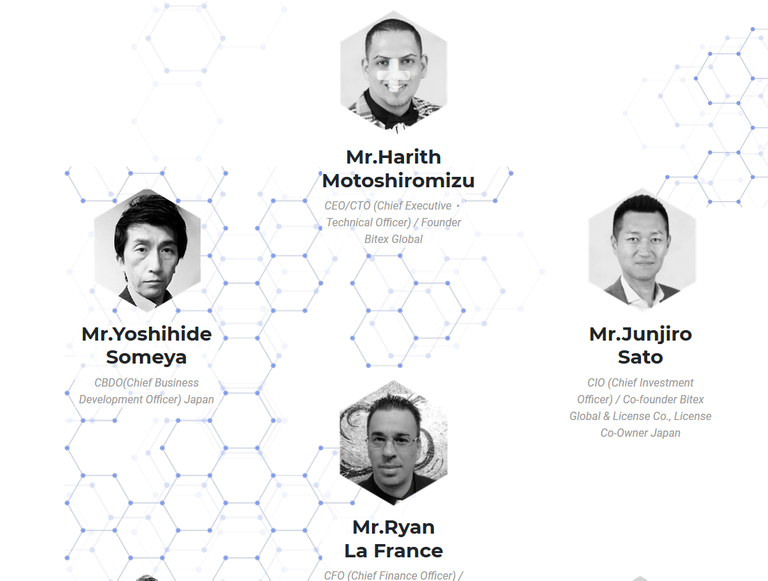

THE TEAM BEHIND THE REVOLUTION

Mr. Harith Motoshiromizu – Founder and CEO, Bitex Global

Mr. Nicolas Louis Laurent Berthoz - Co-founder and CTO, Bitex Global

Mr. Junjiro Sato - Co-founder and CIO, Bitex Global & License Co., Owner Japan

Mr. Ryan La France - Co-founder and CFO, Bitex Global & License Co., Owner Philippines

Mr. Yusuke Asai – CPO

Quentin D. - Web Developer

Raphael T. - Blockchain Developer

Security Manager – Undisclosable (Banking Security Developer)

Raj W. - Technical Project Manager

Shashwat G. - Full Stack Developer

Ankur B. - Backend Developer

Gopal T. - Backend Developer

Gunjan G. - iOS Developer

Daljeet S. - Android Developer

Chandan K. - Sr. Java Web Developer

Neha G. - UI/UX Designer

Anuj B. - UI/UX Designer

Himanshu K. - Blockchain Developer

Aditi N. - Quality Analyst

Palak S. - UI Developer

Please click on the link below For more information:

Website: https://ico.bitex.global/

Whitepaper: https://ico.bitex.global/docs/XBX-Token-WhitePaper.pdf

ANN Thread: https://bitcointalk.org/index.php?topic=3651047

Twitter: https://twitter.com/bitex_global

Telegram: https://t.me/joinchat/IV2i4Q6llH7ttm5n9hqT5g

Facebook : https://www.facebook.com/bitex.global/

Instagram: https://www.instagram.com/bitex.global

Author: Tosin David

My BitcoinTalk Profile: https://bitcointalk.org/index.php?action=profile;u=1180815