Warren Buffet, the Oracle of Omaha, great and wise leader of the Berkshire Hathaway company and one of the best investors in history. Most everyone in financial markets quotes him on a daily basis, even those who aren't quote him quite often, and for good reason. He is one of the most brilliant minds in history!

Though not a value investor, like Mr. Buffet, his knowledge is not lost on me.

Waiting For The Perfect Opportunity

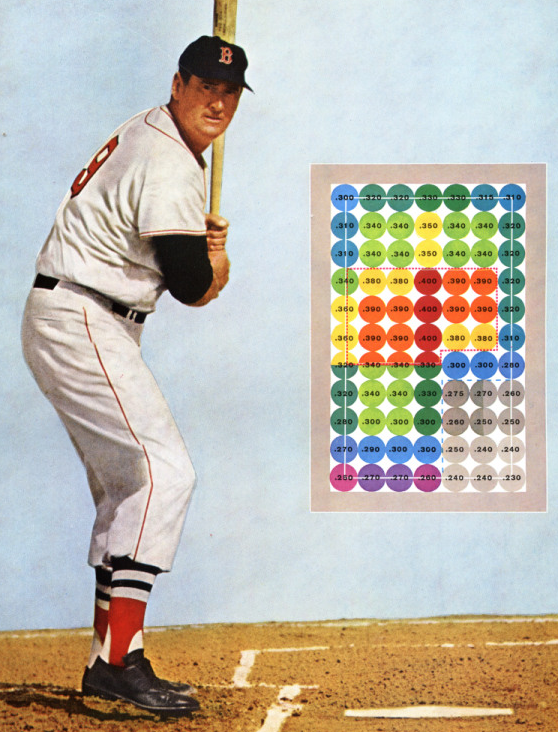

In his movie "Being Warren Buffet" he talks about Ted Williams book, the Science of Batting. Ted Williams was a famous baseball player and had a theory about waiting to hit when the ball was thrown in the perfect location and not take any swings that are not. He said he would hit .400 if this plan was followed.

As traders/investors we have the enviable position to not have to swing at every opportunity that we see. In fact not swinging will protect your capital far better that swinging at every opportunity can offer.

Developing a system has been the difference between losing all my money and being able to trade for most of my adult life and earn a fine living.

My sweet spot is clearly defined, I know what to look for.

For me, my system needs to be:

Predictable - I need to be able to anticipate the upcoming move.

Repeatable - I need to be able to trade it across different markets.

Backtestable - I need to be able to test it historically, Monte Carlo simulations, across different asset classes.

When I have that sweet spot tested, repeating and predicting I can sit back and just let pitch after pitch come across the plate. And as Mr. Buffet says, I'm in a no call pitch game. A batter can only get thrown so many pitches before they walk or strike out. I can literally see 100's of pitches and not need to swing, until the perfect opportunity is delivered to me.

True dat! From the best in the game. I've got a few posts talking about Paul's trading and management style.