At this year’s Investor Day, J.P. Morgan has signaled significant investments in blockchain technology underlying bitcoin, despite its CEO Jamie Dimon famously calling bitcoin a fraud.

Banks eager to join blockchain information network

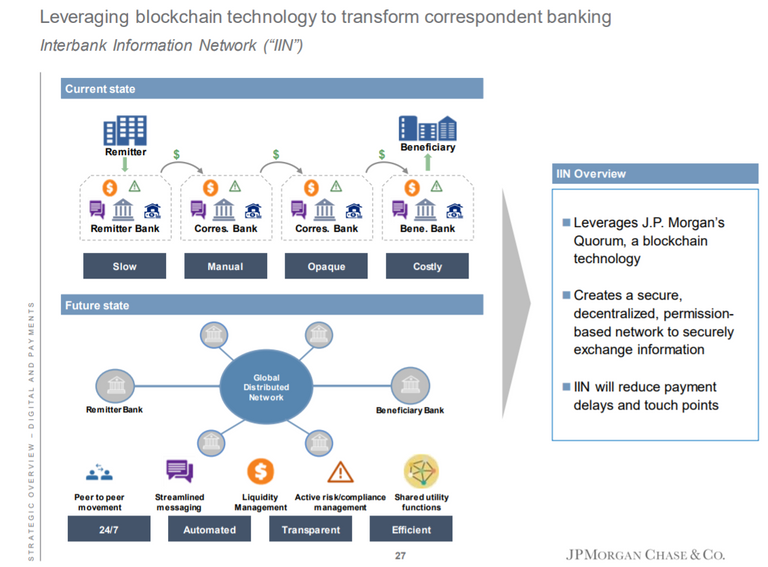

The Wall Street juggernaut had launched its own blockchain-based payments processing network called the Interbank Information Network (IIN) in October 2017, and the firm’s Chief Financial Officer Marianne Lake says the initiative is working.

Source: J.P. Morgan 2018 Investor Day Presentation

Developed in partnership with the Royal Bank of Canada (RY.TO) and Australia and New Zealand Banking Group (ANZ.AX), the IIN enables J.P. Morgan to exchange information with other banks to address compliance issues in certain cross-border payments, Lake said. Despite only being in its pilot stage, Lake asserted that other banks have “a lot of appetite” to “join the party”.

Pioneering blockchain innovations through Quorum

In 2015, long before Dimon’s comments on bitcoin, J.P. Morgan had began secretive research and testing of blockchain technology similar to that of bitcoin, culminating in the launch of the firm’s own blockchain system on the Ethereum network. The system, named “Quorum”, is designed to bring together the public and private in the realm of shuffling derivatives and payments. Through an updated consensus mechanism, Quorum aims to be both regulatory compliant by accommodating for regulators’ needs for seamless access to financial transactions, whilst protecting the privacy of transacting parties. J.P. Morgan’s Interbank Information Network is thus powered by its Quorum blockchain.

During the Investor Day, Lake mentioned that the IIN is simply the first of many initiatives the bank will spearhead in payments.

“The Interbank Information Network represents the first step in our ability to improve end-to-end wholesale payments,”

Lake said.

J.P. Morgan is not the only bank testing the potential of blockchain technology. UBS, Credit Suisse and Barclays are among those that have took part in a pilot intended to help prepare them for Markets in Financial Instruments Directive (MIFID) II, a sweeping regulatory overhaul in Europe which went live this year.

##Resources##

J.P. Morgan: 2018 Investor Day Presentation

J.P. Morgan: The Quorum blockchain

Businesswire: Launch of the Interbank Information Network

BusinessInsider: Banks have big appetite to join J.P. Morgan's Blockchain Party

Follow our Steemit blog, @Cryptovate for daily cryptocurrency analysis, insights and opinions.

Disclaimer: Research publications are furnished by independent authors on the Cryptovate team. You are not obtaining any advice from Cryptovate Investments. You should always consult with your advisers before making any investment decisions and should you have any questions as to the laws that govern our cryptocurrency research, you should consult with your legal or investment advisers.