Time for another update on my cryptocurrency portfolio. The last four weeks have been crazy and a lot has happened. You’ll see some reflections of that in the details below, mostly in the Play Money segment.

I hope you find these updates valuable. The main goal of these updates is to spark a discussion on what might be the ideal cryptocurrency target distribution within a long-term focused portfolio (even though the short term is always interesting as well). Please share your thoughts with me and others :-)

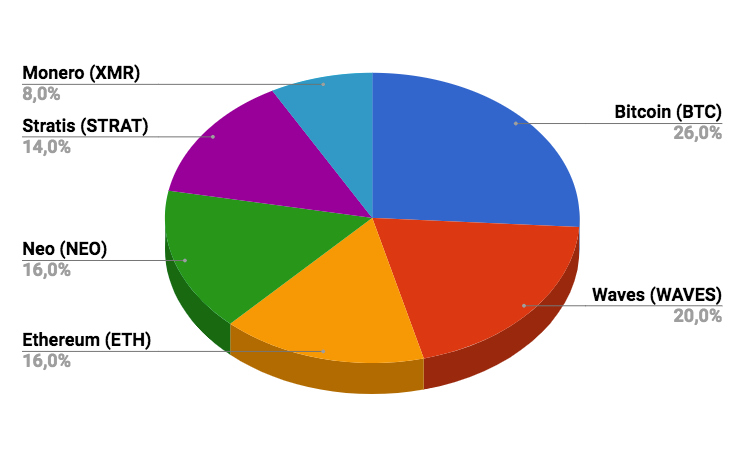

Current target distribution long-term segment

The cryptocurrencies below make up at least 70% of all the coins that I hold at the moment of writing. They are the ‘Core’ segment of my portfolio as described in my post about the 70% Core / 30% Play Money approach to cryptocurrency investing.

Changes in the long-term segment (Core)

The coins in the Core segment are still the same ones, but with a slightly different distribution.

I decided to decrease Bitcoins dominance a bit, together with that of Waves, to make room for a relatively bigger position for Neo. Lately I am quite impressed by Da Hongfei and his team. Neo is making big steps and is on its way to compete with Ethereum. More ICOs are coming to Neo and some built on Ethereum actually switch to Neo or are planning to. Waves has a lot of stuff coming as well this year, but somehow stays behind a bit.

| Name | Symbol | Current | Change (Δ) |

|---|---|---|---|

| Bitcoin | BTC | 26% | -4% |

| Waves | WAVES | 20% | -4% |

| Ethereum | ETH | 16% | 0% |

| Neo | NEO | 16% | +8% |

| Stratis | STRAT | 14% | 0% |

| Monero | XMR | 8% | 0% |

Changes in the short-term segment (Play Money)

A brief overview of the buys and sells since the last update:

Sold

- Digibyte (DGB)

- Pivx (PIVX)

- Decred (DCR)

- Ark (ARK)

- Everex (EVX)

Bought

- AChain (ACT)

- Aion (AION)

- AXpire (AXP)

- BeeToken (BEE)

- WePower (WPR)

- CoinLion (LION)

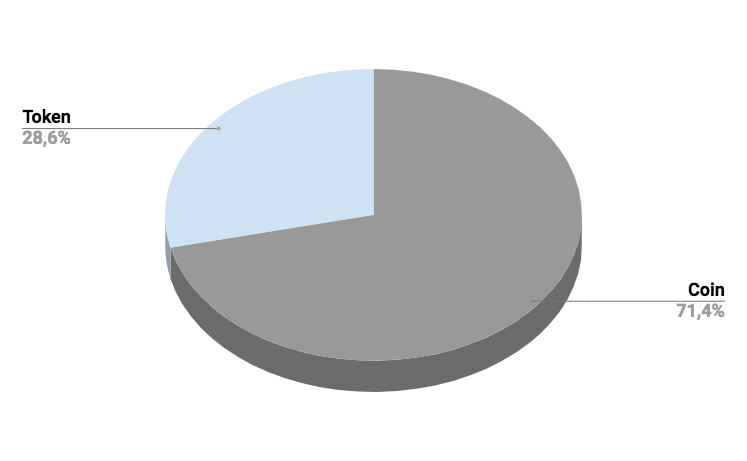

Current token vs coin distribution

I prefer to bet on the house rather than the player. Therefore I want to keep an eye on the token vs coin distribution in the short-term segment. Want to know how I define 'coin' and 'token'? Read this post. Also, I’ve counted the projects that eventually have their own blockchain, but now temporarily use a token (e.g. ERC-20/NEP-5), as a coin.

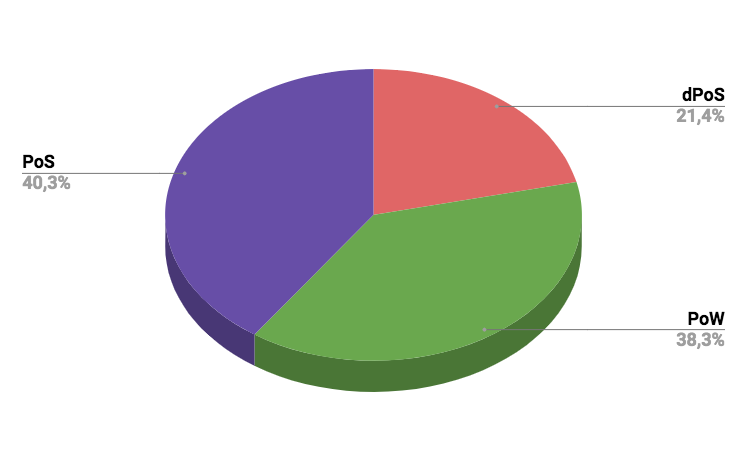

Current consensus mechanism distribution

Since I don't want to bet all my investments on just one method of reaching consensus, I also keep an eye on the current consensus mechanism distribution within the short-term segment.

