A couple of days ago I wrote that to kick off 2018 I'd be posting about my crypto portfolio: https://steemit.com/cryptocurrency/@davidpakman/welcome-to-2018-my-cryptocurrency-portfolio

I'll be posting about each currency I hold in the order I took positions in them. Yesterday's post, the first, was about Bitcoin (BTC): https://steemit.com/cryptocurrency/@davidpakman/my-crypto-portfolio-day-1-bitcoin

Today, I'll talk about the second crypto I bought, Ethereum (ETH). As you can probably already tell, my initial forays into crypto were with the more well known coins.

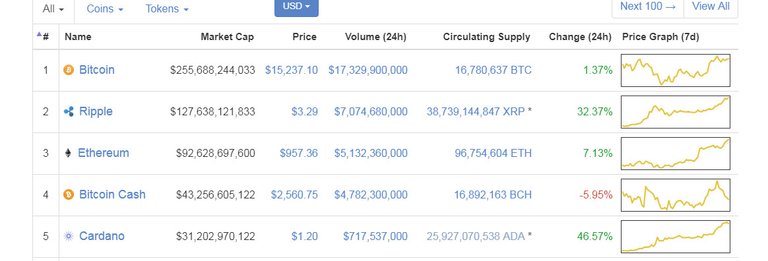

Ethereum was first proposed by Vitalik Buterin, who has become incredibly wealthy, no surprise. Ethereum's market cap is currently third, as of today.

Initially, my interest in ETH when I owned ONLY BTC at the time was diversification, but in learning about ETH, I've come to realize the underlying technology is tremendous, and that's part of the reason why it is serving as the platform for numerous ICOs. In recent days, ETH has also had a record run-up

Arguably the biggest difference, as I understand it, between BTC and ETH is that rather than mining Bitcoin, in the ETH blockchain, miners work to earn Ether, which us a token that sort of serves as "gasoline" for the network. Although the technical aspects of this start to get beyond my expertise, Ethereum has the significant appeal of being able to be used in building Decentralized Autonomous Organization (DAO), which in and of themselves are decentralized with no specific person in charge.

Although I am experience even LOWER transactions fees and times with Litecoin (LTC) than with ETH, ETH is functioning in my personal experience much more quickly and cheaply than yesterday's coin, BTC.

Currently, ETH represents about 16% of my total crypto holdings, surpassing my BTC holdings due to the recent run-up over the last 2 days. What are your thoughts about ETH? Leave them in a reply!

Doing well I just wish I didnt sell off partial of my ETH back when it was $219 ouch but hey made profit from $4 each lol

that's some serious profit

but what do you think about the price of sbd and steem at the beginning of this month?

My understanding of crypto currencies are limited, so I base my desitions on rumors. Which is suboptimal.

Right now, about 60% of my crypto values is in ethereum. I hear that it is a tool that can make transactions and contracts easier to implement in programs. Therefore it seems like a very interesting coin.

I think it was undervalued when the price was 450 dollars concidering its max value had not risen in 1 year.

Ethereum has existed since 2012 and competitors has had a long time to learn from ethereum. I hear that if EOS works as intended, it will be superior to ethereum.

Yes, it's a good goal to have -- I think -- to move beyond making decisions based on rumors.

Doing great man. I remember in 2014 there was really only BTC that I new about and then bam.. ETH and Litecoin blew me away. I bought 1000 Ether at like.$1.20 and spent a few BtC on it... That was big risk for me. I cashed out all but 50eth when it hit $11.00 and spent it traveling Southeast Asia :( wish I would have bought more BTC

If you think Steem is cool, definitely check out EOS!

IOTA of China :-D@davidpakman, how about IOTA next in line? By the way, better do not fall for the alleged

IOTA is on my list, but not next in chronological purchase order...but I will get to it!

You must have gotten some nice gains. Congrats!

My opinion is that this year is the YEAR of ETHEREUM and if all goes well I am expected a price in the vicinity of 10 000$. You might say it is not feasible, but believe me that there will be more adoption on it than in other currencies. When I made my portfolio, while it was not in the begining, ETH sounded pretty good and I've started with it as the MAIN crypto and so far the returns are exponential.

