Hey Steemit! I wrote this piece which is also my first post on Steemit :) to address best practices when deciding on investing in ICO's. It is a great resource for both beginners who have never even heard of bitcoin, ethereum, or blockchain as well as some evaluation tips that more experienced investors can add to their toolkit. With that, I present to you The Unofficial Guide to ICO Investing.

Investors are rushing to put their money into ICO’s.

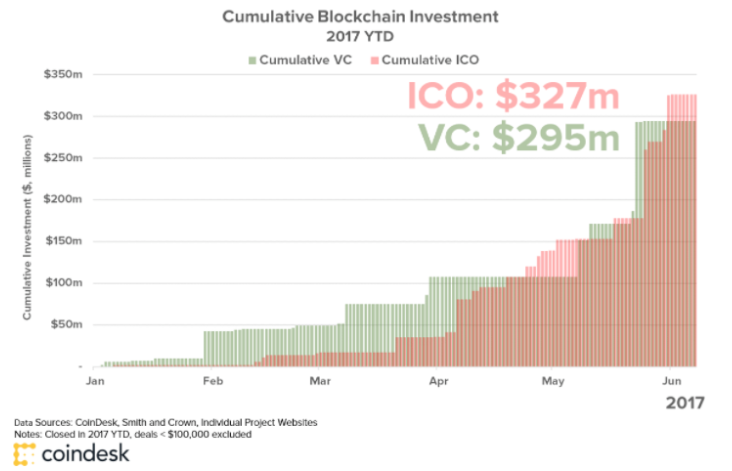

There’s been a lot of buzz lately about Initial Coin Offerings, more commonly referred to as ICO’s. Just less than a week ago, Tezos raised $232 million worth of cryptocurrency, breaking the record for the largest ICO with the previous title-holder being Bancor, which raised $153 million in 2 hours a month ago. These massive numbers show no sign of slowing down, either. According to Coindesk, year-to-date, ICO’s have surpassed VC funding for blockchain startups:

This guide will include a brief overview of ICO’s and best practices in properly evaluate companies to make an educated decision before placing your bets on the “next big thing”.

What is an Initial Coin Offering?

If you already know what an ICO is, feel free to move onto the next section. If this term sounds unfamiliar to you, think about it this way: Instead of raising angel funding, institutional funding, or going public, cryptocurrency and blockchain companies can now perform what is called an ICO whereby they issue a digital token that anyone in the world can buy using cryptocurrencies like ethereum and bitcoin. If the word blockchain also sounds new to you, this video does a pretty good job at explaining it on a very basic level:

The main difference between ICO’s and IPO’s is regulation. If a company were to go public, they have to go through the SEC and comply with all sorts of regulation and guidelines. With an ICO, it’s as simple as setting up a collection wallet with the crypto of choice (ethereum ERC-20 tokens being the de facto ICO token) and issuing them to eager buyers. ERC-20 is a standard for ethereum tokens to adhere to in order to ensure they work properly in the ecosystem. Tokens serve a couple of different functions which vary from company to company, but examples include interacting with their native platforms and voting rights in the case of Tezos. The larger tokens are even easily exchanged for fiat currency, USD, for example, or other popular cryptocurrencies like bitcoin and ethereum. Now that you understand what an ICO is, let’s go into how to invest in them.

1. Discovery

Logically, the first step toward investing in an ICO is to find a project you like. Smith + Crown has a pretty good, curated list of ICO’s also has a short description of the project so you can scroll through and get an idea of what you like. As you’re reading through the various descriptions, you’ll notice there are lots of buzzwords. For the most part, try to ignore these. It is important to note that there are some projects that are protocol tokens, which require a bit of technical know-how to understand how they work. If you’re willing to put in the time to really understand how these tokens work, it can be worth it as they have the potential to become the backbone of the new internet.

Tezos is an example of a protocol token that has recently raised $232 million through their ICO in July.