---> 👍🏼 Follow me for regular updates on my cryptocurrency portfolio, investments and crypto related articles.

---> 👍🏼 Resteems and upvotes are appreciated ;-)

Disclaimer: I am not a financial advisor, trader or developer. I am just a crypto/blockchain enthusiast. Please do your own research, draw your own conclusions and do not invest any money that you cannot afford to lose.

Kepp NEO, it will have a really bright future!

I hope you are right!

Really like your strategy thanks for sharing I will have to rethink my strategy.

Thanks. What is your current strategy then?

I like the portfolio! Some of the same names that I carry.

as you probably know I have a love/hate relationship with STRAT but I was a bit surprised to see it in your portfolio in such a high amount. Did you have this last time you posted your portfolio also? Or was it a new buy?

I myself am itching for the chance to get out of STRAT! I've had it with the devs and their promises..

Also Waves.. I wonder about the large portion of it in your portfolio. I know that you're a fan of the project, but for me as an outsider I have difficulty feeling the large attraction to it. I know some people like the project, but I wonder if you like it so much that it should have a higher stake than ETH in your portfolio?

The way I look at investments is I ask myself: Will this be around in 2-3 years? for ETH I can pretty much guarantee a yes. For Waves? Not sure I could give the same guarantee. Not trying to slam Waves, I know too little about it to do that, just trying to give you some critical feedback to make you think! :)

Good point and I definitely think I have a weak spot for Waves, so good comment and thanks for that! So far, Waves has always delivered on their roadmap as opposed to Stratis. I start to like that less as well. The Stratis position is the same as last update, but I will reduce its position. I am planning to add 1 or 2 long term holds to the Core segment, which will take some percentage away from Stratis and some others.

Currently I am most excited about NEO, it seems Da is really killing it. A lot of momentum there, definitely with the Neo DevCon. I haven't watched a lot of the footage from the event. According to you, which 3 things were most interesting/surprising/amazing?

Truthfully, the entire Devcon had so much footage .. I didn't watch nearly 10% of it all..

I think the most important facts probably made it to reddit anyway. The rest is ..well.. too much to watch it all unless I take a day off for it!

I'm as always super bullish on NEO. It has been my biggest hold for most of 2017 and continues to be it in 2018, I am pretty sure. Despite China FUD it's doing great! Can't wait until they ease up on regulations, it should make it even better (price wise anyway)

NICE PORTFOLIO I M MISSING SOME INOVATION AS SMARTCASH :)

Hopefully you sold decred during the recent pumps for the biggest gain.....been doing well.

Interesting seeing Waves in a long term hodl/core portfolio.

Very good insight as it is reflection time for many folks as the market has changed, and is in some nice transition phases right now.

Sold Decred almost at ATH, around $119 :-P

I do a reflection on my portfolio every month or so. And small reflections every time I want to buy something new, since I have to think well on what is best to sell.

Do you have any particular rules or strategies when it comes to your portfolio?

In the beginning, I simply tried to pick the top 3 horses in the game.....assuming that the bottom couple hundred will get shot before the race is over. My main focus was to make sure that when BTC really broke the mainstream surface of adoption, I had it and the coins that would be dragged with it (ETH, LTC) as well as some anon coins (Monero DASH) in case government regulation was prohibitive.

Now, I am diversifying into investments like SMARTCASH, taking some longshots like TRON, and augmenting the original notion and adding NEO (good chinese support) and ZEC.

About to look at rations specifically now and bolster my core with that I have learned in the past few months thanks to posts like yours.

Thanks man!

Interesting, we've started out almost the same way with the 'big ones' + 'privacy'!

Good luck with all your choices :-)

You bought very good coins. I really like BeeToken and WePower and I think that these two coins will have an important role in the crypto world in the future. You write your blogs very good and you deserve a lot of upvotes and resteems. Keep up the good work.

Thanks! I will try to keep on bringing value this way :-)

Your portfolio looks pretty solid to me! I am holding several of these coins.

Cool, thanks. Any coins that are your favourite but are not on my list?

I am an advocate for SMART so I am building up 1k of them to stake. I also just bought some POT to stake because they are legalizing in Canada this coming July. I intend to get some LiteCoin due to their payment system announcement that is coming this week.

muy buena estrategia, creo que en este momento lo mejor es ahorrar, Saludos:)

Thanks!

Para eso estamos amigo :D

Hi,

Really a nice post, How do you track your portfolio ?

For quick checking I use Blockfolio. For more in-depth tracking I have my Google Spreadsheets ;-)

What about you?

Blockfolio is addictive,

I use cryptocompare, it has got lot of features including 'no addictive app' :)

Hahaha true!

Ur fav pick?

At the moment I like Neo a lot :-)

You got a 6.20% upvote from @mercurybot courtesy of @cryptotem!

This post has received a 12.11 % upvote from @morwhale thanks to: @cryptotem.

This post has received a 12.71 % upvote from @booster thanks to: @cryptotem.