BlockChain Technology is already changing the World. We can see the example of Cryptocurrencies which are growing rapidly and giving us applications to make our lives easy and convenient. BlockChain technology is not limited to cyyptocurrencies only, instead it can spread over financial system as well as making it more efficient, effective and economical. Some Tech and Finance Giants like JPMorgan Chase and Citi group already considering the use of BlockChain technology in their day to day operations.

Let's understand this topic in details.

What is BlockChain?

I would like explain this terminology in simple words.

BlockChain is a technology which creates a decentralized public records of transactions. These transaction remains secure, anonymous, hassle free and most of all unchangeable. That means, something once recorded on the Blockchain always remains on it.

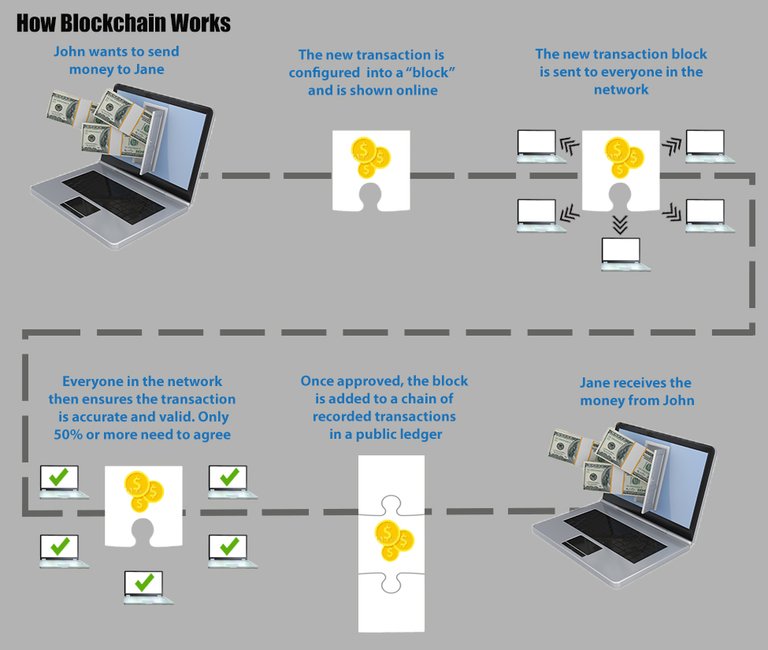

Example: Whenever a person transact something on Blockchain, a new block creates and the submitted into the already built chain which is recording transactions consistently. If Brain wants to send some money to Dom via blockchain technology, then a transaction record will generate which will be added to the Blockchain network, which can be seen anytime publicly.

The main highlight of blockchain technology is that, it diminishes the presence of Intermediary while conducting a transaction.

Now Let's understand our existing Banking and Financial Industry and How it works?

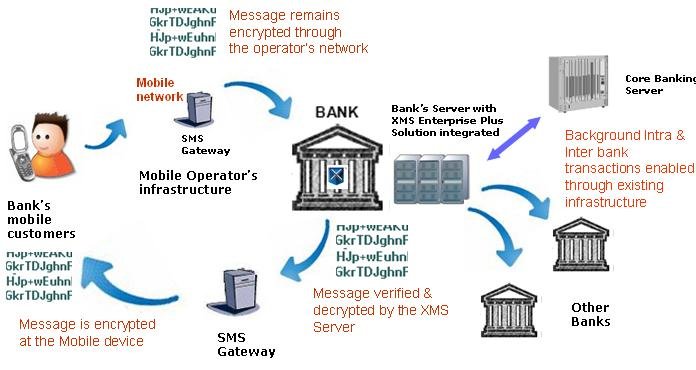

Our current banking and financial industry work as an Intermediary to all the transactions ever done by anyone. Banking exists to intermediate the transactions and trade between people, business and corporations.

Let's suppose: Jim wants to send some money to Jude. How will he get this done?

Simple, he will go to the internet banking website or mobile wallet application of the respected bank he has an account with, He will simply add details of the person he wants to transfer money and with a single click, its done. So, what banks did was to intermediate a transaction between Jim and Jude. Without a bank or wallet application, or should I say an intermediary, the transactions were not possible.

In the same way our Financial Industry work. If a person needs a loan, then he'll go to the financial Institutions like HDFC Financial solutions and present them their documents and if everything is in accordance, a transaction will conclude between Financial Institution and that person. But still that Financial Institution still worked as an intermediary to conduct the transaction and hold the records of that transaction in their own servers.

The Problem with Intermediaries is that they hold all the public and private records of transaction and they charge a hefty amount for the same. What if their server got crashed? What if someone hack their servers and steals all your information?