A general rule of thumb for non-protocol tokens is that if 1) it makes sense to you and 2) you think to yourself “yeah, this seems like it could have value in society one day or even today”, then it is worth looking further into. Again, theres tons of these projects and there’s only gonna be more as people rush into the industry to catch the wave, so have a sense of focus, pragmatism, and very strong skepticism. There’s a reason that Warren Buffett has never invested in any technology stocks. Invest in what you know and stay away from what you don’t.

2. Read the White Paper and Evaluate the Team

Once you’ve narrowed down the sea of ICO’s to a couple of coins-of-interest, you’ll want to do a deep dive into each coin. A white paper is more or less a business plan which goes through the concept of the project, problems in the market, competitors, details of the token sale, team members, etc. For good measure, read the white paper a couple of times. The more you read it, the more confident you will feel when you actually decide to pull the trigger. And don’t just take their word for it. Fact-check every aspect of it. Is the market actually that big? Do people actually have the problem that they’re trying to solve? A thorough white paper will also list their allocation of ICO funds. 50% for marketing? Something like that isn’t an automatic red flag, but they should probably also break down the different marketing channels. After you’ve meticulously picked apart the white paper, look at the team. This includes the founders, developers, advisors, pre-ICO investors and anyone else involved in the project. As with any startup, the team is crucial. It’s a good sign if they have domain expertise or previous success with starting companies. Do a quick LinkedIn search on each of the founders, if links are not provided on the website or white paper. It can at least show some validity that they are who they say they are. If they said they founded X company, look at the site’s traffic using SimilarWeb or use crunchbase to see if it was really as successful as they say it is. Some companies have participated in accelerators like Boost VC which could mean that the team has done a good job surrounding themselves with the right people.

3. More Due Diligence

After you feel comfortable that the project is legit and the team is capable, do some miscellaneous due diligence. In this case, imagine you are a detective. Set your default mode to “skeptical” and actively look for something that’s not quite right. It’s wishful thinking for us to hope that all of these ICO’s will be home runs, but the truth is they won’t. There is plenty of positive sentiment around just about every project. Understanding human psychology also helps in this case. Unlike the stock market, the ICO market is not a zero-sum game. The more hype created around them leads to more demand which leads to a price uptick. The more digging you do, especially the kind that all of the yes-man investors and bandwagoners aren’t willing to do, the more you’re saving yourself and your money from the inevitable unsuccessful projects. When you’re evaluating a token, look to see if existing tokens can perform what they’re trying to do. You want to make sure that they are not only solving a problem, but using a proprietary solution. This will greatly increase their chances of being successful 5–10 years down the road. Other good methods for your evaluation is reading through Reddit threads and Bitcoin Talk. Again, be somewhat skeptical: People who speak loudly don’t necessarily know what they’re talking about/have their own agenda. Try Googling or searching in Bitcoin Talk for the token with the word scam after it. Although flagrant scams are not prevalent, they exist. See what’s going on in the Twitter-sphere and coverage in the press. Be careful of paid press releases and endorsements and anything that makes things seem better than it is. Another good habit to get into is joining the project’s Slack. If a company is not transparent and does not list any communication channels, whether through Slack or Telegram, that should raise an eyebrow. There are also a number of rating agencies out there like ICOrating and CoinSchedule which aim to create a standardized and objective analyses of companies. Another good place to see other people’s research is a Slack group like CoinFund, which has very good community-driven insights. Using these may affirm your own research, but don’t rely on any centralized stamp of approval to decide where you invest.

4. Purchasing Ether/Bitcoin

So, you’ve found a couple of tokens and know everything about it like the back of your hand. You’re ready to take part in their ICO. The first thing you need to do is get ether or bitcoin. Some ICO’s also take fiat currency so if you know that beforehand, you can also contribute that way. One of the best ways to get your hands on some is Coinbase. It probably has the most user-friendly interface and it’s quite simple to make your first purchase. Other popular exchanges are Poloniex, Gemini, and Bittrex.