That price seems very reasonable to me, as around 10x growth is actually way smaller than ETH had in 2017. Not to mention so many other coins completely rely on the ETH token technology.

Indeed that is true, but as the price increases the percentage from growth gets smaller. It is easier to step up from 1$ to 3$, rather than from 1000$ to 5000$ but 10X should be a common sense target for 2018 considering that all ICO's are based on ETHEREUM network.

I like it your post..

Please visit to my blog.

Please upvote me

Ethereum extends beyond transactions and in my view is most valued for its smart contract capability.

A great mini-documentary to learn more about it:

A notable quote from the video: "One of the highest ambitions of ethereum from the beginning was that you would actually be able to program the functioning of entire corporations into this global computer. and you would have not just a decentralized currency, but a decentralized company."

You should download Toshi - it's a browser built for the Ethereum network and allows you to explore apps that are built on the blockchain, like Cryptokitties and Leeroy. It demonstrates the tangible capabilities of it, which I am sure will be further demonstrated in the years to come with continued development efforts.

I like ETH as a currency and think of tokens as a "kickstarter" mechanism. It's had some rough patches but I believe it will have a long life and future. The currency aspect needs to be sped up somehow I think, it's not as fast as Litecoin, but it's still good.

Eth is probably my favorite coin so far. I was interested a year ago or more, but I think it was ICO or just unlisted, in general. Then I had to step out of the crypto space because of familial health concerns. Come back in and it's all Moon-splosion.

upvoted

kindly follow and upvote

Thanks https://steemit.com/sport/@lightflower/arsenal-vs-chelsea

ETH is a much better buy at this point. There are so many more uses. If BTC transaction times and speeds are fixed then i might take that statement back

Ethereum has so many technologies relying on it, that it is hard to imagine a scenario where it does not do well this year. It is also interesting to note that this year, they plan to move from a Proof-of-Work model(mining) to a Proof-of-Stake model(dividends for ownership). This should reduce its footprint as far as wasted electricity. People seem on the fence about this change.

What does the change from POW to POS mean for the miners, does that mean they no longer get ether for mining?

I am fairly certain it means that they are killing off mining.

Hmm. So what do ex-miners get for continuing to provide computing power?

I have a similar holding in ETH, but have been hearing a lot about Cardano (ADA) uprooting it.

Cardano is very hot now but will soon fade. It’s only so enticing for people because it is so new. Lisk it the real challenge for Ethereum in the next few years. Keep your eye out for that one.

EOS is another similar project.

excelente post, gracias por al informacion

Gotta love ETH. I sold mine some time ago. Bummer.

As to me switching beteen coins has become my hobby and it is making me welthy as well in a day i make 650% profit by switching coin to coin. But my base coins for transaction are ripple and ETH. AND OFFCOURSE BITCOIN. For me it is an art as well as an economics. By the way i have

And information system msc

I think they are perfect for cryptocurency.

Just a correction Dave...

Currently Ethereum does have miners creating ETH blocks on the Ethereum blockchain just like miners do in Bitcoin. They are rewarded for that with with some new ETH. Just like with Bitcoin they are also paid a fee for the transactions embedded in each block. The fee for each transaction is paid for in "gas" but the gas is ETH too. So they both create blocks and get an ETH block reward, and get paid for processing transactions in each block in "gas" aka ETH.

Some blockchains like NEO have a separate coin or token for their "gas", Ethereum does not.

Some people have mentioned that Ethereum is moving to PoS (Proof of Stake) for mining new blocks. This is a stated goal and will remove the very wasteful PoW (Proof of Work) from the picture. This process is already underway with the Casper FFG project which is introducing PoS into Ethereum to validate some blocks, but not all. Eventually only PoS will be used and miners will be replaced with Casper block producers and validators. Except there won't be 30,000 of them, maybe a thousand or two.

Regardless I would say the main differences between Ethereum and Bitcoin are actually:

Meanwhile Ethereum has the Ethereum Foundation supporting it and Vitalik is a huge part of that. Whatever he says has a huge impact. Miners of Ethereum largely go with the flow and seem to accept whatever the foundation says. The notable exception would be Ethereum Classic where a group of miners didn't agree with the fork to "undo" the DAO contract disaster. ETC is still out there but dying out, currently worth 0.038 ETH.