For most of its history, humanity has used money systems based on commodity money. Fiat money is a much later invention, they appeared about 1000 years ago, and today they are the dominant kind of money. But, perhaps, this is not the last chapter in the history of monetary circulation. Crypto-currencies are neither commodity nor fiat money, it is a new, experimental type of money. It is not known whether the crypto-currency experiment will be considered more or less successful, but in any case the issues that arise with such a set of technical and monetary characteristics differ from those that are usually discussed in the annex to the previously known means of payment.

This article explains what a crypto currency is and gives an attempt to give some answers to these kinds of questions. To understand why cryptocurrencies have precisely these characteristics, it is necessary to understand what problems are designed to solve their appearance. Therefore, to begin with, we will outline the problems faced by electronic payment systems in their history and point to technical innovations that made the emergence of cryptocurrency. Based on this, we turn to specific economic themes that arise in connection with the appearance of this kind of money.

Review

Cryptocurrency is the name of a distributed and decentralized system for secure exchange and transfer of digital banknotes based on cryptography. The money symbols of such a system can be exchanged for fiat money at a market rate. The first crypto currency was Bitcoin, whose work began in January 2009. Later, using the same innovations that introduced Bitcoin, a number of other crypto-currencies were created - however, some specific parameters of the algorithms laid in their work differed from Bitcoin. Two major innovations, thanks to which Bitcoin appeared and due to which the existence of crypto currency became possible in principle - the solution of two long-known problems of computer science: "the problems of double spending" and "the problems of Byzantine generals".

The problem of double spending.

Prior to the Bitcoin invention, the two parties could not conduct electronic transactions without the involvement of a third party, a trusted intermediary. The reason was a paradoxical situation in computer science called "the problem of double spending," because of which all attempts to create electronic banknotes since the advent of the Internet have invariably been unsuccessful.

To understand the essence of this problem, let us first consider how normal transactions with cash take place. A person who has a paper bill can transfer it to another person, and the latter, to confirm the fact that he is now its only holder, just look at what is in his hands. For example, if Alice gave Bob a hundred-dollar bill, she ceases to be its holder - it becomes Bob. Bob can easily make sure that he has a bill, and Alice, accordingly, no longer has it. In addition, physical cash transactions are final: in order to conduct a reverse transaction, the owner of the banknote must return it - that is, within the framework of our example, Bob must pay $ 100 to Alice. Thanks to all this, cash provides transactions between different parties, including those who are not familiar with each other, regardless of whether they trust each other.

Now let's see how electronic payment tools work. Naturally, paper money in this process is impossible, it is necessary some kind of digital implementation of banknotes. In fact, instead of a hundred-dollar bill, we need to imagine a computer file with a face value of $ 100. If Alice wants to send Bob 100 dollars, she attaches this file to an email and sends it to the addressee. But, and this is known to every email user, when you send a file by e-mail the original file in your computer remains. Thus, Alice will have an indistinguishable copy of the 100 dollars that she already sent to Bob - and she can expend them repeatedly, as well as three times, four times and as many as she likes. Alice, of course, can promise Bob to erase this file after sending. But without cooperation with Alice, Bob does not have any way to check if she did it.

Until recently, the only way to overcome the problem of double spending was to participate in the transaction of a third party - a trusted intermediary. Alice and Bob needed to have accounts from a third party, whom they both trust, for example, in the PayPal system. Trusted intermediaries such as PayPal keep a record of all transactions and account balances. When Alice wants to send $ 100 to Bob, she reports this to PayPal, who withdraws this amount from her account and transfers it to Bob's account, and then closes the deal. Alice can not spend the $ 100 again, and Bob relies on PayPal, which He trusts to verify this. At the end of the day, all transactions with all accounts are completed. Note that transactions involving a trusted intermediary are not final in the definition we gave for the finality of transactions with ordinary money - since a third party can "reverse" it back.

The task of Byzantine generals.

The Bitcoin solution to the problem of double spending by accounting for thousands of peer-to-peer network nodes raises another problem. If there is a complete copy of the "ledger" on each of the network nodes, which he shares with other nodes, how will the new user connected to the network know that he was not given a fake copy? And how already connected to the network user can be sure that he does not receive fake updates of this book? The problem of reaching a consensus between participants in a distributed network that do not trust each other is another long-standing problem known in the computer science literature as "the task of Byzantine generals": for it, the Bitcoin system also had an elegant solution.

