Disclaimer: As is standard practice in broadcasting market analysis in the cryptocurrency space, I need to begin by making clear that all discussions about price and market trends are my personal opinions, and NOT financial advice. I do not take responsibility for any investments except my own. I am not a financial adviser, and this is not financial advice.

CHECK OUT ColeWorld for Weekly Market Updates, All Things Crypto & Cannabis, All things Cole*

Now that we have that out of the way, lets delve into some technical analysis. In this post, and in weekly update posts for the foreseeable future, I will be giving my own opinions of the market in an educated, clear way hoping to inform investors like myself - a self-taught, small time part time investor with a 9-to-5 career - of MAJOR opportunities within the cryptocurrency space. For simplicity sake, today's post will just be a light review of a variety of Large, Medium, and Small Cap tokens/coins that are popular within the space and that are easier to understand for the everyday-investor.

LARGE CAP ANALYSIS:

If we're going to talk cryptocurrency, we need to start with the Grandfather of them all - yep, Bitcoin. Now in the last few months we've seen Bitcoin moonshot from its Summer 2017 valuation of 1k-2k USD all the way to its all time high in late December 2017 to 22k USD. While this was a momentous occasion for Bitcoin and crypto-traders alike, following its moonshot we have seen bitcoin undergo a healthy correction to almost half its all time high, down to 11k. So lets look at the chart, using data from Coinbase.

BTC/USD

(Image not shown due to low ratings)

As we see here, the almost 50% correction and consolidation is nearing its end. We have entered into, in my humble opinion, the last few hours or days of the Q1 2018 market correction - with Bitcoin's price action spiraling into the corner of a very strong, month long wedge in price action. If you're a bitcoin guy, this is the time to invest. Look for bitcoin to find support around a big even number - 15k USD looks to be the obvious spot. Invest accordingly, my friends. As we know from previous corrections, Bitcoin carries the market - so with bitcoin, we will most likely see major players like Ethereum, Litecoin, Bitcoin Cash enter into a short consolidation phase as "big momma" gains volume, but I believe these will also eventually breakout.

Why do I say so? Well, lets delve into the next chart ----> Ethereum

ETH/USD

(Image not shown due to low ratings)

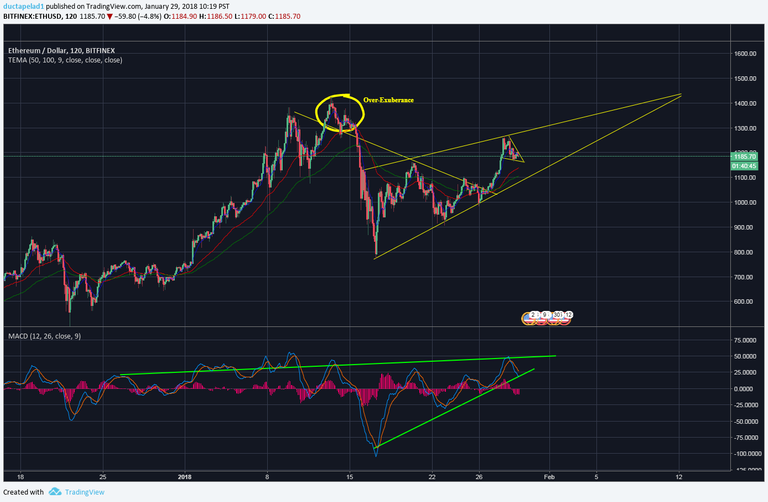

Ethereum is about two weeks into an increasing support price wedge - a wedge defined by the "support" levels, or local minimums in price, increasing over the last two weeks span. With all things considered, this is a VERY bullish trend when speaking about appreciable assets. It cues us, investors, onto overarching market opinions, as the "support" levels are increasing. This can be thought of like the price of any asset in demand - as demand increases, and supply stays relatively constant, the minimum price investors within the market feel is reasonable to pay begins to increase.

Look for Ethereum to have a LARGE breakout around the first week in February 2018. $1400 USD is a natural spot to look for support, but should ETH find support and break through the $1400 USD level, there is little stopping it from reaching its "Over-Exuberance" price of $1800 USD. Remember, previous resistance usually turns into support.

Not excited enough yet? We'll lets look at another Large Cap coin ------> Litecoin.

LTC/USD

(Image not shown due to low ratings)

After hitting an all time high in early January, Litecoin entered a very significant correction where the world markets saw price action stay within a hefty Depreciating Price Channel highlighted in Red. During this time, Litecoin prices corrected to ALMOST 50% of the All-Time-High posted just weeks before. When we see major players within the market undergo nearly 50% reductions, do not be overwhelmed with fear! These types of trends are VERY HEALTHY for markets such as this crypto-crazed market. Clearly, as seen here once again, over-exuberance dominated the market, as volumes flooded in and causes a massive run up, followed by a mass-consolidation within the market.

The indicators with this chart are not as strong as the previous major players, and while I do not want to speculate heavily on reasons as to why (maybe Charlie Lee could give us some insight) I will say that assuming market conditions remain consistent, watching LTC hit around $250 USD is not far-fetched - it was valued over 300$ at the peak of market exuberance in early January.

This concludes my Large Cap analysis! If you enjoyed the first part of this blog, PLEASE resteem and upvote! Follow my page for more content in the following weeks as we realize these price actions! I will be posting a medium cap price predictions post later this week!