US markets may see thin trading in holiday week

Dubai: After a more than 35 per cent fall, Bitcoin prices may find strong support at lower levels, and may recover to hit new highs.

The crypto currency fell more than 9 per cent to be at $13,168.51 (Dh48,328.43) on Sunday after moving in the range of $12,508.43-$14,610.14, according to coinbase.com. The market capitalisation for Bitcoin was at $219 billion.

“We may go down below $10,000 but that does not mean the bubble is bursting. We see this as a small hiccup. We expect the long term trend to continue to the upside,” Naeem Aslam, chief market analyst with Think Markets in London told Gulf News.

Bitcoin prices tumbled from a record high of $19,600 levels to a low of $12,600 last week, triggering panic among traders amid wild fluctuations.

“Traders should not fear looking at the 35 per cent decline in prices as rally also was very steep. In the past four corrections, Bitcoin tumbled by 30-35 per cent from its peak, and later we witnessed new high,” said a technical analyst who did not wish to be named.

“The sharp fall took support at 50 per cent retracement level at 10,500. If that level holds strong we may see recovery towards 14,500 in the near term. Investors should buy at lower levels because we see Bitcoin prices touching new high of $44,000 in coming quarters,” said the analyst.

Recently, Bitcoin prices recovered more than 250 per cent from the low of $5,555 in November to the high of $19,700 levels seen last week.

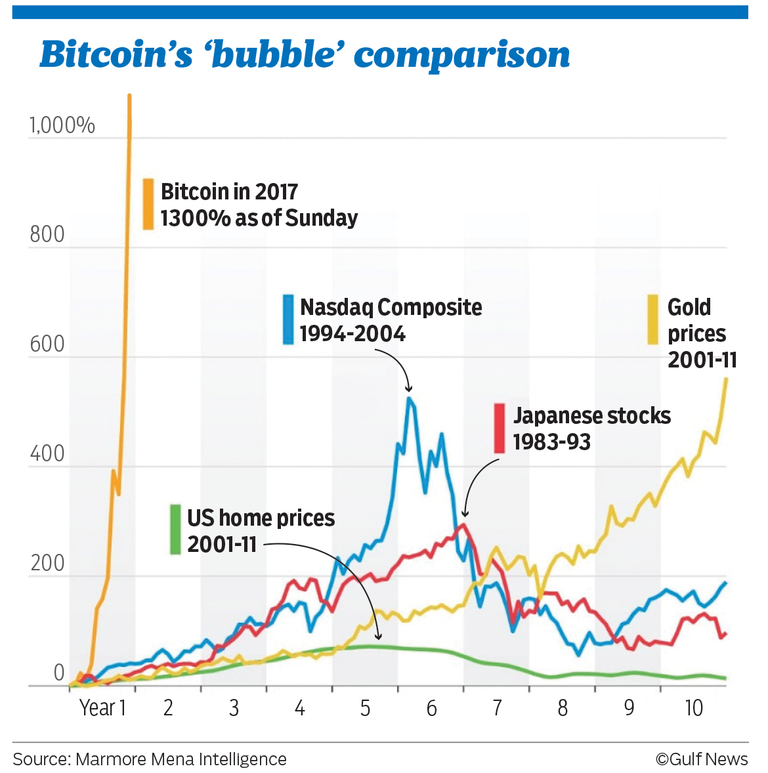

Despite the price fall, Bitcoin still fares better in terms of returns compared to other assets classes.

“If Bitcoin falls 90 per cent from current levels, it will still have outperformed stocks, bonds, and real estate in 2017,” said Ari Paul

Co-Founder of BlockTower Capital, on his LinkedIn page.

Traders are focusing on smaller cryptocurrencies like Ethereum and Litecoin, betting that they will equal the size of Bitcoin in the near-term.

Ethereum has gained to $638.45 from $10 in January.

Other small cryptos like Litecoin, and IOTA, and Monero have jumped 300 per cent since their low of near $1-6 a few months ago. Verge (XVG) also has been witnessing massive interest from traders.

Global markets

Market experts expect thin trading in a truncated week due to holidays.

“Historically, the stock market gains in the last week of the year, and given the strong economic and corporate growth backdrop, is expected to add to the year’s gains,” said Vaqar Zuberi, Head of Hedge Funds — Mirabaud Asset Management.

Markets have been witnessing positive momentum on the back of tax reform in the US, and also the government plan to extend spending plan for 30 days.

The Dow Jones Industrial Average, which has gained more than 27 per cent since the start of the year, closed at 24,754.06, down 0.11 per cent on Friday.

Siddesh Suresh Mayenkar, Senior Reporter

http://gulfnews.com/business/sectors/markets/panic-selling-in-bitcoin-may-be-short-lived-1.2146311

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

http://www.venturecanvas.com/2017/12/24/panic-selling-in-bitcoin-may-be-short-lived-venturecanvas-2/

Bitcoin has only been around for 1 year? This chart looks like BS to me.