Global Blockchain Industry Overview and Prospects: ICOs

Huobi is about to release a “Global Blockchain Industry Overview and Prospects report for the Fiscal first quarter of 2018. The full report will be released at the Blockchain Festival in Ho Chi Minh City Vietnam between May 24th and 25th. I have a sneak peek of the report and would like to share what I consider to be the most interesting parts of the report. This is the first part of four overviews of this report.

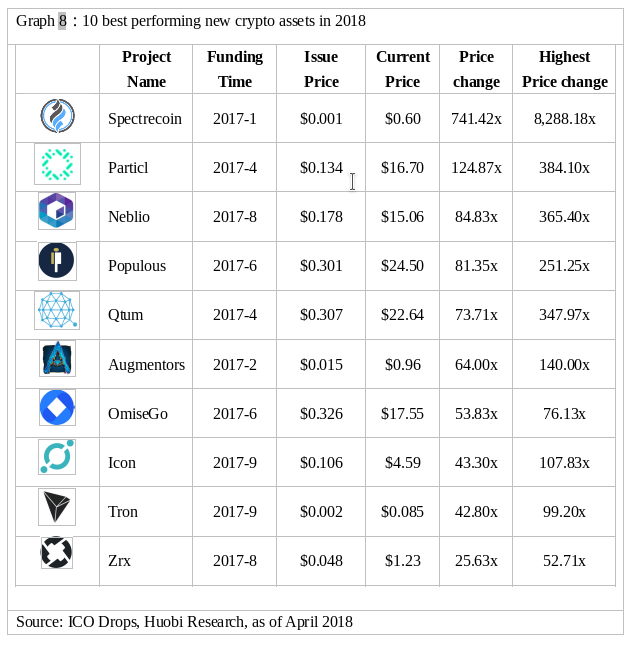

As we know, in 2017 there was a paradigm shift in the crypto asset markets. Attention and investments shifted from being only bitcoin oriented to being altcoin or token oriented. This drive into alternative tokens was driven by several factors with the most important being crown funding capital through ICOs (Initial Coin Offerings). According to Huobi’s statistics 435 out of 913 token sales succeeded in hitting their soft cap targets, which is a success rate of almost %50. ICOs in 2017 raised over 5.6 billion US dollars, compared to only 240 million US dollars in 2016. Not only were there an unprecedented amount of ICOs, but those ICOs saw unprecedented appreciation within the same year, in some cases appreciating hundreds of times over their initial ICO value. Spectrecoin, Particle, Neblio, Populous, Qtum, Augmentors, OmiseGo, Icon, Ton and Ox were some of the best performing ICOs in 2017.

In 2018 the amount raised in ICOs has already exceeded that of 2017 with over 2.5 billion US dollars being raised in February alone. Telegram, with their Gram ICO raised 850 million US dollars of the 2.5 Billion US dollars total raised in February. EOS has also continued to raise record amounts of funding during 2018 with EOS raising 3.3 billion US dollars by the end of April 2018.

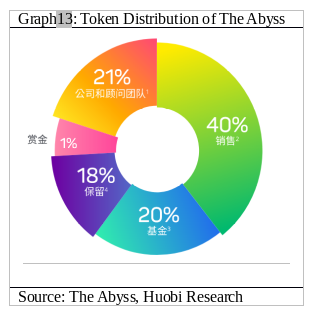

With so many ICOs raising money, and with little regulation or accountability in the sector, it has been difficult for investors to distinguish between the good and the bad projects. This led to a lot of scam ICOs where investors were conned out of their money by entrepreneurs who did not end up delivering on their promises. As the majority of the ICO’s run on Ethereum Smart Contracts, the ethereum community headed by Ethereum founder Vitalik Buterin proposed a new way of ICO funding through what he called a DAICO which stands for “Decentralized Autonomous Initial Coin Offering”. DAICO combines the benefits of the DAO (Decentralized Autonomous Organizations) with the traditional initial coin offering crowdfunding approach. The DAICO model gives investors more control over the release of their investment. The system uses a system where project developers are given funds raised as they complete developments of the project. Once a development is complete, initial investors are able to vote release funds to the developers. In contrast, if a developer fails to meet a goal or deadline, the investors can vote to terminate the contract and shut down the DAICO in order to recoup their investments. “The Abyss” is the first project to have used the DAICO, raising over 17,057 Eth and 141,183 BNB (roughly 14.38 million US Dollars) during their crowdfunding in April and May of 2018. The Abyss Token Distribution was (will add english translations soon):

With many tokens being accused of being securities in 2018, some blockchain projects have decided to go back to the old way of raising money with traditional IPOs, offering Reg A+, Reg D or Reg @ Security offerings. By complying with the more strict regulations of an IPO, these companies can be assured that they meet any legal requirements that they may be liable for.

Huobi believes that these tokens, that were predominantly created through ICO’s, will continue to enhance the crypto markets throughout 2018 by driving the market with real world use of blockchain and the tokens that are used on them. A new paradigm shift from investment-driven crypto assets to “investment + application” driven assets. It is also expected that crypto-to-fiat transactions will decline and crypto-to-token transactions will increase as more users experience this shift.

The information that I have been given to share came from the first part of four of the “Global Blockchain Industry Overview and Prospects” by www.huobi.pro. The full report will be made available exclusively to attendees of the Blockchain festival Vietnam in Ho Chi Minh City Vietnam. If you would like to attend the festival you can obtain tickets for 50% off the cost with promotional code “WRITE50”. Please visit www.blockchainfestival.com to learn more and to get tickets. To trade new tokens you can visit www.hadax.com which is operated by Huobi Pro and is where newly listed tokens can be traded and voted on for listing.

You have a minor misspelling in the following sentence:

It should be sneak peek instead of sneak peak.thankSS