The release of Bitcoin in 2009 is not an incidental but an essential part of one of the many driving forces behind the explosive growth of value and trust in Bitcoin as well as other cryptocurrencies. Just two years prior, the housing market bubble burst, ushering in with it a global economic collapse of the traditional securities and exchange market. Many economists and social advocates put blame on corporate greed, malice and the market manipulation thereof, calling on an increase in transparency and honesty that many of today’s younger generations rightfully seek. In this I will argue that Bitcoin and other cryptos can in fact be seen as an incredibly powerful hedge against the next collapse of traditional financial markets. It’s also important to realize that although crypto prices presently align themselves well with the likes of S&P and Nasdaq, there really is no way to accurately predict what will happen to the cryptocurrency market as a result of the next financial crash seeing as cryptos are relatively new and have not yet weathered a recession – not enough historic data to make a proper assessment in correlation; if such correlation even exists.

The release of Bitcoin in 2009 is not an incidental but an essential part of one of the many driving forces behind the explosive growth of value and trust in Bitcoin as well as other cryptocurrencies. Just two years prior, the housing market bubble burst, ushering in with it a global economic collapse of the traditional securities and exchange market. Many economists and social advocates put blame on corporate greed, malice and the market manipulation thereof, calling on an increase in transparency and honesty that many of today’s younger generations rightfully seek. In this I will argue that Bitcoin and other cryptos can in fact be seen as an incredibly powerful hedge against the next collapse of traditional financial markets. It’s also important to realize that although crypto prices presently align themselves well with the likes of S&P and Nasdaq, there really is no way to accurately predict what will happen to the cryptocurrency market as a result of the next financial crash seeing as cryptos are relatively new and have not yet weathered a recession – not enough historic data to make a proper assessment in correlation; if such correlation even exists.

The cause behind the next financial crisis will undoubtedly prove to be one of, if not the most crucial determining factor for the crypto market. If we undergo a period of extreme inflation and the value of the US dollar dips to record lows, the probability that more people with lose faith in their fiat-based system is incredibly high and as a result will migrate to cryptocurrency which is a deflationary currency by its very nature. The buying power of the dollar has taken a substantial hit over the past year as evident by the rising gas prices and as further indicated by the US Dollar Index below.

Aside from the dangers of hyperinflation, the alternative crisis can take the form of a stock-market crash. According to Matt Lee from Investopedia…

If we compare the US Dollar Index (USDX), an index that tracks the value of the U.S. dollar against six other major currencies, and the value of the Dow Jones Industrial Average (DJIA), Nasdaq and S&P 500 over a 20-year period, the correlation coefficient calculated for the USDX versus the DJIA, Nasdaq and S&P 500, is 0.35, 0.39 and 0.38, respectively. Note that all of the coefficients are positive, which means that as the value of the U.S. dollar increases, so do the stock indexes, but only by a certain amount. Notice also that each coefficient is below 0.4, which means that only about 35% to 40% of the stock indexes’ movements are associated with the movement of the U.S. dollar.

The correlation between the US Dollar Index and the stock market is clear and significant. It’s more difficult to say what might happen in the event of a stock market crash as on the one hand people will seek cash liquidity due to heightened market uncertainty, while on the other may look for other means of value store that are known to hold a negative correlation to stock market performance; such as gold.

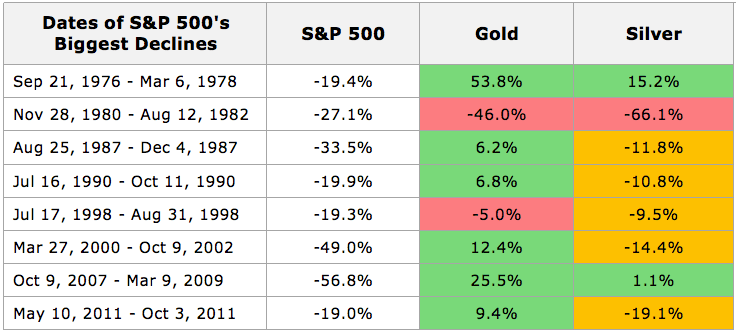

As shown below, gold holds a consistent negative correlation to stock market performance, in particular the S&P 500.

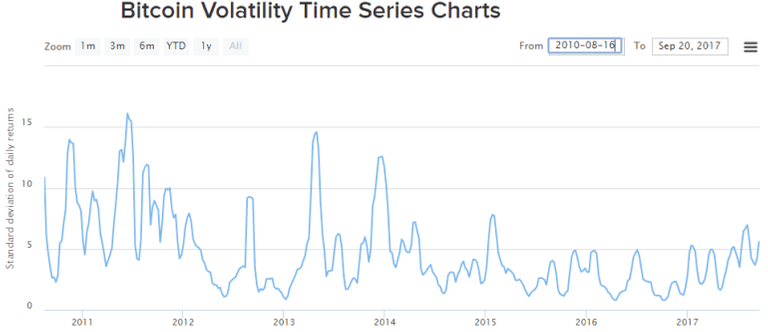

We already know that cryptocurrency is a deflationary mechanism similar to that of gold (limited supply). Therefore I think it’s not unreasonable to expect cryptocurrency to behave in the same manner gold does in an financial downturn. One of the main differences between crypto and gold however is their disparity in volatility. It’s important to note that since crypto has historically been a wildly volatile asset, some will argue that because of the aforementioned disparity, we shouldn’t expect cryptocurrency to be a good hedge against a fiat market crash. While this argument may still hold merit, if we look at the volatility trend of Bitcoin, we’ll see that as the currency matures, its price swings become not only less in volume, but overall frequency as well.

Moreover it also seems that negative news at the macroeconomic level generally comes of net benefit to the cryptocurrency market. Just a few examples include the recent the Cypriot financial crisis in 2012-13, Brexit in 2016 and India’s Central Bank ban on various denomination of their native fiat notes, also in 2016. As a result of these events, Cyprus was the first country to adopt Bitcoin ATMs and the price of Bitcoin today stands stronger than ever before.

As our legacy systems continue to fail more people, we can see two dynamics begin to take shape; increased efficiency and effectiveness of traditional business instruments and the practices thereof, and an overall mass adoption of cryptocurrency – the likes of which we have yet to see.

source - www.cryptoanswers.net

Copying/Pasting full texts is frowned upon by the community.

Some tips to share content and add value:

Repeated copy/paste posts could be considered spam. Spam is discouraged by the community, and may result in action from the cheetah bot.

Creative Commons: If you are posting content under a Creative Commons license, please attribute and link according to the specific license. If you are posting content under CC0 or Public Domain please consider noting that at the end of your post.

If you are actually the original author, please do reply to let us know!

Thank You!

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://cryptoanswers.net/next-financial-collapse/