Introduction.

Bitcoin, blockchain, initial coin offerings, ether, exchanges. As you’ve no doubt noticed, cryptocurrencies (and their corresponding jargon) have caused quite the uproar in the media, online forums, and perhaps even in your dinnertime conversations. Despite the buzz, the meanings of these terms still elude many people’s comprehension. Perhaps we could put it as simply as Stephen Colbert does below, but we’ll be a tad more precise.

Originally known for their reputation as havens for criminals and money launderers, cryptocurrencies have come a long way—with regards to both technological advancement and popularity. As of earlier this month, the market cap of Bitcoin exceeded $70 billion, with peak trading volumes around $3 billion per day. The technology underlying cryptocurrencies has been said to have powerful applications in various sectors ranging from healthcare to media.

With that said, cryptocurrencies remain controversial. While critics including economist Paul Krugman and Warren Buffet have called Bitcoin “evil” and a “mirage,” others, such as venture capitalist Marc Andreessen, tout them as “the next internet.” For every person declaring that cryptocurrencies are in a bubble, there’s another insisting that they are the next wave of the democratization of finance. At their simplest, they are merely the newest fintech fad; yet at the most complex level, they’re a revolutionary technology challenging the political, economic, and social underpinnings of society.

This article will attempt to demystify cryptocurrencies’ appeal, its complex underlying technology, and why a purely digital currency is able to have value. It will also examine the outstanding issues surrounding the space, including their evolving accounting and regulatory treatment.

What Are Cryptocurrencies and Why Use Them?

Cryptocurrencies are digital assets that use cryptography, an encryption technique, for security. Cryptocurrencies are primarily used to buy and sell goods and services, though some newer cryptocurrencies also function to provide a set of rules or obligations for its holders—something we will discuss later. They possess no intrinsic value in that they are not redeemable for another commodity, such as gold. Unlike traditional currency, they are not issued by a central authority and are not considered legal tender.

At this point, use of cryptocurrencies is largely limited to “early adopters.” For scale, there are around 10 million Bitcoin holders worldwide, with around half holding Bitcoin purely for investment purposes. Objectively, cryptocurrencies are not necessary because government-backed currencies function adequately. For most adopters, the advantages of cryptocurrencies are theoretical. Therefore, mainstream adoption will only come when there is a significant tangible benefit of using a cryptocurrency. So what are the advantages to using them?

Pseudonymity (Near Anonymity)

Buying goods and services with cryptocurrencies takes place online and does not require disclosure of identities. However, a common misconception about cryptocurrencies is that they guarantee completely anonymous transactions. What they actually offer is pseudonymity, which is a near-anonymous state. They allow consumers to complete purchases without providing personal information to merchants. However, from a law enforcement perspective, a transaction can be traced back to a person or entity. Still, amid rising concerns of identity theft and privacy, cryptocurrencies can offer advantages to users.

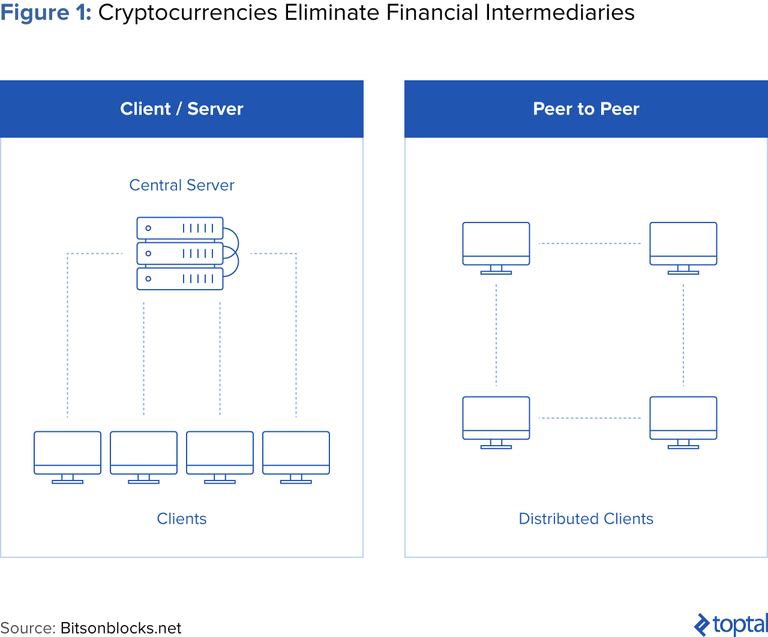

Peer-to-Peer Purchasing

One of the biggest benefits of cryptocurrencies is that they do not involve financial institution intermediaries. For merchants, the lack of a “middleman” lowers transaction costs. For consumers, there’s a tremendous advantage if the financial system is hacked or if the user does not trust the traditional system. For comparison’s sake, if a bank’s database were hacked or damaged, the bank would be completely reliant on its backups to restore any missing information. With cryptocurrencies, even if a portion were compromised, the remaining portions would continue to be able to confirm transactions.

