Whenever you’ve heard of the loan, the only thing that comes in your mind is going to the bank. Bank has become a reliable platform to secure our assets and a place to generate a loan. A loan is something you’re doing for big purposes like a start-up, education, home, etc. Certain types of loans approved for small business purposes. Therefore, the lender’s idea of the loan makes you borrow the money immediately and gradually you can pay back the principal amount along with the monthly instalment interest.

Sounds pretty simple, right? But get credit verification is moving through multiple processes. Going through different ways, banks sometimes refuse to apply for a loan if they think or find any fault.

Therefore, what are the obstacles that could be met while applying for a loan?

Massive paper works are needed for a standard and accurate bank loan application. For the intent of the loan application, you must inquire. The bank manager will securitize the reason and judge whether the reason is sufficient to justify the amount of the loan or not. Sometimes a proper job, home, gold, or any other property needed to authenticate the process. After all this documentation, you won’t be sure if your loan is going to pass or not. Moral of the story, it doesn’t matter how hard you’re searching for if the documents are real, you’ve got to wait a long time for the paperwork to be approved. Sometimes an immediate loan is required, which is hard to get while working through the traditional way.

How is blockchain-based technology helping to get a loan?

Cryptocurrency is the easiest and most secure way to transfer money and is also the first-ever decentralized system in the world of finance. After 2009, blockchain technology has never had to look down, it expands within every sector, and this technology is being used wisely.

In the banking sector, the bank has already been decentralized and is looking for new ventures and ways to partner with cryptocurrencies. Banks actually acquires cryptocurrencies to convert fiat to crypto to fiat. Now some decentralized banks offer loans reserving clients’ crypto assets.

With a much simpler way, anyone can get a crypto loan. With a mutual agreement in the context of a smart contract, both the investor and the creditor are presented with a private key. The borrower will have to deposit his or her crypto assets into an account, and the lender will provide the fiat money for a particular interest. The borrower has now entered into an agreement to pay some interest along with the principal amount for a certain period until the loan amount has been completed. After the payment of the entire loan amount, the borrower will take his / her crypto asset back into the account. Here, crypto-assets like Bitcoin, Ethereum, etc. have been taken for collateral.

This peer-to-peer lending scheme does not require any kind of reason for the loan provider. This is a moment with a smart contract. All lenders must share a third-party custodian’s account. The custodian strategy would protect the asset so that the investor can’t steal the cryptocurrency and the creditor can’t do the same thing until time. It will also check whether or not the creditor complies with the legal terms. Or maybe he/she pays the money on time or not.

So, compared to the traditional bank loan, this crypto asset loan is much easier and hassle-free.

What are the flaws that still remain in the crypto to the fiat loan system?

Although the crypto loan fiat market is still in development, there are many drawbacks amid the advantages. It does not require any kind of consent from the bank manager, however, the broker must conduct a smart contract where the investor and the borrower have to settle on the same terms.

As the network is still under development, there are questions regarding responsibility. Yes, we’re going to know the name of the creditor or investor, the intent of the money that seems to be a kind of fishy in the loan process. On the other side, the regulatory framework has not yet been developed, so there are a lot of chances of fraud and hacking within the network.

The limitation you can’t ignore is that you need to get bitcoin to get a crypto loan without a crypto commodity that you can’t get. Only some decentralized services offer crypto asset channel trust loans so you don’t have a lot of options to choose from, but you can compare interest rate and protection program.

Where do you get the crypto loan?

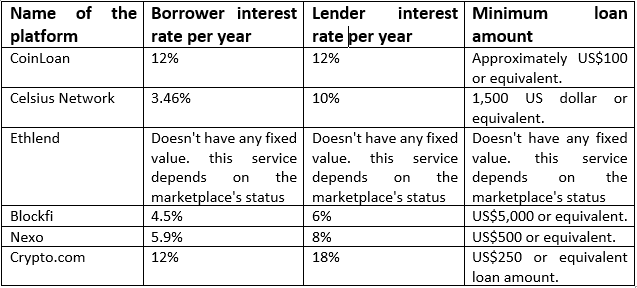

The decentralized platform who achieved the idea and executes the fiat loan from crypto assets are not much. But some top companies are reliable and secure to conduct the loan process through a smart contract. Let’s have look inside some decentralized platforms and compare the interest amounts and minimum loan limit:-

Apart from these platforms there many which also offers crypto to fiat loan services. Like BitBond can offer you maximum loan amount of equivalent to $25,000 and the percentage for the borrower will be as low as 1%. Bitfinex is well known for margin trading where bitfinex traders can borrow money. Other platforms are like Credible Friends, Kambo, Lending Block, Money token, Lendo, Poloneix, Salt Lending etc.

With the future possibility of crypto platforms, this service will have a better and well-designed future. One can easily access the amount of the loan required instantly without any problems. Safety bridges are also focusing on bugs and holding this business free from scammers and hackers. There is still a risk associated with the services, however, with the facilities that attract clients to this service.

https://www.coinbreze.com/

Telegram: https://t.me/coinbreze

Twitter: https://twitter.com/coinbreze

Facebook: https://www.facebook.com/Coinbreze