Hey everyone!

While I wait for feedback on my previous post about doing a fundamental analysis series, I wanted to post my thoughts on 'red flags' and the dangers I try to avoid outright. I'd also love for this to grow into a discussion, I don't know everything. Let me know in the comments what red flags you look out for!

The cryptocurrency space is still mostly unregulated. This is why you can see such insane growth rates, but that reward is also the harbinger of risk. We must always be wary. Even Twitter comments are inundated with obvious scams that still manage to bring in significant amounts of money.

Red Flags

These are indicators that don't necessarily steer me away from the instrument, but certainly give rise to increased alertness and scrutiny. They add to the risk profile.

- Inexperienced team, or a sales/marketing focused team. Again, there are exceptions, that's why this is a red flag and not a dealbreaker.

- Team has many relatives / siblings on it. While this can work, it adds unfavorably to the risk profile in my view. Even if this is a bit ad hominem, I can't help but factor it in.

- Forked tokens. This isn't to say that all forks are bad - but if you picked one at random, chances are it's not great.

- Recruitment / community engagement rewards. I see the necessity of marketing in this way, but the similarities to multi-level marketing and their big cousin Ponzi can't be ignored. A good team can market, especially with how much money token sales have brought in.

Dealbreakers

- Crappy website. If you can't make a half-decent website in 2018, I don't know what to tell you.

- Nothing published regarding regulations and compliance. This is huge to me, and gets weighted even more if the token is finance-adjacent (payments, privacy coin, etc)

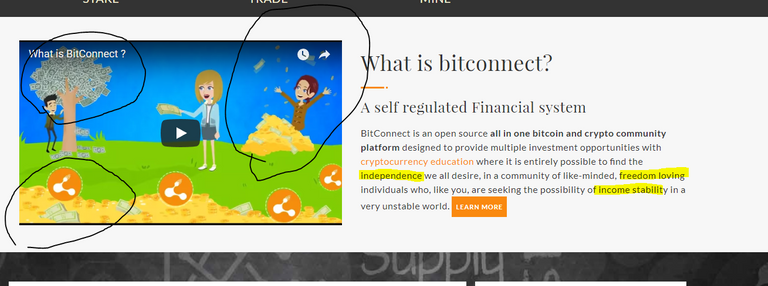

- Emphasis on wealth / ROI. Exhibit A:

I honestly don't know what the biggest red flag is here. I got a belly laugh circling the woman throwing money. Ok, I'm being funny, but these are marketing points that are consistently used to rip off people who are trying to better their lot in life.

- Outlandish market cap. I'm pretty sure TRX was valued at or above Twitter for a moment there. That's absolutely INSANE. No one knows the intrinsic value of any of this, but exercise common sense.

- Involvement of known bad actors. Simple enough.

- Inconsistent of unclear location. While I am all for decentralization, we aren't there yet. If a project is in a potentially hostile jurisdiction (or worse, a sanctioned jurisdiction) then there are myriad problems that can arise. You don't want to end up funneling money in violation of sanctions, even accidentally. Plus, the lack of transparency is telling.

- "Tokens" that are really securities, or are marketed as securities. While I might consider taking that risk if it were up to me, regulators are stepping in. Personally I am in US jurisdiction and it's really obvious that the SEC is putting their foot down on this while letting the rest of crypto be.

What red flags and dealbreakers do YOU keep an eye out for when looking at new cryptocurrencies / tokens? Let me know in the comments.

By the way, if you're interested in some detailed fundamental analysis reporting,

let me know here: https://steemit.com/cryptocurrency/@cmshigeta/introducing-my-cryptocurrency-analysis-series-feedback-and-nominations-needed-so-i-can-provide-the-most-valuable-information

Nice posting guys.. thank for sharing