Still, cryptocurrencies are not completely immune from security threats. In one of the “largest digital heists in history,” the Decentralized Autonomous Organization (DAO), a decentralized fund intended to democratize the funding of Ethereum projects, was hacked. The decentralized application (DAPP) built on top of the Ethereum currency was hacked and hackers gained control of one-third of the fund ($55 million). Fortunately, most of the funds were restored. However, the incident shook the community and prompted the SEC’s decision to subject offerings and exchanges to US securities laws.

Programmable, “Smart” Capabilities

Certain cryptocurrencies can confer other benefits to their holders, including limited ownership and voting rights. For example, a cryptocurrency-funded organization can include voting rights in the currency’s software code. Cryptocurrencies could also include fractional ownership interests in physical assets such as art or real estate.

Cryptocurrency Technology

Much of the cryptocurrencies’ popularity and security advantages are derived from its groundbreaking technological innovation.

Blockchain Technology Explained

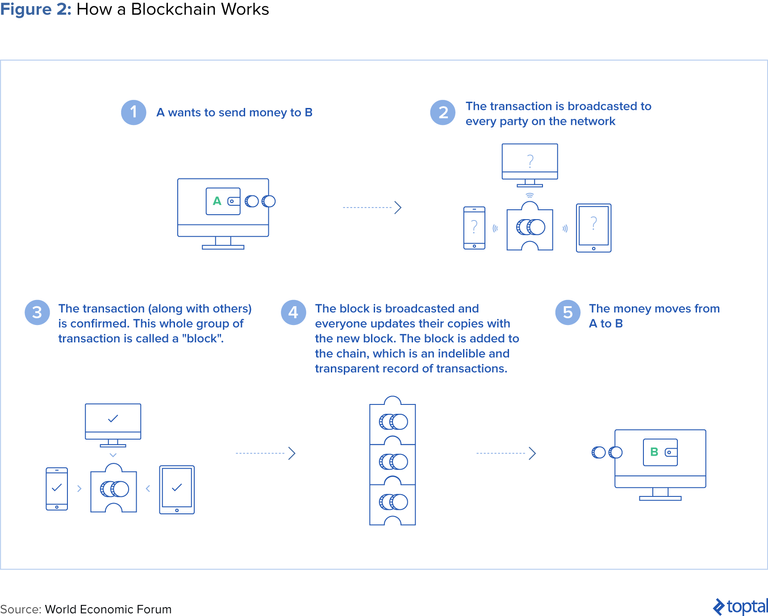

Blockchain technology underlies Bitcoin and many other cryptocurrencies. It relies on a public, continuously updating ledger to record all transactions that take place. Blockchain is groundbreaking because it allows transactions to be processed without a central authority—such as a bank, the government, or a payments company. The buyer and seller interact directly with each other, removing the need for verification by a trusted third-party intermediary. It thus cuts out costly middlemen and allows businesses and services to be decentralized.

Another distinguishing feature of blockchain technology is its accessibility for involved parties. It’s akin to Google Docs, where multiple parties can access the ledger at once, in real time. Today, if you write a friend a check, you and your friend balance your respective checkbooks when it’s deposited. But things start to go awry if your friend forgets to update their checkbook ledger, or if you don’t have enough in your bank account to cover the check (which the bank has no way of knowing beforehand).

With blockchain, you and your friend would view the same ledger of transactions. The ledger is not controlled by either of you, but it operates on consensus, so both of you need to approve and verify the transaction for it to be added to the chain. The chain is also secured with cryptography, and significantly, no one can change the chain after the fact.

From a technical perspective, the blockchain utilizes consensus algorithms, and transactions are recorded in multiple nodes instead of on one server. A node is a computer connected to the blockchain network, which automatically downloads a copy of the blockchain upon joining the network. For a transaction to be valid, all nodes need to be in agreement.

Though blockchain technology was conceived as part of Bitcoin in 2009, there may be many other applications. Technology consulting firm CB Insights has identified 27 ways it can fundamentally change processes as diverse as banking, cybersecurity, voting, and academics. The Swedish government, for example, is testing the use of blockchain technology to record land transactions, which are currently recorded on paper and transmitted through physical mail. The World Economic Forum estimates that by 2027, 10% of global GDP will be stored on blockchain technology.

Cryptocurrency Mining

“Mining” refers to a step whereby two things occur: Cryptocurrency transactions are verified and new units of the cryptocurrency are created. Effective mining requires both powerful hardware and software.

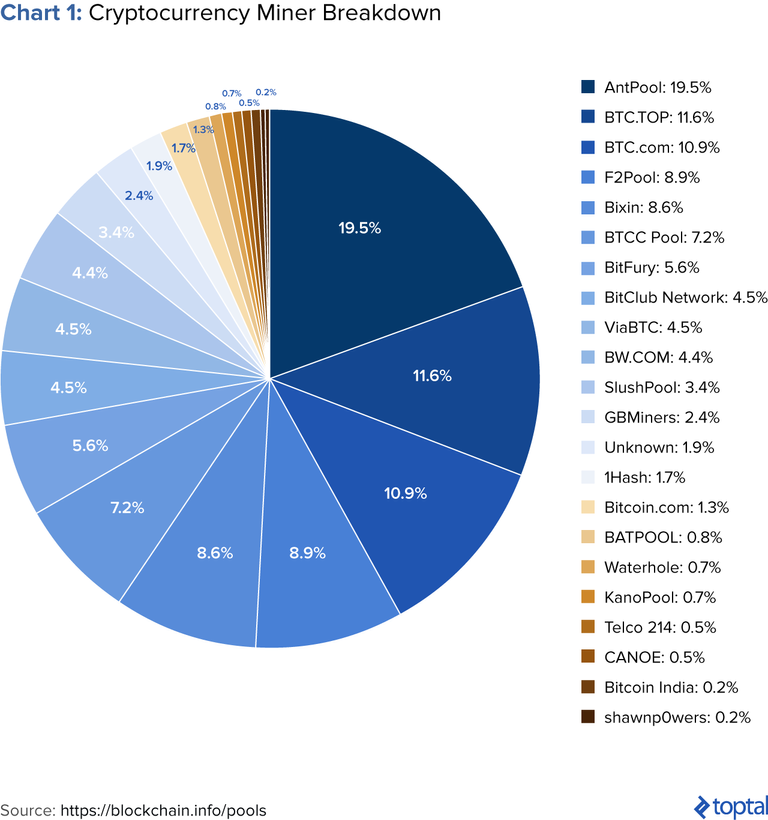

When it comes to verification, an individual computer isn’t powerful enough to profitably mine cryptocurrencies because you’d run up your power bill. To address this, miners often join pools to increase collective computing power, allocating miner profits to participants. Groups of miners compete to verify pending transactions and reap the profits, leveraging specialized hardware and cheap electricity. This competition helps to ensure the integrity of transactions.

The largest pools include AntPool, F2Pool, and BitFury, with AntPool alone controlling over 19% of all mining. Most mining pools are located in China, comprising more than 70% of total Bitcoin mining. China manufactures most cryptocurrency mining equipment and leverages the country’s cheap electricity prices.

Cryptocurrency Exchanges

Cryptocurrency exchanges are websites where individuals can buy, sell, or exchange cryptocurrencies for other digital currency or traditional currency. The exchanges can convert cryptocurrencies into major government-backed currencies, and can convert cryptocurrencies into other cryptocurrencies. Some of the largest exchanges include Poloniex, Bitfinex, Kraken, and GDAX, which can trade more than $100 million (equivalent) per day. Almost every exchange is subject to government anti-money laundering regulations, and customers are required to provide proof of identity when opening an account.

Instead of exchanges, people sometimes use peer-to-peer transactions via sites like LocalBitcoins, which allow traders to avoid disclosing personal information. In a peer-to-peer transaction, participants trade cryptocurrencies in transactions via software without the involvement of any other intermediary.

Cryptocurrency Wallets

Cryptocurrency wallets are necessary for users to send and receive digital currency and monitor their balance. Wallets can be either hardware or software, though hardware wallets are considered more secure. For example, the Ledger wallet looks like a USB thumb drive, and connects to a computer’s USB port. While the transactions and balances for a bitcoin account is recorded on the blockchain itself, the private key used to sign new transactions is saved inside the Ledger wallet. When you try to create a new transaction, your computer asks the wallet to sign it and then broadcasts it to the blockchain. Since the private key never leaves the hardware wallet, your bitcoins are safe, even if your computer is hacked. Still, unless backed up, losing the wallet would result in the loss of the holder’s assets.

In contrast, a software wallet such as the Coinbase wallet is virtual. This type of software device can place the holder’s funds online in the possession of the wallet provider, which has added risk. Coinbase introduced its Vault service to increase the security of its wallet.

Types of Cryptocurrencies

Currently, there are two major categories of cryptocurrencies: those utilized for the purchase of goods and services and those that allow for the creation of “smart contracts,” which are agreements that enforce themselves via code rather than courts. We’ll discuss both in this section.

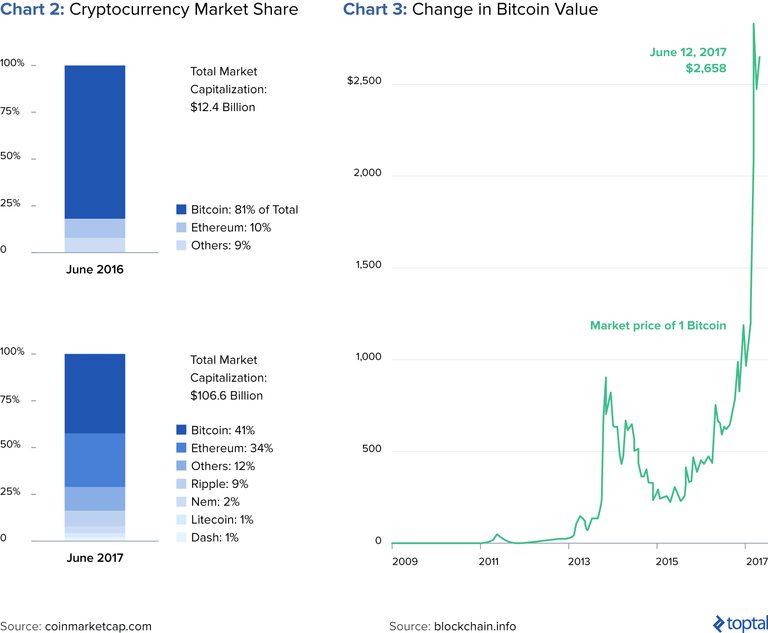

According to experts in the industry, “There won’t be one supreme digital currency…A kind of crypto-pluralism is taking hold.” Though Bitcoin and Ethereum comprise the majority of the cryptocurrency market share (see Chart 2 below), we’ve seen the emergence and rapid growth of many new technologies. In fact, there are over 1,000 cryptocurrencies in existence right now (called “altcoins”); over 600 have market capitalizations of over $100,000.

Bitcoin

Released in 2009 by someone under the alias Satoshi Nakamoto, Bitcoin is the most well known of all cryptocurrencies. Despite the complicated technology behind it, payment via Bitcoin is simple. In a transaction, the buyer and seller utilize mobile wallets to send and receive payments. The list of merchants accepting Bitcoin continues to expand, including merchants as diverse as Microsoft, Expedia, and Subway, the sandwich chain.

Although Bitcoin is widely recognized as pioneering, it is not without limitations. For example, it can only process seven transactions a second. By contrast, Visa handles thousands of transactions per second. The time it takes to confirm transactions has also risen. Not only is Bitcoin slower than some of its alternatives, but its functionality is also limited. This is reflected in its market share, which has fallen from 81% in June 2016, to 41% one year later, in June 2017. However, Bitcoin’s price has continued to soar. Other currencies like Bitcoin include Litecoin, Zcash and Dash, which claim to provide greater anonymity.

Ether and Ethereum

Ether and currencies based on the Ethereum blockchain have become increasingly popular. In August 2017, its market capitalization was around $28 billion. At one point, financial analysts had anticipated that Ether’s market capitalization would surpass that of Bitcoin (the “flippening”). However, issues with Ethereum technology have since caused declines in value.

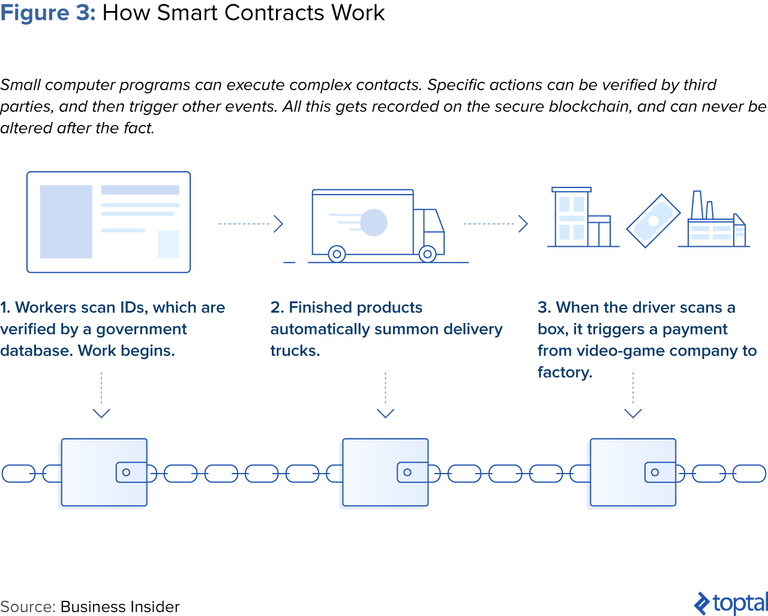

Often used interchangeably, Ethereum is a platform that allows for relatively easy creation of smart contracts while Ether is a “token” used to enter into transactions on the Ethereum blockchain. Put simply, smart contracts are computer programs that can automatically execute the terms of a contract. They function similarly to the “IF (then)” Excel function: When a pre-programmed condition is triggered, the smart contract executes the corresponding contractual clause.

Let’s apply this to an example. Let’s say you’re a company that creates and sells video game consoles. You work with suppliers and shipping companies, and you’re concerned with ensuring that: 1) the consoles are manufactured well and on time, 2) there are no labor violations, and 3) all parties get paid on time. With traditional operations, numerous contracts would be involved just to manufacture a single console, with each party retaining their own paper copies.

However, combined with blockchain, smart contracts provide automated accountability. Smart contracts can be leveraged in a few ways: When a truck picks up the manufactured consoles from the factory, the shipping company scans the boxes. These are then added to the blockchain, which triggers a release of funds from the video game company’s account. There’s no invoice or chasing down of payments. Beyond payments, a given worker in production could scan their ID card, which is then verified by third-party sources to ensure that they do not violate labor policies.

Like blockchain technology, smart contracts can also have many use cases in other industries, including healthcare or music/media.

Other Popular Cryptocurrencies

Litecoin: Launched in 2011, Litecoin functions similarly to Bitcoin in that is also open sourced, decentralized, and backed by cryptography. However, it was intended to serve in a complementary role to Bitcoin, “the silver to Bitcoin’s gold.” Litecoin has a faster block generate rate and faster transaction confirmation.

Dash: Released in 2014 as “Darkcoin,” Dash has since re-branded and offers more anonymity for its users due to its decentralized mastercode network. It utilizes something called a “Masternode” network which has a more robust foundation than Bitcoin.

Zcash: Released in October 2016, Zcash is a relative newcomer in the space. However, there are claims that it is the first truly anonymous cryptocurrency in existence due to its employment of zero knowledge SNARKS, which involves no transaction records whatsoever. The technology ensures that, despite all the information being encrypted, it is still correct and that double spending is impossible.

Monero: Monero possesses unique privacy properties. For example, Monero enables complete privacy by leveraging a technique called “ring signatures.” It’s become popular in the dark web black market, where users purchase everything from drugs to firearms.

Ripple: Released in 2012, Ripple offers instant and low-cost international payments. Ripple utilizes a consensus ledger as its method of verification and doesn’t require mining—which distinguishes it from Bitcoin and other cryptocurrencies. It thus requires less computing power.

Awesome review here. A lot more people need to see this. Good work.

I upvoted you,it might be small probably because my voting power is reduced at this time, but it's just a sign of my good will.

Am on a contest now and I really need your vote. All you need do is click this link https://steemit.com/contest/@jaynie/the-never-would-i-ever-challenge-3-sports

And then upvote my comment @stellastella in the comment section.

That will help me win the sports contest. Thanks a lot for your anticipated help. You can join the contest also if you desire. Thanks alot for your help

Thank you for time :) . Favour shall be returned :) .

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.toptal.com/finance/financial-consultants/cryptocurrency-market

Mate, put a bit of headings, subtitles, bold texts, etc. Good content but hard to read.

Thank you for your time and honest opinion, I'll be careful next time :)