Hello!

My background is in music and art, not business or tech. I'm no crypto wizard. I'm not a financial adviser or tech guru. I'm just a firm believer in the future of the blockchain technology across a wide spectrum of platforms. I discovered Bitcoin a few years ago as a way to cash out online poker winnings. It was way more efficient than all other options we were left with in the United States after the government essentially made online poker illegal in 2011. Recently I've begun ramping up my investments and want to share some of my thoughts with you, more specifically my current "portfolio roadmap."

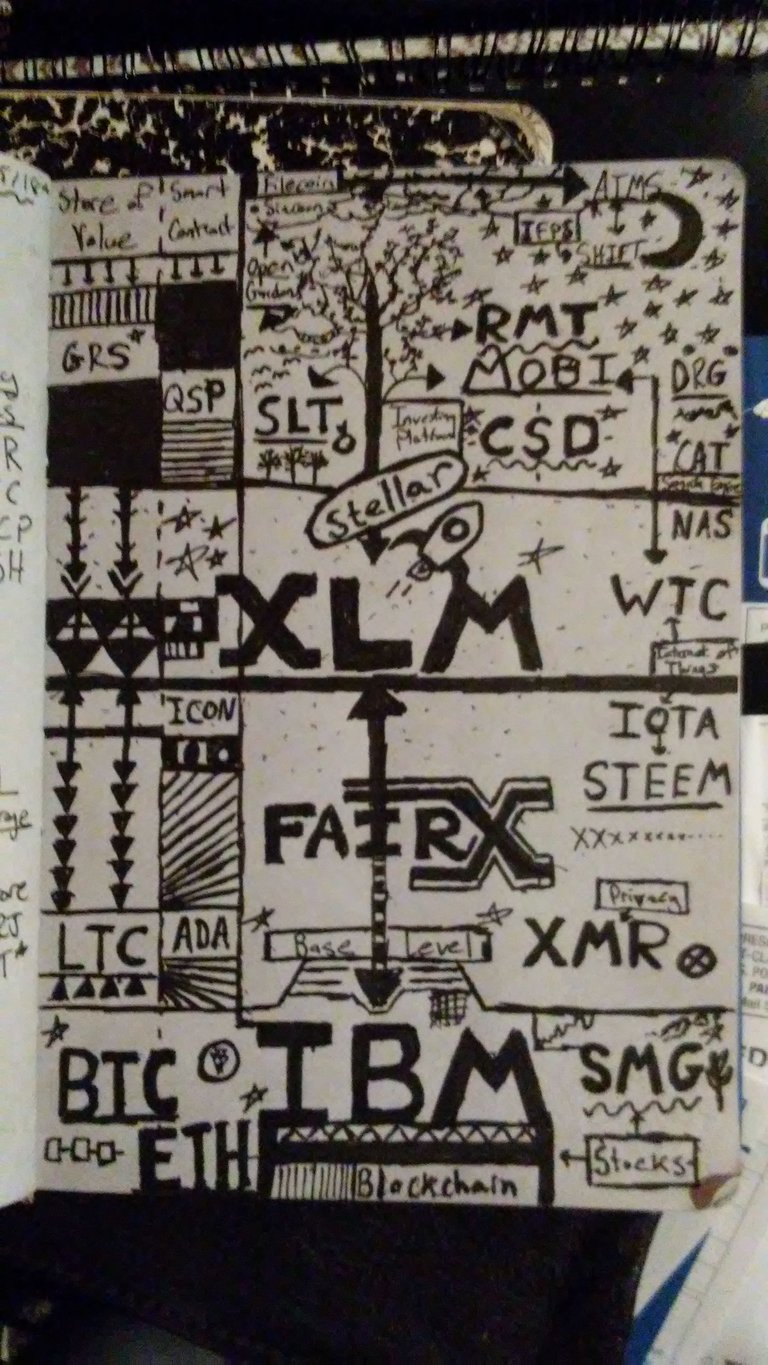

Soooo, here's my "portfolio roadmap" ... basically a glorified doodle

I do one of these "doodles" basically every week. I kind of like having this time-lined picture book, seeing my ideas growing each week. It has been a continuing evolution and I find it quite beneficial. I'd recommend doing something like it. It also gives me a good way to discuss my thinking and specific blockchain interests. There is some organization here that I will try to explain.

First, Cryptos that are bigger, underlined, are in bold, or stared, I have more belief or interest in. I'm sure you notice a few. There is also a tier setup. I have started attempting to create a "safer" base investment, that's at the bottom. There's basically 3 tiers I've made here, with the middle tier kind of being broken into two sections (still a work in progress). The tiers are pretty much by market cap with the top being the lowest market cap, "more risk but more reward" investments. That leaves the middle area as my sort of in between. Most of my money is going into my base investments to attempt to minimize my risk. I'm putting a similar amount in my low market cap investments (slightly less) ... because I like to gamble. There is no one size fits all plan or amount of investment that works for everyone. Do what works best for you, but do give it some thought.

I have grouped things into generalized categories. I've separated value storing coins from smart contract platforms, and tried to tie together coins that share other similarities. Generally, I'm investing in what use-cases I believe have future value, then trying to cover my basis in that particular use-case. Admittedly, this is hard to do. A lot of coins have similar functions but have some sort of redeeming individual qualities that make them hard to group in this way. Yet, it is important to understand this concept of grouping in order to understand what use-cases you want to invest in ... so that's what I'm trying to accomplish here.

