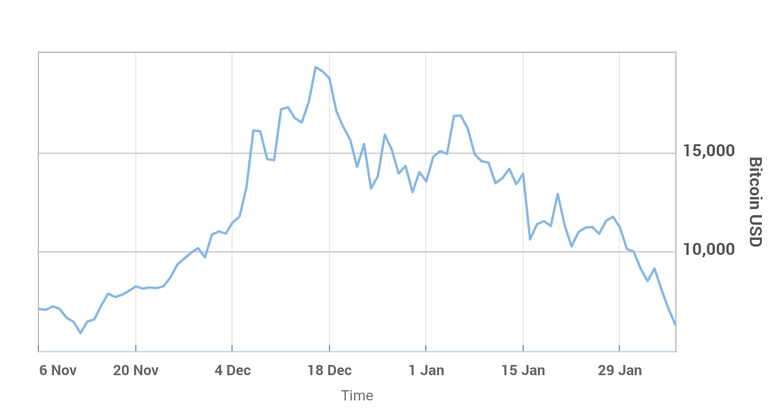

Bitcoin falls below $7,000, hits a 60 day low

- The world’s largest cryprocurrency was last down 9% in late Monday trading, at $6,471.54, its first foray below $7,000 since mid-November

- Bitcoin is down more than 60% since its record high above $19,700 in mid-December

- Overall cryptocurrency market has fallen more than 50% since early January

- Overall market cap plunging from about $830 billion to about $366 billion

Still, bitcoin is up more than 600% in the past year alone, overall crypto market is up more than 1,800% since February 2017. No panic yet! Have my doubts of anything lower than $6000

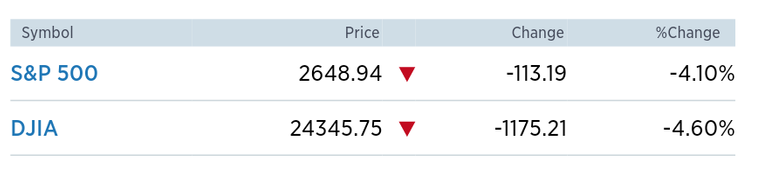

Dow plunges nearly 1,200 points as North American market losses deepen

-Dow Jones index fell 1,175 points, largest single day loss in its history

-There were only two stocks in the S&P 500 that were up for the day, while all of the Dow’s 30 members fell. Both indexes are now down for 2018, having erased all of their gains for the year

-Dow stocks alone lost more than $300 billion.

-Google parent company Alphabet (GOOGL, -5.20%) (which is not in the Dow), lost $40 billion of its market cap for the second trading day in a row—meaning Alphabet stock investors have lost more than $80 billion since Friday!!

-Dow needs to only lose another 361 points to officially mark a correction.

China to eliminate all cryptocurrency trading, -- Banning foreign exchanges!

- People's Bank of China said that it would block access to all domestic and foreign cryptocurrency exchanges and ICO sites

- The cryptocurrency market lost $340 billion of value since the start of January 2018, many speculate it has much to do with a crackdown in Asia

- China already banned bitcoin exchanges in late 2017 as a way to stop online trading

- China's moves to ban cryptocurrency trading in the country has yet to deter individual investors, who move their trading to other areas like Hong Kong or Japan while still raising funds from mainland investors

- China news agency Xinhua said the PBOC would tighten its regulations on domestic crypto investors engaging in foreign transactions of ICOs and virtual currency as the market remains unstable.

Clearly still being protectionist to their economy. Lets wait and see if some chinese home grown cryptos become accepted into chinese mainstream. cough cough TRX, EOS, OCN and the like!

S. Korean intelligence says N. Korean hackers possibly behind Coincheck breach

- National Intelligence Service did not present evidence but rather flagged it as a possibility.

- The virtual coin market remains a likely target for N. Korean hackers due to its sheer size and light regulation, no firm evidence the North was responsible.

- N. Korea sent emails that could hack into cryptocurrency exchanges and their customers’ private information

USE 2FA and do not reply or click links in suspicious emails!!

Singapore: No Strong Case To Ban Cryptocurrency Trading!

- Singapore's central bank has been studying the potential risks of cryptocurrencies, but there is no strong case to ban trading of the digital coins in the city state

- "Cryptocurrencies are an experiment. The number and different forms of cryptocurrencies is growing internationally. It is too early to say if they will succeed"

- The Monetary Authority of Singapore (MAS) has been closely studying the crypto space

If you like what you read, follow @captboatface! Dont fall for the games of outdated social media. Support the people and projects you believe in!

If you haven't signed up on Binance Exchange, It is highly recommended, Discounted fees with invite -> Binance