Yes, It can happen. The transactions on banking servers are changeable and can be modified at will. Plus there are no public records available for those transactions. This is a drawback which BlockChain is going to solve.

How BlockChain Will Help In Changing The Finance Industry?

Blockchain technology will simply help Banks and Financial Industry to reduce their cost of intermediating the transactions as well as the fees they charge from their customers will also be reduced plus all the information or transactions records will be publicly available with out any hassle, security issue and the main thing is that it'll be unchangeable. Think about the money we have to pay regularly on our daily transactions. Think about the time we waste by visiting financial institutions for our menial to large transactions.

The problem which Blockchain solves is the problem of centralization. Centralization systems are more prone to attacks and security issue. All the power rests in the hands of an individual instead of public. Blockchain works on the basis of decentralization system. It creates the public records of all the transactions and add those records on the live chain where that information will be stored kind of forever and one can easily review it whenever a need arise to confirm its genuinity.

Blockchain is going to be huge in the near future and various Financial giants are trying to implement it within their existing systems. These financial giants includes some renowned names like JPMorgan Chase, Goldman Sachs, Citi group and many more.

Let's hope, in near future we'll get a hassle free, secured and an economical medium of transactions.

Thanks for reading ..!!

Don't forget to follow me on discord. I represent Adsactly, a community highly concerned with Cryptocurrencies and financial solutions. Join us today.

- Discord: https://discord.gg/CvQpfSD

- Twitter: https://twitter.com/adsactlycrypto?lang=en

- Telegram: https://t.me/ADSactlyCrypto

- Facebook: https://www.facebook.com/groups/ADSactly777/

- Reddit: https://www.reddit.com/r/ADSactly/

- Bitcoin Talk: https://bitcointalk.org/index.php?topic=405590.0

- Steemit: https://steemit.com/@adsactly

Check this article out:

https://news.bitcoin.com/1-4-billion-invested-blockchain-pwc/

Blockchains will be especially good at tracking supply chain management. This is seriously just the beginning. There ARE lots of solutions to real world problems. To say blockchain technology doesn't offer any solutions is ignoring the technology and putting on blinders basically.

65 banks are already using Ripple, a blockchain based finance settlement network, to settle overseas transactions faster, quicker and cheaper than before.

Also, BHP is using Blockchain to track core samples and it's being used in production right now.

This is just the beginning, we have barley even started to tap into what this technology can do. I urge you to take another look and do your own research, it's happening and it's coming fast.

I have done my research, I am aware about the Ripple thing and many banks are using it right and many are considering to use it in future.

My whole point was that in future, Blockchain technology will help us making transactions easier, hasslefree and economical. This is exactly what is happening right now, and will increase in future too.

Thanks for your views by the way :)

Great post @cryptonet, I agree with many of your points. With institutional money starting to flow into digital currencies, it is clear that there are many uses and advantages of this blockchain technology. Exciting times ahead!

Thank you @dylanjacobson. It's good to hear from you.

Nice breakdown, @cryptonet. The infographics were easy a good choice of visual aide.

Thank you :)

Very informative, thank you!

Wouldnt hacking be considered an issue with both central and decentralized?

My concern is security. If your credit card gets hacked, usually the bank would make good on it. Not so with crypto.

Yes, it does concern me but having decentralization means the resources are not at a single location. the data is decentralized and couldn't be hacked in a single attempt.

That is true!

I am definitely all for decentralization! It is a great thing that will revolutionize many different industries, not just finance.

Good post! The blockchain brings trust and decentralization. I think it's awesome!

thanks for explaining blockchain.

its good if they are benefitting the economy

Okay, don't understand every words in english but blockchain seems more clear to me know. Thanks for explaining

Thanks man about the introduction! Now i have still a lot to learn about it ahaha but thanks to you it's less then before.

same me

Block chain technology is a future of financial institution of every country around the globe. And we are lucky we already here on top of the block chain on its infancy. It means we grow together as a block chain is growing. Early birds adaptors, that is who we are.

Well, yeah that is the whole idea.

good post

follow me

Nice poste and info. I trust him. Upvoted and Re-steemit

https://steemit.com/money/@dobartim/how-did-i-earn-from-usd-40-79-btc-for-8-months

Hi @ceyptonet. . I like your post and i have followed you. Thankyou for sharing.

Solid article. I think it's only natural that with out-dated systems, something better and even revolutionary replaces it. However, do you think cryptocurrencies will be way to do that? As it seems, the main use of cryptocurrencies are as a purely speculative investment. Can the transition to legal tender legitimately be made for cryptocurrencies?