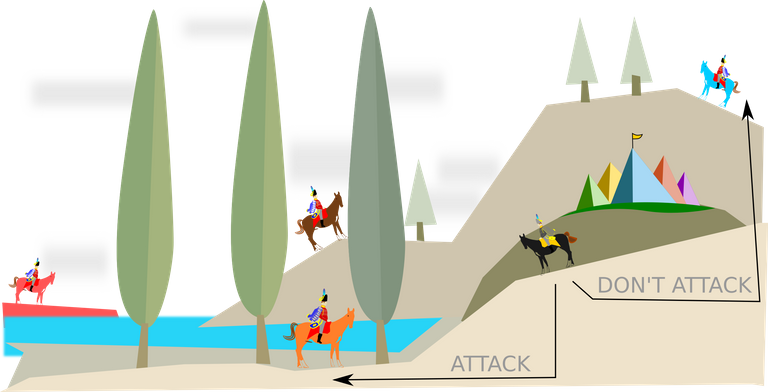

"The problem of Byzantine generals" is formulated as follows. Several generals, each at the head of his legion, besieged the city. Each of them knows that half of all their troops are enough to take the city with a simultaneous attack - but if the attack is not simultaneous, then the forces will not suffice, they will fail. Communicate with each other generals can only through messengers, there is no way to verify the authenticity of the delivered dispatches, and there is reason to suspect that some of the generals are traitors who will send false information to the others. What should be the strategy of negotiations of the generals about the single time of storming the city, if there is no mutual trust or a single high command, and the probability of attempts to prevent the assault by false reports is great?

As a matter of fact, exactly this problem is faced by Bitcoin "miners" - specialized nodes that check new transactions and add them to the ledger. The method used by Bitcoin - all the additions to the book are possible only based on the results of solving a certain mathematical problem, very laborious, but easily verifiable for correctness (this is largely reminiscent of the calculation of simple multipliers - a time-consuming task whose performance is verified simply). About new transactions in the peer-to-peer network are reported by their participants. Miners learn and confirm these transactions, checking on their copy of the book (block chains) that they do not have double expenses. If the transaction is legitimate, the miner enters it into the "queue" of new transactions to add a "new ledger" (new block in the chain) as a new page. At the same time, all exchange participants simultaneously solve a mathematical problem, where all the previous blocks of the chain are its introductory. Miner, who manages to solve the problem, communicates his decision along with a new block to add to the chain all the rest. All reporters who have received the message can easily verify the correctness of the solution: if the solution is correct, then they add a new block to their copy of the chain. Then everything starts again, and the updated chain becomes the initial data for the task that you need to solve to add the next block-the record of the next transaction.

The solution of the mathematical problem for creating a block takes about 10 minutes. This is very important: the solution is not important in itself, but the fact that the miner costs ten minutes of work. On average, every 10 minutes a new block is added to the chain, because it is during this time that the miners decide the next task they have set. However, if more miners join or network their computing power, the average gap between the addition of new blocks decreases. To maintain the number of blocks added at the level of six per hour, every 2016 blocks (two weeks) the task complexity increases. Again, the main thing here is to provide a solution for each current task in about 10 minutes.

How can this solve the "problem of Byzantine generals"? Imagine that the miner collided with two competing chains of blocks (just as the general receives two dispatches with different assault times offered by other generals). To choose which chain to accept and continue, the miner determines which one is longer - that is, which circuit was given more computing power. Always choosing a longer chain, an honest miner ensures that he is always in agreement with at least 51% of honest miners in the system. The gap between the longest chain and its "competitors" will increase with time - since it will have more computing power behind it.

The new blocks contain not only new transactions transmitted over the network, but also one more - accruing the winner-winner of 25 specially issued bitcoins, and this serves as a stimulus for all to provide the system with its computer capacities. In addition, for every 210,000 newly created blocks (every four years), the size of the prize for miners is halved. When the system was launched in 2009, the premium for the new block was 50 bitcoins. Today it is equal to 25 bitcoins, and in 2016 will be reduced to 12.5. This means that the total amount of issued bitcoins will never exceed 21 million. But with the reduction of the premium to the miners - what is their incentive to provide the power of their computers to verify the transactions of the system? The following solution was found: the participants in the transaction can pay commissions to the miner who successfully adds their transaction to the chain of blocks.

The economic essence of the cryptocurrency

For the operation of the crypto currency, there is no need for a central bank that would manage the money supply or supervise financial institutions in the system - but the role of the governing institutions in the crypto currency system of monetary circulation should not be understated. We will focus on two separate but interrelated methods of "managing" crypto-currencies.

Algorithmic control

The rules that determine the validity of transactions with crypto currency are laid down in peer-to-peer network programs that are used by miners and users. One of the forms of legitimate transactions is the issue of new coins-bitcoins "out of nothing". Such operations can not be performed by everyone - the miners compete for the right to secure one such transaction per unit (on Bitcoin approximately every 10 minutes). When the miner finds a valid hash for the block, he can claim newly issued coins. Transaction on the issuance of new coins by the miner, like any other, must comply with the rules of the system. So, the block containing the transaction will be rejected, within which the miner credits himself with coins that he did not earn and for which he did not have the right to issue. Thus, the growth of the money supply is restrained by the fixed amount for each block.

At Bitcoin, this fixed amount does not remain constant, but is halved every 210000 blocks, or every four years, as mentioned above. The total mass of all bitcoins that exist and can exist is asymptotically approaching 21 million. In 2025, it will reach 20 million, and in 2140 it will cease to grow altogether.

Open Source Management

An attentive reader will certainly notice that Bitcoin software, which establishes certain rules of transaction confirmation, did not appear on its own. These rules laid down in the programs have arisen as a result of the interaction between the leaders of the open-source project developing the so-called reference client program, other developers, miners, the community of users and malicious players. The dynamics of the relationship between these actors is also important for understanding Bitcoin, as the relationship between central banks, traditional financial institutions and monetary policy - to understand the mechanism of the work of fiat money.

Like all successful crypto currency systems, Bitcoin is an open-source project with no owner. Users, as a rule, are suspicious of crypto-currency projects acting on the basis of a closed code - for such crypto-currencies, there are significant amounts of preliminary mining to reward insiders or other features of ownership. Constraints for developers are also the certainty of users' expectations regarding the future of the system. For example, a hard limit of 21 million bitcoins can in principle be changed when upgrading a software product, but in the case of Bitcoin this is not discussed - although other crypto currencies have different rules for regulating the money supply.

The nature of the evolution of the system is also affected by the separation of Bitcoin software into a reference client program and so-called alternative client programs. The community of users believes that the main Bitcoin team should manage and manage the network. An alternative approach would be to agree the community on the specification of the network, after which independent development teams could write client programs to implement this specification. The fact that Bitcoin has a dominant reference program means that the evolution of the system can go faster, although there are pitfalls. For example, the community must firmly believe that the core team of Bitcoin developers will not undertake non-procedural changes in the system. A more dispersed approach to the development of the crypto currency would slow the evolution process, which would not allow any changes to be made to the system without a full-scale discussion by the whole community. Perhaps Bitcoin will eventually move towards this model, but so far the benefits of rapid evolution seem to be considered more important than its costs.

Important role in the management of the Bitcoin system is played by the miners. Since they provide cryptographic protection against double expenses, the operation of the crypto currency requires their agreement on what can be considered an absentee transaction.

Since any changes in Bitcoin are possible only if they are accepted by most miners, they can also deter developers. The influence of the miners is also carried out through the mining pools. Miners are pooled for more stable payouts. Sometimes a separate miner does not find a new block for quite some time. But if the miners join forces and divide the reward, they can receive payments on a daily basis.

In connection with the mining pools there are complications. For example, the largest mining pool in Bitcoin often has at its disposal up to one-third or more of the computing power of the network. If any pool ever will have more than 50% of the processing power of the entire network, it will be able to provide any double expenses in the system. This hypothetical situation will undermine Bitcoin's credibility and, most likely, will cause a collapse of the course of this crypto currency. Accordingly, we observe a certain self-regulation of the mining pools, vitally interested in the success of Bitcoin. As soon as the computing power of one of the pools approaches 40% of the total network resources, some of the participants leave it and join another pool. So far, this rule operates without exceptions, but many members of the community are concerned about the concentration of resources in the pools. Recently, the mining pool of GHash.IO briefly concentrated more than 50% of Bitcoin's processing power in its hands. There is no evidence that he used his opportunities for double spending the bitcoins, but many observers were alarmed by what had happened.

