Have you ever made a few thousands in cryptocurrency and found it hard to spend? Not because you’re saving it but you wish to take advantage of the volatility of cryptocurrency and keep it so that when the price increases in the future, you make more money? Have you been in a situation where you had sufficient funds to purchase a product but just dont want to spend your cryptocurrency to buy it?

While you might think this is not possible, it's actually something that every cryptocurrency investor can relate to. You’ll have the money but you are unwilling spend it. It’s absurd, isn’t it? But that’s the reality for cryptocurrency investors.

THE PROBLEM

The usecase of cryptocurrencies in real life is restricted, it's used mostly in the cyberspace. It is very rare to see cryptocurrencies such as Bitcoin and Ethereum gain physical utility. Their utility is restricted to the cyberspace where they are traded over the Internet.

Sadly, the cryptocurrencies we have at the moment cannot function as collaterals for loans because even with the huge strides cryptocurrency has made, in most financial institutions, it is not regarded as an asset. Though steadily increasing in value, they lack the relevance as a collateral for loans. This is partly because of the risk of price volatility of the collateral which is prone to unnoticed increase or decrease. The effect of this is the non-acceptance of cryptocurrencies as collaterals by traditional financial institutions.

Cryptocurrencies function better as assets rather than currencies as its miners and investors literally HODL it rather than utilizing them in the purchase of goods and services.

THE SOLUTION

But what if I tell you that there is a platform that can enable you to "Spend" your crypto assets and still gain value from it if the price increases? What if I tell you that there is a platform that would enable you to access credit in fiat or stable currency and use your crypto asset as collateral and even if the value of your asset increases when you repaid, your full asset would be returned to you in full even if the value has increased? Such a platform does exist and I am proud to introduce you to Money Token.

How effective will MoneyToken be?

To solve the nagging crypto conversion problems, MoneyToken setup its platform that will allow you borrow stable currencies. The stable currencies can be obtained on the MoneyToken platform and before you get the loan, your crypto asset value will be ascertained to ensure its correspondence with your specified loan.

With the MoneyToken platform, you can take a stable currency loan and issue your Bitcoin or Ethereum as collateral and on paying back your loan, the collateralized cryptocurrency will be issued back to you.

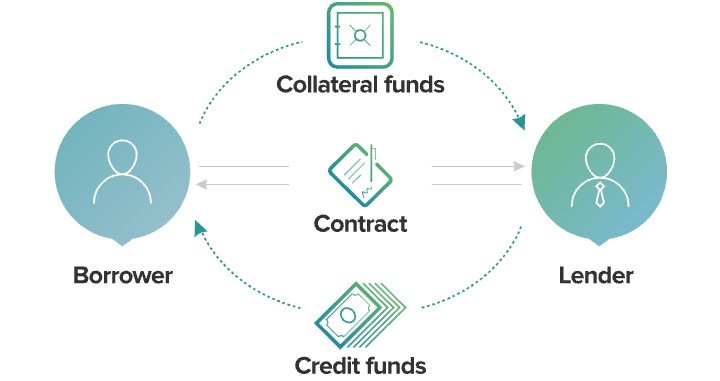

MoneyToken is an entirely decentralised platform, As opposed to the earlier solution, MoneyToken aims at resolving issues that emanated from the Credit Model approach. MoneyToken aims at clients’ risk management while enabling the creation of a stable lending model that will be implemented using cryptocurrencies. MoneyToken would link lenders and borrowers using smart contracts as the escrow.

MoneyToken’s lending model involves using crypto-assets and currencies such as Bitcoin and Ethereum as a collateral in exchange for either a stablecoin or fiat currency. Loans are confirmed within minutes of application except for long term loans which are issued in about 3-90 days.

The amount of loans obtainable on the MoneyToken platform is $500 to $1,000,000 for the short and long term loans. The loan amounts might change depending on the equivalent in other currencies at the time of request. Interest on loan is about 0.5% per day.

Before a loan can be secured, four processes have to be completed:

• Loan term selection

• Depositing a collateral

• Deal approval

• Receipt of credit funds

For collaterals, MoneyToken accepts the following liquid currencies:

• Selected ICO tokens (this will come into being after review and approval)

• Altcoins(after review)

• Bitcoin(BTC)

• Ethereum(ETH)

The Amanda on MoneyToken

MoneyToken features an Artificial Intelligence Assistant called Amanda. Amanda is responsible for automating loan operations on the MoneyToken platform. Powered by a deep learning Artificial Intelligence algorithm, Amanda helps MoneyToken users get to the last step of the loan process and offers directions where necessary.

Token & TokenSale Details

The Initial Money Token (IMT) is the token used on the MoneyToken platform to pay all fees in the platform and you can get up to 60% discount if you pay with the IMT and you can also access loans in IMT. Presently the IMT is being offered up in a Tokensale.

Token Ticker: IMT

Price: 1 IMT equals $0.005 USD

Platform: Ethereum (ETH)

Accepting: LTC, BCH, ETH and BTC

Soft Cap: 3, 000, 000 in USD

Hard Cap: 35, 000, 000 in USD

TEAM & ADVISORS

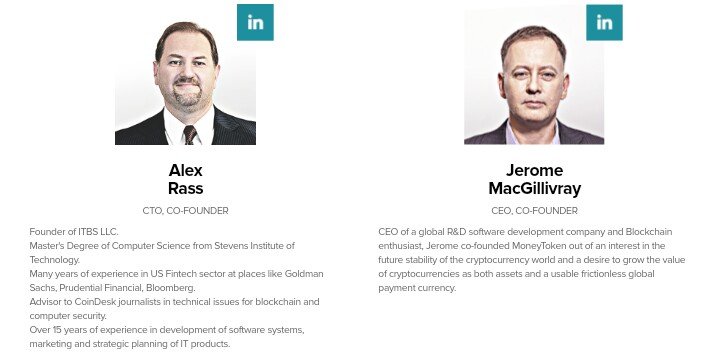

The MoneyToken Team is comprised of of distinguished individuals in different fields and the MoneyToken advisors features quite an impressive number of distinguished advisors including Roger Ver, The Founder of Bitcoin.com.

To find out more about MoneyToken, check the links i added below

Website: https://moneytoken.com

Whitepaper: https://moneytoken.com/doc/MoneyTokenWP_ENG.pdf?ver=1.02

Telegram: https://t.me/moneytoken

Twitter: https://twitter.com/MoneyToken

Writer: Collinberg

BItcointalk Link: https://bitcointalk.org/index.php?action=profile;u=1532780

I'm following this project and it's remarkable. Cool piece 👌

Nice write-up

Coins mentioned in post: