The recent price surge of the Bitcoin, the world’s largest and possibly the most volatile cryptocurrency, has given rise to several theories regarding its soaring prices that hit the $2,400 mark a few weeks ago.

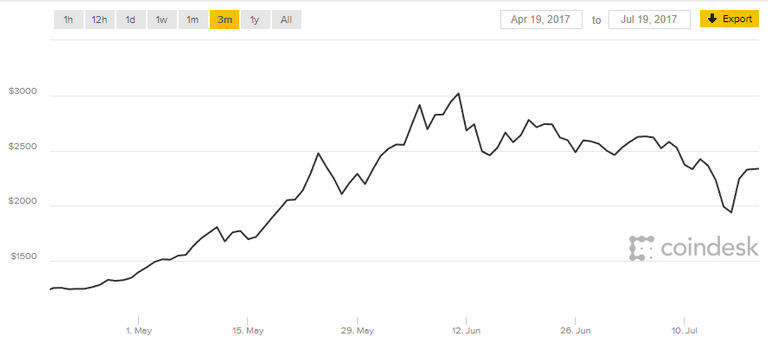

Bitcoin witnessed a 100% rise in its price in the month of May, and while it suffered a dip below the $2,000 mark this month due to the ongoing scaling debate, it seems to have recovered from the same and the current price is around $2,300, according to Coindesk data.

Origin Of The Recent Price Surge

While investors continue to speculate the future value of Bitcoin, it is important to understand the reasons behind the steady and rapid increase in its price over the past few months.

One of the primary reasons behind the price surge could be the recent declaration of Bitcoin as a legal method of payment in Japan. Experts believe that a flood of new investors from Korea and Japan has directly contributed to the growth of the price of the cryptocurrency this year.

Countries around the globe that once viewed digital currency with doubt are beginning to accept it as legal tender. Many investors view Bitcoins as an asset, similar to gold, which will hold its value in the face of political instability. Investors in countries such as Brazil, that have witnessed political upheaval this year, may have contributed to the uptick in Bitcoin purchases.

Besides the new found global recognition of Bitcoin as a valuable asset, the fact that the blockchain technology that drives Bitcoin has gone mainstream could also be one of the reasons behind this dramatic price surge of the cryptocurrency.

August 1st - Pending Scaling Issues

While the price trend over the past year has been extremely promising, there is a threat to the future value of Bitcoin due to the ongoing scaling issues.

The scaling problem at hand arises out of the fact that as of now, Bitcoin can only process up to 1MB of transactions in 10 minutes, which significantly slows down the transactions during periods of heavy use. The members of the Bitcoin community have been discussing the possible solutions to this problem. One way to speed up the transactions is to incorporate the system of Segregated Witness (SegWit), which requires 95% support from the miners to be implemented in the Blockchain but has not been able to gather these votes.

Due to the resistance faced by the SegWit proposal, members have come up with an alternative called the BIP148, wherein the blockchain would split into two, forking out a new blockchain that would reject any block of the cryptocurrency that does not support SegWit. This splitting of the blockchain could have a negative impact on the prices of Bitcoins belonging to both the chains, which could be a roadblock for the growth of the cryptocurrency.

In order to avoid a fork, several miners are currently in favor of a third solution called BIP91 that would implement SegWit2X in the blockchain and requires only 80% support.

Due to the lower threshold of support required by this solution, its implementation is less risky and could decrease the possibility of forking. The current support for BIP91 is what has possibly lead to the recovery of the price of Bitcoin from an 8-week-low of $1,863 to $2,300.

It seems that BIP91 could solve the scaling issue after all and if that happens, the prices of Bitcoin will continue to soar even after August 1st, in all likelihood.

/R. Darell (@bitrebels)

Sources:

- http://www.cnbc.com/2017/07/18/bitcoin-soars-as-miners-move-to-solve-the-digital-currency-scaling-problem.html

- http://fortune.com/2017/05/26/bitcoin-price-3/

- https://venturebeat.com/2017/07/08/why-bitcoins-value-could-get-even-more-volatile/

- http://www.cnbc.com/2017/07/18/bitcoin-soars-as-miners-move-to-solve-the-digital-currency-scaling-problem.html

- https://www.applancer.co/blog/15-facts-about-the-bitcoin-fork-on-1st-august-2017

nice info

Thank you! Glad you liked it.

interesting

Thank you, Joey! Much appreciated.