Hi Steem community, I am the founder of a young startup (BlockNovum) that is specialized on Blockchain and Cryptoasset investment research. We aim to value cryptoassets according to fundamental drivers and their long-term potential. Since cryptos are not companies (they have no cash flows), traditional investment valuation methods such as DCF can’t be used.

Various crypto valuation approaches have been pioneered over the last months by exponents such as Chris Burniske, Alex Evans, Dmitry Kalichkin, and others. I studied these different valuation methods to refine and professionalize them. My goal is to advance the practices how we value this new asset class.

Since we just released our first public investment research report that covers Bitcoin [BTC], I thought it would be great to share the report here on Steemit and get feedback from the community:

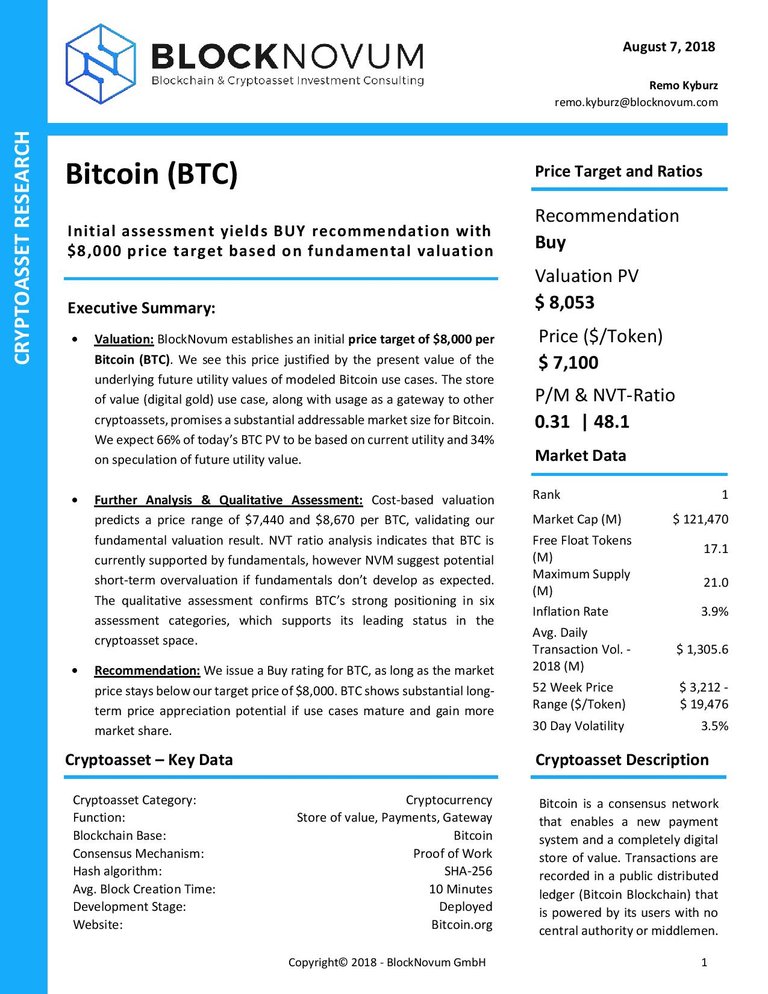

- You can see the executive summary / one pager of our valuation in the above picture.

- Find the complete Bitcoin investment research report here or download it on BlockNovum’s website.

Below I provide a brief written summary of the findings and valuation results:

Executive Summary / tl;dr:

In the report BlockNovum issues a Buy rating for BTC, as long as the market price stays below their current target price of $8,000. The price target represents the present value of BTC’s expected current and future utility values obtained through a fundamental valuation. BTC also shows substantial long-term price appreciation potential if use cases mature and gain more market share. Based on the valuation, a BTC price of above $10,000 is a realistic possibility in the next 12 months.

Research Approach:

The report consists of an extensive fundamental valuation of Bitcoin, based on the expected utility values of its most promising use cases. BlockNovum’s financial model then calculates the present value of a Bitcoin token, by discounting these future utility value inherent to one BTC at a discount rate of 30%. Consequently, the identified present value then helps decide if Bitcoin is under- or overvalued at today’s price level.

In addition, alternative valuation approaches are illustrated, such as cost-based valuation or ratio-analysis, to achieve a holistic valuation perspective and to verify the $8,000 valuation result. Finally, BlockNovum analyzes Bitcoin according to a set of key qualitative assessment factors. The complete analysis is then synthesized into a recommendation and investment profile.

Summary of Bitcoin Investment Report:

BlockNovum expects the price of Bitcoin to have a current value of $8,000 per BTC. This price is justified by the present values of the underlying future utility values of modeled Bitcoin use cases. The store of value (“digital gold”) use case, along with the usage as a gateway to other cryptoassets, promises a substantial addressable market size for Bitcoin. The size of the market served by BTC, for these two use cases alone, is estimated to be over $2.8 trillion in 2028. Further markets where Bitcoin acts as a transfer facilitator (though at a smaller scale) are digital payments, remittances, and banking of the unbanked.

Bitcoin’s characteristics as a fully digital, safe, decentralized, scarce and autonomous currency free from any government control makes it a perfect fit as a digital store of value asset with appreciation potential. Furthermore, Bitcoin’s ability to reduce transaction costs and simultaneously increase speed through technological improvements (e.g. Lightning Network) makes its usage highly attractive in the other aforementioned industries.

BlockNovum also estimates that 66% of today’s present value of $8,000 is based on current utility value and 34% accounts for speculation on future utility value.

An alternative approach, cost-based valuation, predicts a price range of $7,440 and $8,670 per BTC, validating the fundamental valuation result. The ratio analysis — consisting of Network Value to Transactions Ratio (NVT), Price to Metcalfe Ratio (P/M), and Network Value to Metcalfe Ratio (NVM) indicates that BTC is currently largely supported by fundamentals. However, short-term corrections are a possibility if fundamentals don’t develop as expected or market sentiment stays bearish. For example, NVM shows signs of a temporary overvaluation of BTC, which might lead cautious investors to delay investing for a few months.

Nevertheless, the qualitative assessment confirms BTC’s strong positioning in six assessment categories, which supports its leading role as a “blue chip” token in the cryptoasset space. Recent developments such as the announcement of Bakkt, a jointly launched company by Starbucks, NYSE parent Intercontinental Exchange, and Microsoft to create an open and regulated, global ecosystem for digital assets, highlight Bitcoin’s perceived potential among leading corporations.

Conclusion:

BlockNovum issues a Buy rating for Bitcoin, as long as the BTC price stays below the target price of $8,000. Hence, investors should aim to buy Bitcoin below the target price and account for their preferred margin of safety. Bitcoin serves several promising use cases, which gives it fundamental value. In particular, the store of value use case, where Bitcoin serves as digital gold, offers enormous market potential with an estimated market size of $2.6 trillion served by BTC in 2028. The qualitative assessment framework and ratio analysis confirmed Bitcoin’s strong and continuously growing fundamentals and further support BlockNovum’s price target. However, another short-term price correction is a possibility if fundamental on-chain activity does not develop as expected.

Future Research:

Bitcoin is one of many promising cryptoassets that BlockNovum is covering in the upcoming months. If there is enough interest, 'll plan to publish another research report here on Steemit in the future.

If you are interested in a potential cryptoasset research report subscription, or BlockNovum’s on-demand cryptoasset investment consulting & research services, please get in touch at info@blocknovum.com or visit us on Twitter or our Website.

Thanks for reading 😊

Disclaimer:

This article does not constitute investment advice. Further disclosures and risks related to cryptoasset investing are listed in the report. I have invested in Bitcoin and several other cryptoassets.

The executive summary did make an interesting read. I've downloaded the full paper and if I get time will comment. I have a problem with the term "store of value" as it can mean an safe investment of last resort utilised when markets are crashing -Bitcoin has behaved like that in the past but it isn't behaving like that now - or it could be just a literal "store of value" which makes it no different to any asset class with no utility value.

Sorry I'm just writing on the fly. It is unfair to comment without reading your paper as a whole.

Incidently I resteemed you post as I think the report should reach more people.

Hi sugarfix. Thanks for resteeming the report and your thoughts above. I appreciate the feedback.