5. The Token Sale

After you’ve purchased your ether/bitcoin and it is in your Coinbase wallet (or other exchange wallet), transfer it into a separate, personal wallet (MyEtherWallet is pretty widely used for ICO’s). This is a very important step. Many ICO’s specifically state to not send them anything from exchange wallets. After you’ve transferred funds into your personal wallet, find the contribution address of the token you’d like to purchase. This can be found on the project website. Before making the transaction, make sure you know exactly what you’re getting. The exchange rate (ETH:Token or BTC:Token) will be specified and sometimes there are also pre-sale and early contributor bonuses, which will be in the white paper and website, so be on the lookout for those. From your personal wallet, just transfer the money into the wallet address, a string of alphanumeric characters, provided by the website. You will also need to set the gas limit for your transaction, which is basically the network cost of running your transaction. Higher gas limit = faster transactions. ICO’s usually provide what they think is a good gas limit based on network activity and generally, it’s pretty safe to follow that number. After the transaction is successfully executed, the respective tokens will be transferred into your wallet and you will be the proud owner of X token!

Buyer Beware

- Most wallets and accounts you will create will have multi-sig verification which just means that there are multiple layers of security of your accounts.

- Many projects have their code completely open-source on GitHub. One caveat of this is some scams are replicating companies landing pages using a different domain in an attempt to siphon money off to an unknown party. These doppelgänger sites pretend to be the official token sale, the only difference being the receiving address. And because transactions are irreversible and no legal framework that prevents such scams, your contribution will go directly into the pockets of these scammers, never to be seen again.

- It is up to you to decide if a pre-product project is worth your investment. Generally speaking, in the venture capital industry, it’s seen as distracting to raise too much money too soon. I think this definitely applies and be extra thoughtful of pre-product ICO’s.

- If you are not looking at long-term value, be really confident you know what you’re doing. There’s plenty of people trying to pump and dump ICO’s or speculators with years of experience day trading taking advantage of ill-advised money. There is a number of private groups on Telegram and Slack that coordinate to speculate certain coins. In almost any other market, this is a crime. In this one, it’s totally legal.

- Expanding upon the previous point, if you’ve done your research, don’t be concerned about price swings and volatility. Start out small and really understand the volatility (it’s crazy). But eventually, it’s what you’ll expect. If you’ve chosen a winner, when blockchain technology matures in the coming years, you’re going to get a ton of long-term value.

- As with normal investing, don’t invest more than you can afford to lose. ICO’s can be a fantastic opportunity with unparalleled returns, but don’t make them the reason why you have to eat ramen noodles for a year.

Closing Thoughts

The current ICO market can be likened to investing in IPO’s during the dotcom fiasco. Investors knew they could put money into the newest internet company and get guaranteed returns. As Mark Cuban put it, whenever people are bragging about how easily they’re making money, it’s a bubble. And I’m not going to pretend that it isn’t a bubble. I’ve seen some horrendous companies raise 7 figures. In this case, I’m pretty hesitant in saying company, when in reality they are projects at best and scams at worst. But that shouldn’t automatically detract you from them because the handful of ICO’s that are providing real-world value and have stellar teams and advisors behind them are bubble-proof just like how Amazon and eBay emerged the dotcom bubble and became tech giants. If you’re on the right side of history, perform your due diligence, and ignore the unnecessary noise, one day you may be one of those people who got in early on the next Google’s and Facebook’s of the world.

Checkout 1broker.com too:

https://steemit.com/bitcoin/@kingscrown/dont-know-how-to-trade-automatically-copy-other-successful-guys

This post received a 2.2% upvote from @randowhale thanks to @warn-a-brutha! For more information, click here!

I love this Info and Up Voted and Resteemed this post. I just got involved in my First couple of ICO's this week. Thank you again for this Great Info.

Thanks so much! Yea, it's an exciting market to be in :)

@connorlin

What ICO's are you currently active in and what ICO's are you looking at for the future?

I missed out on the veritasium hype and hate that I could have made a years salary with just a couple eth