Concentration in the mining pools is not only fraught with risks, but also has certain advantages. In the case of a crisis, it is useful to have the opportunity to bring together the main players. One such Bitcoin crisis erupted on the night of March 11, 2013, when it became clear that changes in version 0.8 of the reference client program inadvertently led to its incompatibility with version 0.7. As a result of this incompatibility, the two Bitcoin programs refused to accept each other's blocks, and the chain of blocks was divided into two versions, which challenged the possession of the bitcoins. A few minutes after it became clear that a "plug" of possible actions was formed, the main developers of the system met in a chat and decided that the network should return to version 0.7. Over the next hours, they discussed the issue with the main operators of the mining pools and persuaded them to switch back to version 0.7 of the reference client, and what turned out to be some losses for some of the miners who received funds in the chain created using the new version 0.8 reference client. After about seven hours, the version of "chain 0.7" became steadily "longer" than the second competing "chain of 0.8", and the crisis was overcome.

Another problem arose in February 2014, when the oldest and largest exchange area of the network is Mt. Gox - said that its bitcoin assets were greatly reduced due to third-party attacks using the "flexibility" of electronic money in the Bitcoin system (in the course of such attacks, bitcoins are not falsified, but their characteristics can be changed before entering a record in the chain of blocks to further challenge the law Ownership of a particular monetary unit). Are the losses Mt. Gox were caused by hacker attacks, remains unclear until now, but within a few days it became obvious that the "flexibility" of transactions can really make the system vulnerable. Some Bitcoin sites temporarily suspended bitcoin interchange: during this period the main development team solved the problem, upgrading the software and explaining to the community that the "flexibility" of transactions is a constructive characteristic of Bitcoin, and not its incorrigible defect.

It should be noted that the issue of managing crypto-currencies requires further study.

Means of exchange or a unit of account?

The absence of a central bank in the Bitcoin system and the prescription of the dynamics of the money supply became the reason for criticism from the economists, who stated that standard countercyclical measures to stabilize the macroeconomic situation in these systems are impossible.

This criticism may not be correct. In most monetarist and Keynesian theories denying the "neutrality" of money, the macroeconomic properties of the latter are associated with their use in the economy as a unit of account. Bitcoins, as a rule, are used as a medium of exchange, and not a unit of account - that is, transactions themselves are made in dollars or other currencies, but payments are made in bitcoins. If prices, salaries and contracts are not nominated in bitcoins, the work of such a system can hardly affect the cyclical nature of the ecoCrypto-currencies have a number of properties that give them special utility as a means of exchange, rather than a unit of account. Unlike cash, transactions with them can be carried out both "personally", contacts of two computers, and on the network in the presence of access to the Internet. In addition, unlike credit cards, the fee for simple operations with crypto currency is low and is voluntary: it is used to encourage rapid processing of transactions by miners. In payment systems using credit cards, as a rule, commission is charged for the transaction of 25 cents plus 3% of the transaction amount. In the Bitcoin network, the transaction commission is only a few cents. Some retailers use commercial services to accept payments denominated in bitcoins, holding an equivalent amount of dollars on their bank accounts. Service providers usually charge a commission of 1% of the payment amount, but it may decrease as the hedging costs are reduced (for details, see below). Even with this commission for conversion, traders on transactions through the Bitcoin network save 2% of the transaction or even more than this amount. Traders are also attracted by the fact that a customer who declines a purchase can not cancel most transactions with bitcoins - unlike transactions with credit cards.

By a similar division of functions, the means of exchange and the unit of account of the crypto currency realize in practice some ideas developed by economists such as FischerBlack (1970), EugeneFama (1980), Robert Hall (1982) And Neil Wallace (NeilWallace 1983). These authors believe that the properties of money in a conventional economy strongly depend on the legal and institutional arrangement; In the conditions of laissezfaire, free exchange, they argue, we would observe the formation of direct or indirect prices for the means of exchange themselves and blurring the differences between money and other financial assets. Although the crypto currency remains a niche currency, and traditional monetary institutions retain their dominance, experiments on the borders of our current monetary system with Bitcoin and other new crypto currencies can be a fertile ground for new research within this scientific school.

To be continued...

Source: inliberty.ru

Thank you for waching!

To support our project just

Follow, upvote and resteem!

Welcome to Steemit :)

I follow u, follow me back if u want lot of fun and amazing picture every day.