What do I like? I'll start with the obvious. I like Stellar. A large part of my investing is based on the Stellar platform. From top to bottom there is involvement in the Stellar platform. At the base level, my biggest stock holding is IBM, whom are partnered with Stellar. In the middle tier, I love the native asset of the Stellar network, Lumens (XLM). At the top with my higher risk investments, you will see several of the ICOs that are on the Stellar network. I believe in the Stellar Consensus Protocol. The Stellar Decentralized Exchange has offered a very positive experience so far. I also think FairX could be a game changer in the US cryptocurrency market, and that touches every tier of my investments with Stellar and it's partners.

Let's start at the base. I believe strongly in BTC and ETH. I don't see them being knocked out of their top two spots anytime soon. I am open to competitors threatening their dominance at some point, but not yet. I think it makes sense to keep these as the base of your overall crypto investment. They seem like a safe bet (relatively) in what is considered a very risky investment space. Which leads into my other base investments, stocks.

Stocks are a safer investment than cryptocurrency (right?!?), so I'm also including them in the base of my investment. I like IBM. They have sort of fallen out of public favor and lost their spot as one of the top tech companies in terms of market cap, but that makes me like them more. I just feel like I'm getting them at a discount. IBM seems to be going all in on blockchain technology, and it's reasonable for you to assume that I like that move. I'm also buying Scott's Miracle Grow because of their involvement with the legal marijuana industry, specifically hydroponics. This industry is growing as legalization progresses nationally.

Working up from my base to my middle tier, we are back to XLM. I believe that payment processing is an obvious use-case of cryptocurrency, and will probably be one of the first to be successfully implemented. Most people agree that the international banking payment system is broken. I think Stellar could fix this. There are of course competitors in this space worth your consideration, but i like XLM. Ripple (XRP) could definitely continue to pay off as an investment, but I am personally not a fan. There are other payment processing coins as well. I've heard some interesting things about the Request Network (REQ) , but I've gone a little one track on this use-case because of my strong belief in XLM.

Also in my middle tier you will see Monero (XMR). Basically, I want some exposure to the privacy coin market, which against the grain of the majority of the crypto community, I am not that interested in or sold on. I totally get it ... privacy coins make sense. There is a demand there. I could be making a mistake not getting very involved in this market, but I am satisfied with just having exposure to XMR. I also worry about regulation eventually trying to affect this market (if it can).

You'll also see Steem here (I invested before I became active!!). This community is vibrant and growing. Dtube is continuing to grow as Youtube continues to not show the gains it once did for its prominent personalities. I also have some future interest in Cardano (ADA) and ICON (ICX). I'd like to see these products come into fruition a little more, but I see the value in other smart contract platforms. In a similar vein, I'm also interested in Zilliqa (ZIL) who is implementing sharding into their smart contract platform to increase transaction speeds.

Now for the most exciting section, the low market cap coins found at the top of my roadmap. I'll start with the coins from Stellar network ICOs. I've found that several of the ICOs appearing on this network have seemed top notch to me, but I'll just focus on a one.

First, I absolutely love SureRemit (RMT). RMT is focused on offering global non-cash remittances for immigrants wanting to send vouchers for goods and services to their friends and families back home. There is an extensive worldwide market for this. RMT is beginning implementation in Nigeria, where they have already setup partnerships to allow the purchase of vouchers with their token. They are planning to expand to India, the Middle East, and Latin America by the end of the year. A lot of remittances are small transactions that become financially nonviable due to bank fees and time delays. RMT could potential solve these problems and offer a global solution for this market.

A use-case for blockchain I'm really high on is decentralized cloud storage. This just makes sense to me. The cloud isn't going away and these platforms can offer cheaper prices and better reliability. Through data being stored in multiple locations and encrypted in piecemeal, decentralized cloud storage eliminates the risk of single point failure. So, it's cheaper and more reliable. We have a few players in this space, Siacoin (SC), STORJ, and Filecoin. After playing with SC and STORJ's platforms, I've decided not to pursue STORJ as an investment. Not that SC is without it's issues, I just think they have a better shot of "winning" this market. Filecoin I have really high hopes for, but there isn't much of a product yet I've seen. I really believe in this use-case and want to corner this market.

Well, that turned into a shill fest more than intended. Apologies. It was not my intention going into this, but I feel like it was necessary to explain my individual picks here in my first post. I also didn't go into every coin on my list, maybe I'll expand on some more later. I have not researched every coin out there, and I know I've left out several legitimate investments. Remember, this isn't Pokemon, you can't catch 'em all. It's just not financially viable. I wanted to focus more on the logic behind my portfolio roadmap and the organization I've tried to establish. I also wanted to make it clear where my interest are so maybe you guys can point me in some interesting directions that I might have missed.

DO YOUR OWN RESEACH!! Read some whitepapers. Try to understand this tech. It is really interesting. What I really wanted to get across was a healthy mindset of planning and organizing your ideas into a viable portfolio roadmap.

This is my first post on Steemit! I'm hoping we will be able to start a dialogue and continue to grow as an investing community together here on Steemit. I want to discuss news, trends, investing, and trading over the coming months. I'm also hoping to expand into some of my other areas of interest, such as music, video games, sports, and travel ... but for now, I will focus on my crypto portfolio.

So, What do you think? Does my organization make sense? Do you like some of my picks? What coins should I look into more that you think I would be interested in? Am I missing some important use-cases? I am here to learn and grow and I understand I do not have the answers. No one does. I merely want to be as informed as possible ... It's a fine line between gambling and investing. Having the information is the difference.

Here's to a prosperous and fruitful future here on Steemit!

Thank you for your time!