The CryptoKick

Hello Cryptoverse!

Disclaimer: I am not your financial advisor and this is not financial advice. This is just my personal view on the crypto currency market. Please, do yourself a favor, only invest what you can afford to lose.

Welcome to CryptoKick! Your one stop shop for CryptoCurrency news, ICO Reviews, and Portfolio tips. Today's Wire is authored by Bruce Parker.

I have received both positive feedback and additional questions regarding my last portfolio piece. Bruce- how do you judge potential investments? How do you choose amongst the 100's of currencies and ICO's? How do I get the same results? Where is the next Ether?

Consider this piece a dedicated, stream of thought approach to how I go about investing. While I won't give your specific tools and trading strategies, I will give you a mental framework to approach this weird world.

Fundamentals//People//Network Effects

Fundamentals

Coin fundamentals are the backbone of crypto and the reason it's revolutionizing the world we live in. A coin should be solving the unsolved or at least making a current solution better. The blending of the solution and the technology should make sense. Sure blockchain tech is great but- do we need Tinder on it? Probably not. Video games on the blockchain? Unlikely to be your Ethereum like unicorn. The protocol should make whatever it's trying to do suck much less than it did before.

What is the application of the coin? Does it's use on the platform give it value? Is it a staking token? A currency? How is the currency supply controlled? Does the application give it intrinsic value or is this just another way for X Company to fund their startup?

Read the WhitePaper even if you aren't techincal! This is your money, you should try to understand as much of the product as you can before giving them your hard earned cashola. Sure you can invest like Big Baby D.R.A.M in the Cash Machine music video, but that usually results in a thousand yard stare into your fire engine red blockfolio app. Do you think Warren Buffet would execute his investments based on the number 9 most popular post from r/CryptoCurrency? Treat this like the once in a generation opportunity it deserves to be.

People

The next, in my opinion most important, part is the people behind the project. If Ray Dalio's life principles taught me anything, it is the who is usually more important than the what. The right combination of people and skills is imperative to a successful project. Even with the right technology and tools, the wrong people can turn your hopeful investment into a money pit. I can fill a 5 star kitchen with the Season 1 cast of Flavor of Love and I will probably get a terrible meal. For every Hoopz theirs a Hottie and for every Gnosis there's a OneCoin. I always learn as much as I can about the people to make an educated guess on whether they have the skill set and experience to accomplish the project's vision.

Read their LinkedIn bios and Google them- are they real people? Okay good jumping off point. Now, how does their experience relate to the product or protocol they are selling? Don't know? ASK! Most smaller coin startups are seriously active on twitter and slack communities. The people guiding the vision of your investment should instill confidence in you.

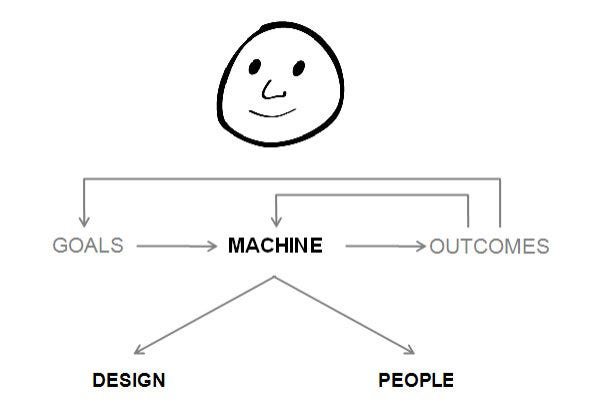

Jumping back to Ray Dalio's vision of how good outputs are achieved [aka obtaining a fantastic ROI]- the combination of a good design and good people make up a non-negotiable 1-2 punch. I will continually reference this machine like thinking- see below for a brilliant artistic example.

Easy stuff. Set your Goals [How many times have you dived into something and forget to do this?], Create a design and who is going to execute that design, and then measure your outputs. Did the outputs achieve your goals? Yes? Great! You listened and included both of these tips! I digress.

Network Effects

The combination of the fundamentals and people will determine what network effects the coin can obtain. The two effects I find the most interesting in the space developer network effects and marketplace network effects.

The developer network effects are simple- how easy and appealing is the protocol for other people to build on? Attracting more developers will attract more users to the products those developers make. How many devs have already signed up to work with the protocol you are researching? How quickly has it been adopted?

Marketplace network effects start out as purely solving a problem for a small group of people. This supplied solution will cause an increase in demand, which attracts supply and so on. How many people can actually use the protocol you are looking at? How many are already using it? How difficult is it for them to start using it?

While it's hard to accurately predict these effects, a sound approach usually leads to better investments. Does this sound like a lot of work? GOOD- it is. If you want to just blindly pick and become a millionaire, I heard of something called the lottery. It's way easier to buy a ticket for and Venezuelan police won't kick in your door for collecting them.

Calculate Your Liquidity Risk

While I feel like this will get it's own article, I want to drop a blurb on calculating your risk. Lets look at the following:

Liquidity

A market's ability to purchase or sell an asset without causing drastic change in the asset's price. Equivalently, an asset's market liquidity (or simply "an asset's liquidity") describes the asset's ability to sell quickly without having to reduce its price to a significant degree.

To rephrase my good friend Wikipedia- How quickly and smoothly can I get out of my position in my investment? Understand while there may be unicorns in low market market cap coins, there is also quick sand. Your risk exposure generally rises the smaller the total market cap and trade volume. Those coins near the bottom of the Coin Market Cap 100 will generally be much higher risk and should only take a smaller percentage of your portfolio [should you choose to even invest].

If you have any questions or want to devil's advocate my approach- feel free to find me @TheCryptoKick on twitter.

Thats all for this one- look out for todays observation later today!